Gold is the world’s most polarising asset. People either love it or hate it.

You’ll be denigrated a gold bug for owning it, or an ignorant moron for not.

There are good reasons for this division.

Gold’s position is an odd one thanks to its characteristics, history and the way it’s traded today. Nobody can agree on any of those three, so they can’t agree about gold either.

Below there’s an extensive guide to the most precious metal in history, with everything that you need to know on how to invest in it.

In this article you’ll find…

- An introduction to understand how the price of gold is set.

- Analysis of past performance and potential for the future.

- A few charts to ease all the data.

- The 9 Gold Stocks that you should add to your portfolio right now.

If you’re a subscriber of Capital & Conflict already, you are aware of what gold is and what it represents.

Click here to go straight to the ‘9 Gold Stocks to Add to Your Portfolio Now.’

Understanding the price of gold

Some people will tell you gold is the only true form of money, while others will decry its uselessness because you can’t spend it. Some will tell you about how gold was money for thousands of years, while others will point out that we finally managed to get rid of it last century. The same facts lead people to opposite conclusions.

The same people who were once staunch advocates of gold can go to being its harshest critics and then return to favour it over the course of their career. The best example of this is former Federal Reserve chair Alan Greenspan.

In the midst of all this, it’s tough to untangle any truths or reach any certain conclusions about gold. After all, when it comes to financial markets, the truth is what enough people perceive it to be.

In the end, you’ll have to make up your own mind about gold. But here is the best possible primer I can give you…

How the gold price is set

Gold is somewhat of an odd asset thanks to its history. For much of the history of money, gold was the determining factor in the value of currencies. Each different currency represented a redeemable amount of gold (or silver). This meant there wasn’t really a price of gold as such. Gold was the constant in a world of changing currencies.

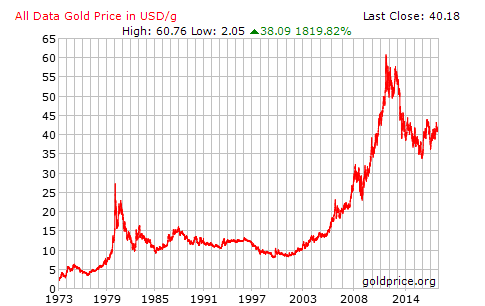

But that ended when the US abandoned the gold standard in the 70s and the US dollar became the world’s reserve currency without any precious metal backing. The chart below shows the history of the gold price since 1973.

These days, the gold price is primarily set in financial markets, just like for other metals. In fact, about 15,000 times more gold is traded in financial markets than there is actual physical gold in the trading process. And almost all contracts settle in cash, not gold.

So you can see how the gold price is completely financialised. The supply and demand for physical gold seem to matter very little in setting the price. Many argue this means the gold price is manipulated.

The financial market price is set between the London Bullion Market Association’s (LBMA) trading and the COMEX contracts in Chicago. The LBMA is steeped in history and still has some esoteric rules. London Metals Exchange gold traders operating in the trading ring must keep one heel touching their seat at all times, for example. The COMEX is the biggest derivatives market in the world.

The power of Asian gold exchanges has been growing, but they’re far from matching the UK and US hold on gold.

The past performance of gold

A few thousand years ago, an ounce of gold would’ve bought you a toga and sandals in Rome. Today, an ounce of gold is worth about the price of an Italian suit and shoes.

That is the immense power of gold. It’s why wealthy families own the stuff – wealth preservation. There is no asset that does it better.

The long-term value of gold is only part of gold’s credentials as a wealth preserver. Thanks to the value people place on gold’s long-term stability, the price surges during crises when people rush in to buy gold. The 2008 financial crisis put that on display nicely:

A 150% gain while stocks crashed? Even a small allocation to gold would’ve offset the disastrous returns elsewhere. Not to mention the peace of mind while banks went broke.

The thing is, wealth preservation only matters at certain times in history. Times of turmoil, war, currency debasement and financial panics.

But these are too difficult to predict accurately, so it’s always a good idea to own some gold. Many advocates choose 10% of your investable wealth as the rule of thumb.

Buying gold as an investment

A separate question to preserving wealth is whether you should own gold as a performing investment as well. Do you expect the price of gold to outpace other investments?

First, don’t forget to keep this investing separate to the ideas of wealth preservation. I think owning some gold is pretty much required if you want your wealth to be robust. Whereas investing in gold for gains is only a good idea sometimes.

