Understanding central banking

Central bankers are the most powerful individuals in the world. They decide which governments, banks and financial markets stay afloat. As an investor, you need to understand how they work, what motivates them and how you can profit from their policies.

Without the financial backing of a central bank, governments couldn’t finance their extraordinary deficits and debts. Banks would have no one to turn to when they fail periodically. And stockmarket crashes like 2008 would be far worse. The world would be a fundamentally different place.

In the first few months of 2017, central bankers pumped a trillion US dollars into financial markets. Last year the Bank of Japan bought so many investments that it owned 60% of the country’s domestic exchange-traded funds (ETFs) and was a top shareholder in 90% of Japanese Nikkei stocks, according to Bloomberg. During Europe’s sovereign debt crisis, the European Central Bank funded government bailouts and was part of the infamous Troika that imposed its will on Greece. In 2008 and 2009 Chairman Ben Bernanke and future Treasury secretary Timothy Geithner of the US Federal Reserve secretly rescued banks around the world, reaching as far as Australia which didn’t even have a recession.

And all this in just the last decade. Some say that central bankers rescue the world with their extraordinary actions. Others argue that it was failed central bank policies which caused the crises in the first place.

Either way, given that central banks are responsible for financial stability, it’s no surprise they had to act. But it’s their immense power to do so that is startling. Especially given the secrecy and lack of accountability that central bankers have. Just auditing the US Federal Reserve has proven elusive for politicians.

One thing is very certain. Investors need to understand central banking. These institutions are responsible for the biggest booms, busts and bailouts of our day.

So what do you need to know about them?

What is a central bank?

Most people think central banks are a cog in the wheel of the economy. They can’t imagine life without Mark Carney running the Bank of England’s monetary policy, the prospect of emergency lending to banks, and daily news analysis of whether Federal Reserve chair Jerome Powell or European Central Bank president Mario Draghi smiled or frowned as they left some meeting.

But central banking and modern monetary policy are barely a fad in the long history of money and debt. The theory of monetary policy is barely being tested in the slow march of economics. Central banks were contrived to perform a different purpose to what they do today. And most importantly of all, the need for a central bank is driven by a monumental lie. More on that below.

Governor Carney’s mission today is rather different to the one laid out in the Bank of England Act of 1694. It’s best to understand central banks by quickly reviewing their evolution. They aren’t a creature of design and forethought, but a slowly developing concept that’s constantly changing, even today.

Central banks and the fraud of fractional reserve banking

Imagine you own a storage company. Someone rents one of your container spaces to deposit their garden furniture. Are you allowed to rent out this furniture? Of course not, that’d be fraud. The owner could come back at any moment and demand their furniture.

The governments of the world have legalised this fraud. But only when it comes to money, and only for those with a banking licence. It’s called fractional-reserve banking because banks only keep on hand a tiny reserve to meet depositors demands, and lend out the rest. And it’s still fraud, even if the law permits it, because the person being defrauded is left without the deposit they own.

Every now and then, depositors of banks realise the bank has lent out their money and they can’t get hold of it. At this moment, known as a bank run, banks turn to the central bank for rescue. That’s what the Bank of England was designed for in one of its earliest forms. The famous Walter Bagehot explained this in his famous book Lombard Street. The Bank of England is to swap good quality investments for cash so that the bank can satisfy its depositors in times of bank runs. When the panic is over, the Bank of England reverses the swap.

Of course having a rescuer standing by encourages misbehaviour in the first place. Bankers can lend irresponsibly and keep reserves at a minimum knowing they stand to reap the benefits and the central bank the costs when things go wrong. Most importantly, the bigger the bank failure, the more likely the rescue. This is known as moral hazard.

Let’s take a closer look at how central banks like the Bank of England actually operate.

What are open market operations?

The basic idea of modern central banking came from the task to rescue banks during bank runs and the method used to do this. A central bank can create an infinite amount of money out of thin air. It’s a simple accounting entry. But how does that cash get into the economy? The method is called open market operations, and they’re carried out by the Monetary Policy Committee.

Think of the central bank as sitting outside of “the economy”. If the economy is lacking cash, the central bank simply buys something from someone inside the economy with newly created money. This injects cash and takes out the investment from the economy. If there is too much cash stoking inflation, the bank does the reverse. It sells investments, removing cash from the economy and returning the investment asset.

