Last week it was China. This week it’s inflation. The US’ bond market is all over the place.

Today we look at what’s got bond traders’ knickers in a twist. And if you’re a bond vigilante, how to take advantage of the tremors.

By the way, it’s not with any delight that I’m trying to expose the ways of the bond market to you. Having to review that bond prices and yields move in opposite directions isn’t fun. But it’s even less fun to try and remember it.

Unfortunately, it’s also something you’re going to need to understand as a British investor. Which is why I’m trying to make you realise how important it is to your personal financial future.

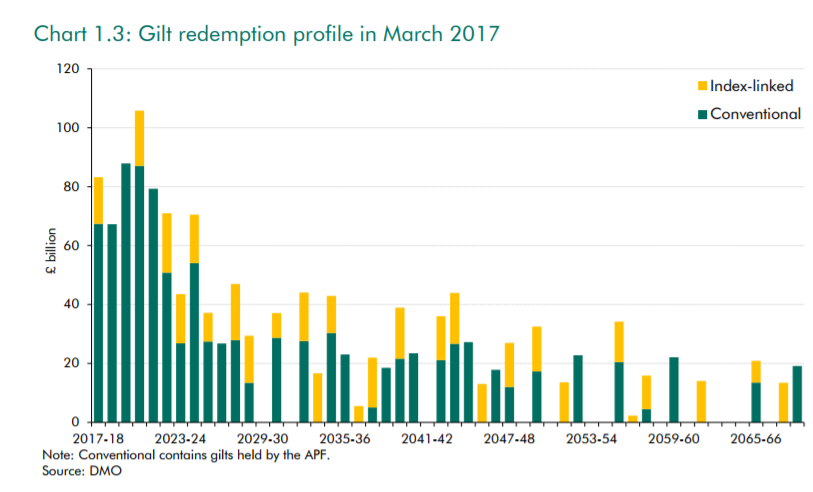

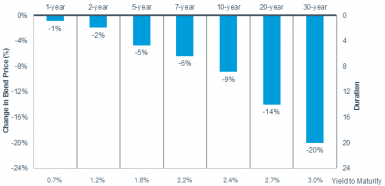

This grainy chart from the Schwab Center for Financial Research shows how the price of various bonds is affected by a 1% increase in interest rates.

Source: Schwab Center for Financial Research

Source: Schwab Center for Financial Research

A bond with 1 year to maturity (when it’s repaid) will lose 1% of its price if interest rates go up 1%. A bond with 5 years to go loses about 5% of its price from the same move. A bond with 30 years to maturity loses about 20%.

So bonds with more years to go before they have to be paid back are more affected by interest rate moves. That’s because 1% a year over the course of 30 years is a lot more than just 5 years’ worth.

The same goes for inflation. An increase in inflation devalues money. So being paid back money after 30 years of high inflation really makes bonds worth less.

(Unfortunately, interest rates and inflation tend to rise at the same time. But let’s leave that for another day.)

Case in point is the recent volatility in the US bond markets. The Financial Times explains:

Investors are cutting their exposure to US government debt, lifting the yield on Treasuries after stronger-than-expected inflation data look to give the Federal Reserve more room to tighten monetary policy.

The yield on the policy-sensitive 2-year Treasury is above 2 per cent for the first time since 2008, up 4.5 basis points on the session at 2.102 per cent. The benchmark 10-year yield is up 5.6bp at 2.5847 per cent. Rising inflation can lead to selling pressure on bonds because it erodes the returns they offer to investors.

In other words, US bond prices took a hit when inflation numbers came in higher than expected. And 10-year bonds took a bigger hit than 2-year, for the reasons described above.

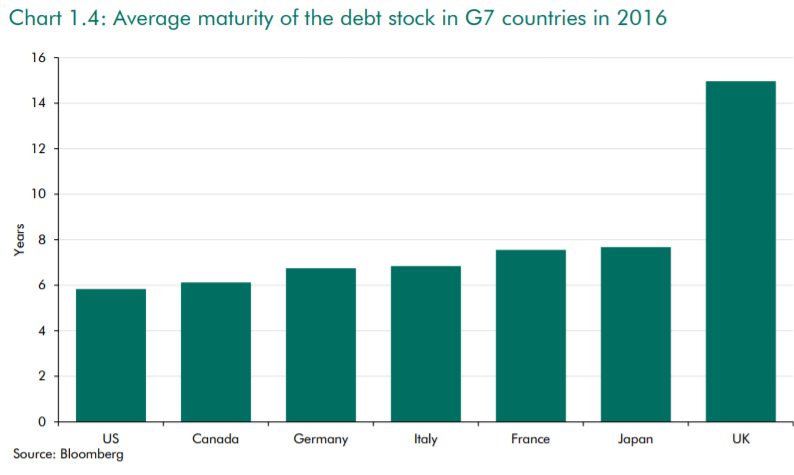

Even if you think you can ignore US debt markets, the reason you need to understand this is simple. Britain has an extraordinarily long average maturity for its government debt.

Source: http://budgetresponsibility.org.uk

Source: http://budgetresponsibility.org.uk

Most people think this is a great thing. It means the UK government doesn’t have to roll over its debt (repay its debt with more borrowing) anytime soon. And that means a spike in interest rates won’t slam the government budget with rising interest expense for some time. Higher interest rates would only slowly make themselves felt on the government budget as the Treasury refinances its debt.