The confusing part is, you want to own gold as an investment when the likelihood of turmoil is rising – just when wealth preservation becomes important. But nonetheless, keep your investment gold separate from your wealth preservation gold, at least in your mind.

So, how has gold performed as an investment? Well, looking back thousands of years certainly doesn’t prove anything relevant if it’s returns you’re looking for. So the question is, how far back should we go?

Regardless how you answer that question, your conclusion will be pretty much the same. As I mentioned, gold outperforms during crises. The rest of the time, it languishes.

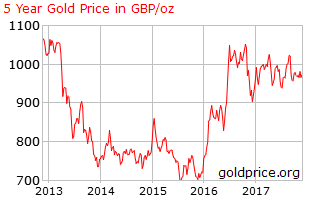

Gold rallied from £700 to over £1,000 in anticipation of the Brexit vote, which sent shockwaves through the stockmarket. It doubled during the financial crisis while stocks crashed.

The rest of the time, gold usually doesn’t quite manage to keep up with the stockmarket.

This five-year chart shows a wedge formation in the gold price since the Brexit referendum.

Any breakout from this wedge suggests a sharp upward or downward movement is in the cards.

But if you would like to speculate on the gold price, there may be a better way to do so than owning the metal itself.

To check the price of gold per gram in the UK, click here.

Gold vs silver, stocks and bitcoin

Gold is often compared to a variety of assets. This can reveal its strengths and weaknesses.

The closest competitor is silver. This cheaper cousin of gold has much the same monetary history. In fact, there’s a good reason our British currency is called the pound sterling. It used to be a pound of sterling silver.

But it’s the differences that make gold and silver interesting. Silver has far more industrial uses than gold. So it can surge during good economic times too. Gold is mostly just a precious metal, not an industrial one. Although jewellery demand is significant.

As for the prices, one way you can look at the relationship between gold and silver is the gold-to-silver ratio. The number tells you how many ounces of silver it takes to buy an ounce of gold. This chart shows 100 years’ worth of data.

When the blue line is at highs, silver is cheap and gold is expensive relative to each other. Right now, buying silver looks like a good bet.

But the silver price per gram can move quite fast.

To check the silver price in the UK, click here.

Another way to invest in gold is to buy shares in gold companies. This introduces new risks and opportunities. Although the gold price is still an important factor, the risks and rewards of owing a stake in a mining company are greater. In some cases, far greater. More on gold stocks below.

Lately, thanks to the bitcoin boom, you often hear people comparing cryptocurrencies to gold. Indeed, about a dozen cryptocurrencies are gold backed. The similarities and differences are intriguing.

Both gold and cryptocurrencies are non-financial assets, meaning they trade outside the financial system. As you discovered above, this is only true to a limited extent. But for both assets, it is possible to escape the financial world entirely while holding your wealth in them.

The gold price and bitcoin price both seem to respond to geopolitical turmoil. People buy both assets when their government is cracking down or breaking up. This makes them a good way to trade that sort of instability.

The key differences are that bitcoin is digital, relies on infrastructure and is far more volatile. Gold is tangible, historically proven and more stable.

That’s not to say gold is superior. It’s just that the assets are and therefore behave differently in different circumstances. Consider what you’re trying to achieve before deciding which one to buy.

The gold quadrants

There’s a particular reason to own gold which most investors don’t know about. That’s because the majority of investment advice in favour of gold comes out of the US.

Ironically enough, American investors benefit least of all from owning gold. The Brits are somewhere in between, while the Australians and Canadians see their gold returns skyrocket during a crisis.

Why? Currencies.

Gold, like oil, is priced in US dollars. That price is then converted to your local currency to get the local gold price. Even if the gold price is steady, changing exchange rates mean changing local gold prices around the world.

This creates an added complication for gold investors outside the US. How will their currency perform in different scenarios? Will it offset their gains or losses in gold, or will it add to them? After all, similar variables affect both the gold and currency markets. Money printing, crises and plain old GDP growth, for example.

If you want to understand how the exchange rate and the gold price work together, you can think about it as the gold quadrants

The gold quadrants are the four possible outcomes when you invest in gold as a British investor. The gold price in US dollars can go up or down. And the exchange rate, which gives you the pound gold price, can go up or down too.

Two variables give you four possible outcomes.

