Not everyone is happy about the prospect of a stronger dollar. By the way, keep in mind that in a world of floating exchange rates, the dollar is only relatively strong. For example, there are over 90 million Americans currently not in the US workforce. Because they’re not in the workforce, many of them don’t count in figuring the unemployment rate.

Do you see what they did there?

You reduce the unemployment rate by not counting people who’ve been looking for jobs for so long that they’ve given up. The ‘headline’ numbers look great. The reality is that the US economy is in the midst of an once-in-a-lifetime shift where tens of millions of middle-class jobs are being replaced; first by cheaper global labour, and next by machines.

A further exploration of the trends in real income in the Western world is beyond the scope of today’s letter. But quoting about the risk to emerging markets from a strong dollar is not.

The Bank for International Settlements (BIS) didn’t pull any punches in its latest quarterly report. It wrote that “Any further appreciation of the dollar would additionally test the debt servicing capacity of EME corporates, many of which have borrowed heavily in US dollars in recent years”.

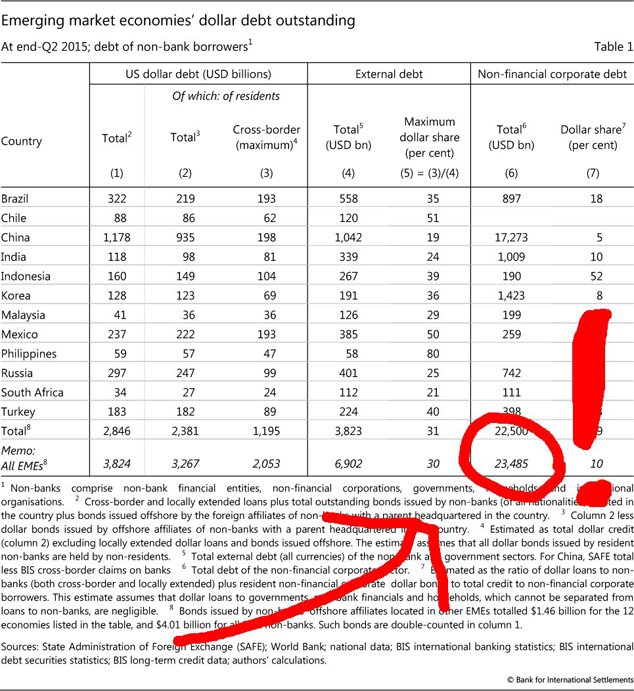

Total dollar-denominated debt grew to £6.5trn by the end of the second quarter, according to BIS data. But the table above is the one that terrified me the most. That’s why I’ve drawn inescapably large red lines on it. What does it show?

Non-financial borrowers in emerging market economies (EMEs) have $23.5trn in total debt outstanding. Not all of it would be as interest-rate sensitive as some of it. And that is a crisis so obvious that it’s almost too obvious to be believed.

But it never hurts to say the obvious when considering your options for the future: low US rates have led to a huge build-up of dollar-denominated debt. If we are, indeed, on the verge of a rate hike cycle from the Fed, you can almost hear the fuse burning on emerging markets.

Yet some of them, such as Brazil, have already blown up. That’s the trouble with markets. When everyone thinks things are going to get worse, they’re probably as bad as they’re going to get. I’ll ask Tim, Charlie, and Dominic on Wednesday.

Greeks lose control of borders

Finally, lest you forget the consequence of letting your debt get out of control, remember Greece. When your creditors have power over you, you’ve lost your freedom. Zerohedge is reporting that Greece is in danger of losing control of its borders to the European Union. Now that’s an interesting proposition. Is it necessary to leave the EU to control your own borders? Let me know what you think at [email protected].

Category: Central Banks