Firstly, this is wrong. Her Majesty’s government must roll over vast amounts of debt in coming years:

Just because others are worse off, doesn’t mean we’re well off. £80 billion a year for five years is a big ask for bond markets to refinance. Especially when they read this next section…

Secondly, a longer time to maturity means bond prices will fall faster when interest rates rise. That’s what you discovered above, remember?

So, as interest rates rise, instead of the UK government budget having to pay up more in interest, UK investment funds will discover their bond holdings are worth far less. That includes your pension fund.

This fall in the value of bonds comes at exactly the wrong time. Just when funds begin selling out of bonds to pay out retirement incomes of baby boomers, those bonds will become worth less.

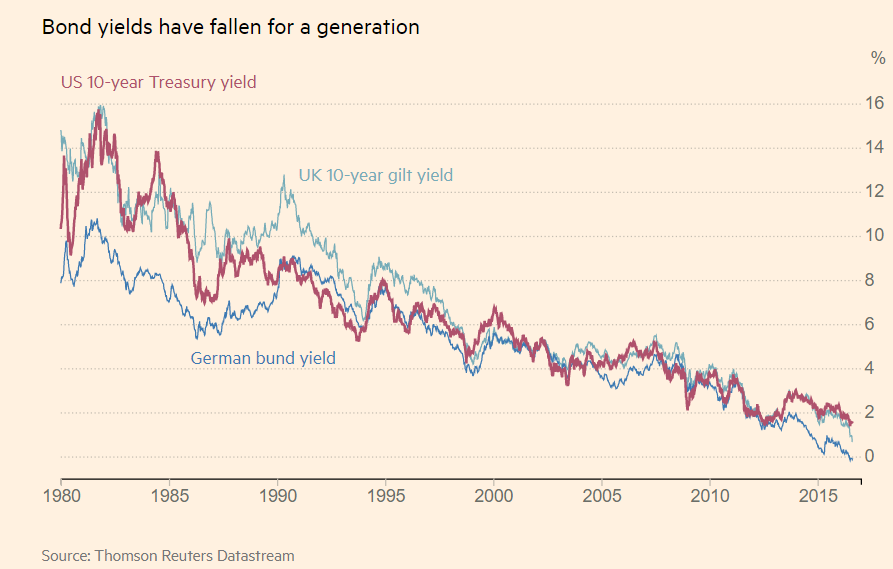

This is after the very same bonds went from 16% yields to 1.5% yields over the course of 35 years, crushing the returns that pension funds delivered. At 16% yields, $100 million gets you the same pension return as a billion dollars does at 1.5%.

Put the two problems together and you have underfunded pensions returning next to nothing that will see their assets fall in value when they try to sell them. It’s a recipe for disaster in every way.

A typically American solution

In the US, its government pension fund cottoned on to this problem.

Government bonds held in the Social Security Trust Fund are now special. They are redeemable at par at any time. Which means, rather than receiving the market price for the bonds by selling them, the trust fund can simply convert them to cash.

This solves the problem for Social Security… by shifting it to the US government’s budget instead. The Treasury will have to fund Social Security’s redemption of its bonds by issuing new bonds at high interest rates. Which is ironic given the whole point of establishing the Social Security Trust Fund was to take the burden away from the government having to pay out pensions.

Even with this fudge, the Social Security Trust Fund will be broke in 17 years according to its own projections. That’s a bit of a problem given 62% of its recipients get at least half their income from the fund and 22.1 million Americans would fall below the poverty line without the income.

The issue with bonds is that all the downside strikes at once. Higher interest bills, falling bond values, forced sales due to maturity mismatch, central banks reversing quantitative easing, and all sorts of other problems all happen at the same time.

The good news is, you can profit from the coming debacle. If you get the timing right…

How to short bonds

The following segment assumes you’re not George Soros. Because shorting the bond market is no easy task as an individual private investor.

It’s also been spectacularly unsuccessful after the following bull market. Remember, falling yields mean rising prices:

But it is possible to make money from a bond bear market, whenever it happens. The bond vigilantes are the caped crusaders of this trade. They used to be important. I used to want to be one.

But, again, the 35-year bull market sucked the life out of that career. Are you brave enough to say it’s over?

The following exchange-traded funds (ETFs) allow you to short UK government bonds. The second option triples the gains or losses of the first:

Boost Gilts 10Y 1x Short Daily ETP 1GIS:LN

The ETP provides a total return comprised of the inverse daily performance of the Long Gilt Rolling Future Index, which tracks front-month Long-Gilt futures, plus the interest revenue earned on the collateralised amount. These futures are traded on LIFFE and deliver UK government bonds with 8.75-13 years to maturity.Boost Gilts 10Y 3x Short Daily ETP 3GIS:LN

The ETP provides a total return comprised of three times the inverse daily performance of the BNP Paribas Long Gilt Future Index, plus the interest revenue earned on the collateralised amount.

Be warned, investing in ETFs does not always deliver the results intended or advertised. Especially short ETFs and leveraged ones.

By the way, the bonds aren’t the only market due for a crash. The stockmarket just made the third crossing. The first two dished up the biggest stockmarket crashes of our time.

Third time lucky? One man thinks not. Find out more here.

Until next time,

Nick Hubble

Capital & Conflict

Related Articles:

- 9 GOLD Stocks that you should BUY now

- A bull market in interest rates is a bear market for you

- A 50% melt-up or meltdown in stocks?

Category: Economics