Say the gold price in US dollars goes up 5% and the pound goes up 5% too. That leaves the UK gold price with no change. That’s because the gains in gold are cancelled out by the lower amount of pounds you get for your US dollars.

This is only one of four possibilities. I’ve put all four possibilities in a table – the gold quadrants table.

It shows all four possible outcome for British investors. What I call “the four quadrants”.

| Pound goes up | Pound goes down | |

| Gold price goes up | quadrant 1

You profit from the gold price but lose money on the exchange rate |

quadrant 2

You profit from gold and the exchange rate |

| Gold price goes down | quadrant 3

You lose money on gold, and lose money on the exchange rate |

quadrant 4

You lose money on the gold price, but make money on the exchange rate |

The thing to understand is that these four quadrants are not equally likely to occur. Each one has a particular set of scenarios which will bring it about. Different combinations of money printing, GDP growth, inflation and everything else that can affect both the exchange rate and the gold price.

For example, during a financial crisis, the US dollar surges against just about all currencies. That means a weaker pound against the dollar. Gold is a safe haven, or safe investment. It spikes when risks in the economy rise like in 2008.

This combination makes gold a brilliant investment for Brits because the currency move supercharges the gains from gold during a crisis – just when you want gold to perform. As quadrant 2 explains in the table, you profit from the gold price and the exchange rate.

Compare this to what happens to an American gold investor in a crisis. Their dollar currency is a safe haven. The US dollar surges alongside the gold price during a crisis. This decreases the benefit of owning gold, as it cancels out some of the gains.

Usually, gold surges faster than the US dollar, making gold a good crisis hedge for Americans too. But far less beneficial than for Brits.

Does it really work like this?

The proof is in the pudding…

Take a look at the charts below. The gold price in US dollars has tumbled since 2013 while the fall in the pound allowed the UK gold price to recover since 2016:

This is an example of currency moves holding your gold steady in pounds – quadrant 4. It’s not a bad result. But the real focus remains the supercharged gains during a crisis.

The geopolitics of gold

The James Bond movie Goldfinger is a little mystifying to the younger generations. Gold has little connection to the global economy or financial stability these days. Back when Goldfinger hit the screens, it was vital.

Still, every now and then gold makes a comeback into geopolitical headlines. Take for example the drama about German gold repatriation.

The German Federal Court of Auditors responded to a growing conspiracy movement in 2012 by demanding the Bundesbank do an audit of its gold. The existence and weight had never been confirmed.

Worse still, in his 1955 autobiography, the German central banker Hjalmar Schacht recalled his visit to the Federal Reserve. The Fed’s founding president, Benjamin Strong, “was proud to be able to show us the vaults, which were situated in the deepest cellar of the building, and remarked: ‘Now, Herr Schacht, you shall see where the Reichsbank gold is kept.’” Unfortunately, “At length we were told: ‘Mr. Strong, we can’t find the Reichsbank gold.’”

Schacht told Strong: “Never mind; I believe you when you say the gold is there. Even if it weren’t, you are good for its replacement.”

But not anymore, say the Germans. They want their gold back now that the Russians aren’t breathing down their necks… to the same extent as after World War 2.

But why?

And why can’t the gold just be audited at the Fed and in the other locations around the world where Germany keeps its gold?

The Bundesbank explained the gold was to be repatriated to “build trust and confidence domestically, and the ability to exchange gold for foreign currencies at gold trading centres abroad within a short space of time.” Unfortunately a spokesperson for the central bank blurted out otherwise: “[It] is in case of a currency crisis.”

Having completed its repatriation of $28 billion in gold three years early, the Bundesbank in Frankfurt thought it was sitting pretty. Until someone found a World War 2 British “blockbuster” bomb down the road.

After all this drama, only about half of Germany’s gold is actually on domestic soil.

Germany’s repatriation was far from the only time gold made headlines in recent years. All sorts of conspiracies about gold continue to roll on. Some have been vindicated.

Lately, the focus has been on China and Russia’s accumulation of gold, adding to their reserves. China only occasionally updates its estimates. And many speculate the true holdings are vastly higher. Russia has the highest ratio of gold relative to its economy.

Why are these countries accumulating gold? More on that in a moment.

Meanwhile, the geopolitics of gold mining is changing too. The former powerhouse of South Africa has fallen badly. China is now the major producer of gold.

The reason gold is so high on the agenda of geopolitics is historical. The experiment of fiat money is still fairly new. The US dollar went off the gold standard in the 70s, ushering in an era of terrible inflation.