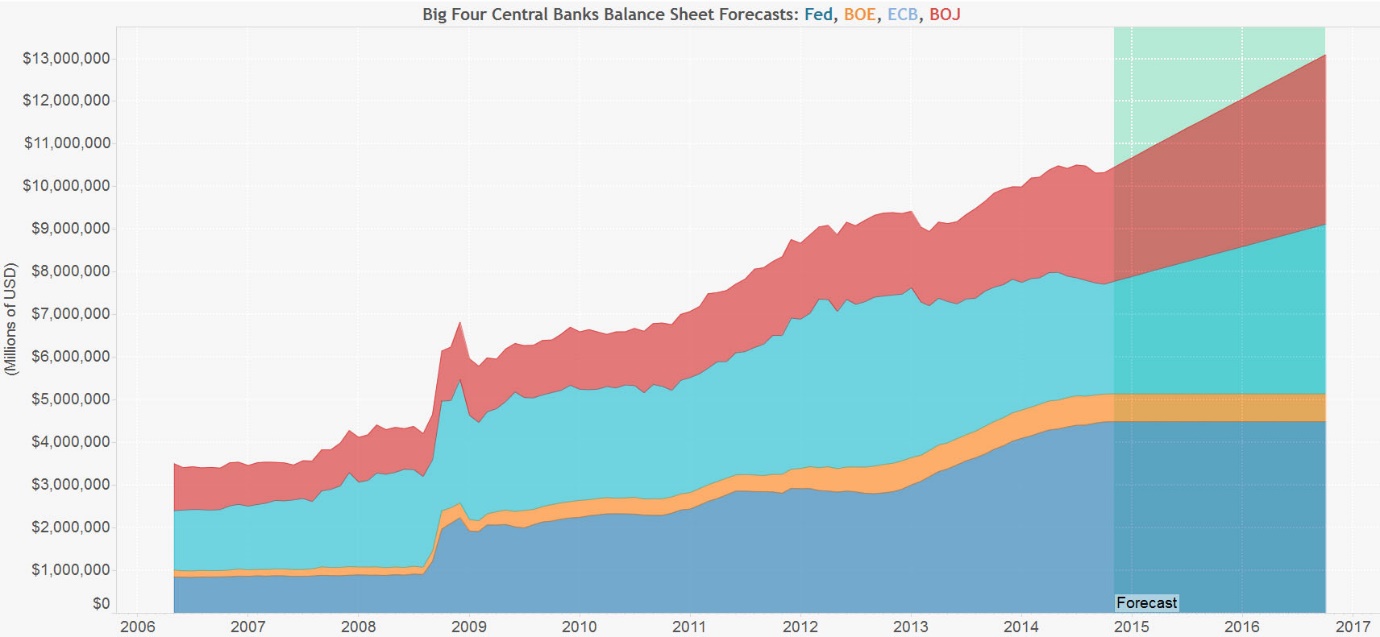

You can measure how much money is in the economy by looking at a central bank’s balance sheet. The amount of money in the economy corresponds to the amount of investments purchased and held there. That’s how we know how much money is being created – by the increase in central banks’ balance sheets.

Source: National Inflation Association, 2015

Source: National Inflation Association, 2015

Usually central banks purchase government bonds. These interventions in the government bond market move the interest rate on those bonds, which has a flow-on effect on to other interest rates in the economy. That’s how modern monetary policy was discovered. Today the Bank of England’s interest rate is the focus rather than the consequence of open market operations in the bond market.

Monetary policy and inflation targeting – third time lucky?

Central banks are no longer just lenders of last resort for dodgy banks. The idea of monetary policy now dominates them. Governments seeking to get re-elected figured out they could control the ebb and flow of the economy by manipulating the amount of money, debt and the interest rate.

First they targeted the amount of money. But this didn’t work as the economy changes too fast and needs the supply of money to respond quickly. Governments can’t be trusted with an infinite supply of money either, as their over spending created inflation over and over again. Central banks emerged as a semi-independent being to prevent this profligacy.

Then the focus changed to targeted exchange rates as economic theory proposed mercantilism. Controlling exchange rates means controlling trade, an important part of the economy. This is where the Bank of England really came into its own. It would stimulate or slow the economy by moving exchange rates, which affect imports and exports.

But using exchange rates to control the economy has a price. It leads to inflows and outflows of capital from a country. And great national embarrassment when the currency has to be revalued. George Soros’ famous bet against the pound is one example of this.

These days central bankers are trying a third option – interest rates. The Bank of England’s interest rate policy tries to influence the economy by encouraging and discouraging borrowing. Every day the Bank of England intervenes in the bond market by buying and selling bonds until they meet the interest rate target.

This concept is just as flawed and will be abandoned eventually too. Just as all government controls are abandoned once people realise they are the problem, not the solution.

In fact, when interest rates hit 0%, central bankers returned to the failed policy of influencing the money supply directly, and some explicitly try to move the exchange rate too. Quantitative easing is an increase in the money supply by having the central bank buy something with newly created money. It lowers the value of the currency by introducing more of it.

Inflation targeting

When Mark Carney, Governor of the Bank of England, manipulates interest rates, what is he trying to do? The aim of the game is to keep inflation running at the target rate, usually around 2%, and minimise unemployment. By changing the cost of debt, the central bank influences spending and thereby economic activity. Unemployment and inflation are dependent on economic activity according to economic theory.

To put it simply, by influencing the cost of your mortgage, Mark Carney can control your amount of spending to the level he wants. It’s an extraordinary power.

What drives inflation targeting is fear of deflation. If prices fall, it becomes harder to repay debts. And given that increasing borrowing is the central bank’s primary policy tool to stoke the economy, this makes deflation the mortal enemy of central banks. It’s why they target around 2% inflation instead of 0%.

Central banking is deeply flawed

Britain used to have government agencies to control the price of coal, electricity, rent and much more. The government used to own many infrastructure companies, allowing them to run at a loss without accountability. We came to understand that this was a bad idea. Government control creates, not alleviates problems like shortages and waste.

But for some reason the same logic was never applied to central banks and monetary policy. Despite the very same economics applying. If you let a government institution control the price of debt – the interest rate – you get surpluses and shortages of debt. During the boom there is a surplus of debt – a borrowing binge. During the bust, there is not enough money to pay back the debt and we experience a crisis.

Central banks are just like all the boards, agencies and institutions which governments create to control the economy. Whoever blamed the financial crisis of 2008 on the free market ignored that the problems occurred in the last government price controlled part of the economy – debt.

The good news is that the flaws of central banking are easy to understand. You can predict their outcomes. And that means you can profit. More on how to do this here.