Today, the position of the US dollar as the world’s reserve currency is perceived as an unfair advantage by some nations. But if they want to turn away from the US dollar, where do they turn to?

Some nations are already using gold as the alternative. Iran, Russia and China, suffering under economic sanctions, use gold instead of US dollars in international trade.

Perhaps gold is set for a return to the world monetary stage?

Gold market controversies

The most imminent threat to your gold investment comes from the questionable nature of the gold market. There is a long list of players who abuse the weaknesses in how gold is traded.

As described above, the gold price is financialised. It can easily be manipulated by people with no connection or interest in physical gold. Or by those with the wrong sort of interest. It’s not just about traders looking to make a quick profit by manipulating the market.

The gold price is a measure of geopolitical tension. Governments wanting to hide their mismanagement of the economy like a lower gold price per gram. A high price is an embarrassment because it signals scepticism of their plans.

Central bankers are sellers and buyers of gold. The gold price determines the return they get, or the cost of their purchases. Former chancellor of the exchequer Gordon Brown famously sold a great deal of Britain’s gold at the low point of the gold price – a period now known as the Brown Bottom in honour of his mistake.

Thanks to all the controversy surrounding gold in financial markets, it’s best to own at least some of your gold outside the financial system.

How to buy physical gold

Many people are intimidated by the idea of buying physical gold as an investment. But it isn’t any different to buying jewellery or diamonds. You simply go to a shop and purchase it.

Just like jewellery, there are more reputable sellers, cheaper ones and more convenient ones. All you have to do is make a quick comparison so your purchase is informed.

Gold is a small, but crucial part of the portfolio of the modern day investor. It always has been. But the financial industry has slowly tried to sway the British public against the precious metal.

It’s obvious why financial advisers and brokers don’t like gold. It doesn’t earn them any fees and gold proves its worth precisely when the financial system is in turmoil. That’s something which, of course, never happens…

Because of gold’s properties as an investment, owning it in its physical form is a key part of the premise. It’s a real, tangible asset you can touch, hold and keep secret.

Investing in paper gold – exchange-traded funds (ETFs) or gold stocks – can be an excellent idea too. But missing out on the security of physical gold negates one of the metal’s key benefits. You still rely on a counterparty if you invest in paper gold, while the physical doesn’t require anyone to fulfil any obligations to you to realise its value.

Should you invest in gold?

The key question is how you should own the yellow metal.

If you’ve decided to invest in physical gold, you have a further decision to make. You’ve got to decide which form you’d like it to take.

The basic options are bars, coins, semi-numismatics and numismatics.

Gold bars and bullion type coins are called bullion and their value is based purely on how much gold they represent by weight and purity. Although a particularly reputable maker of bullion might command a slightly higher price, that’s because people feel surer about the purity and weight.

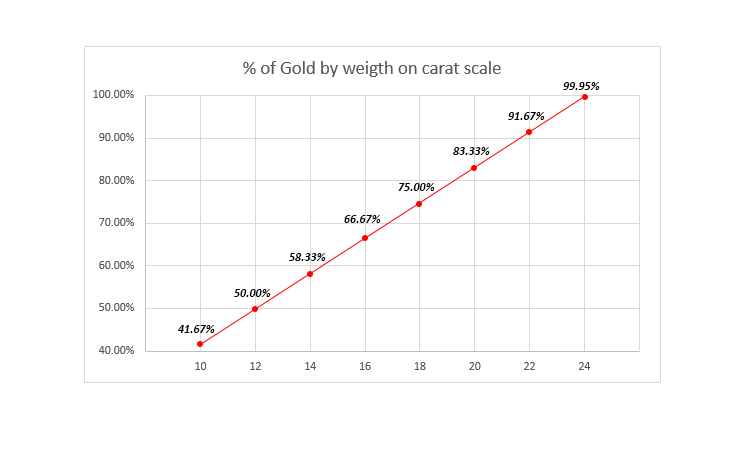

Gold purity is usually measured in carats, sometimes spelled “karats”. The carat scale goes from 24ct, over 99.95% pure gold, all the way down to 9ct, under 40% purity. Copper and other metals are typically added when manufacturing jewellery, as gold by itself is too soft.

Fineness is a more strict way of measuring gold purity. This scales from 999.999 – referred to as six nines fine – to 24 carat gold at 999, or three nines. Here’s a chart with the scale of purity of gold:

Semi-numismatic coins are valuable for more than just their gold content. They might be rare or have collectors value, as well as historical significance. But in the end, semi-numismatics are still about their gold content. They trade at a premium above the gold price which can fluctuate, but tends to stay stable over time.

Semi-numismatic coins are valuable for more than just their gold content. They might be rare or have collectors value, as well as historical significance. But in the end, semi-numismatics are still about their gold content. They trade at a premium above the gold price which can fluctuate, but tends to stay stable over time.

Numismatics are valued far above their gold content.

They’re very rare, have a famous origin or a historically important. These are not really suitable for investors looking for exposure to gold itself. Unless, of course, you manage to find them for bullion prices.

Investing in gold bullion can have impressive tax benefits. When you buy gold bullion, you are exempt from value-added tax (VAT) and some coins are even exempt from capital gains tax (CGT) because they’re classified as legal tender – money. VAT can be charged on gold coins if you buy them as a collector instead of as an investor. The government classifies this based on the premium paid above the gold value. If you pay more than 180% of the gold value of the coin, you’ll have to pay VAT too. Silver is not exempt from VAT.

There’s a particular place I think you should start your physical gold ownership journey: investing in gold coins.

The British gold sovereign is the original one pound coin. That means it’s exempt from CGT alongside a few other precious metal coins. Most sovereigns are considered semi-numismatics, so they trade above the gold value. But that premium is fairly stable and an opportunity for a shrewd buyer.

The Coin Act of 1816 specified the sovereign’s characteristics. The one pound sovereign must weigh 0.257 ounces or just under eight grams and be 22 carat gold.

There’s a big market in buying and selling sovereigns, not just in Britain, so you don’t have to worry about buying and selling convenience. Any gold dealer will have them. It’s best to go to a large reputable one to ensure you’re not paying any excessive premium. Don’t forget to check online prices while you’re buying so you have a good comparison. Always be willing to walk away.

Go ahead and buy one gold bar. See how it makes you feel. If it helps your wealth feel more robust, go ahead and invest a more substantial sum.

If you enjoy semi-numismatics like the sovereign, there are many very similar options from countries around the world. The Canadian Maple Leaf, South African Krugerrand, American Eagle and Australian Kangaroo are great options.

But buying pure bullion bars is the most basic way of investing in the gold price. You pay the lowest premiums. Each different maker has their own.

Understanding gold stocks

The gold stock sector has all sorts of different companies. You can classify them in many ways. According to their activity, there are explorers, developers and producers. According to their size, there are majors, minors and minnows. And according to their cost, there are low cost and marginal producers.

Which type of gold stock you want to buy depends on the investment result you’re looking for. Each type of company comes with its own risks. And mining stocks are particularly risky in additional ways too. They often struggle to find funding and can rely on takeover activity for the investment to actually pay off. Not to mention the political risk of mining in unstable countries.

A major producer like Randgold Resources will closely mimic the gold price. Their reserves and cost of production are established. So the risks are most closely linked to the gold price, which determines their profit margin. Smaller producers like Acacia Mining add uncertainty to this same formula, increasing the volatility of returns. They might only have one or two producing mines, for example.

Explorers are looking for undiscovered gold. These soak up funding until they find something. And usually seek a big payday when they do discover a deposit by selling the rights to it.

Developers are on the cusp of becoming producers, having made a discovery. It takes vast amounts of funds, expertise and time to develop a mine.

These days, most gold stocks have at least some gold production. It helps keep them financed. The smaller ones might just own a share in the producing mine they discovered, for example. Major producers will buy in and do the actual mining.

Once producing, a gold company calculates something called the all-in sustaining costs (AISC). This is its cost of production per ounce of gold, adjusted for all sorts of factors. It tries to tell you the point at which the company would become unprofitable if the gold price falls.

Low cost producers are more robust, but their share price will surge less if the gold price rises. Marginal producers are in trouble if the gold price falls, but their share price can skyrocket if the price rises.

Let’s take a look at some gold stocks for 2018, in anticipation of their 2017 end-of-year results.

9 Gold stocks for 2018

The good news is, there are dozens of gold companies listed on the London Stock Exchange (LSE). They represent the full range of opportunities and operate all around the world. If you believe the gold price is heading upwards, here are my recommended stock picks for 2018. I’ve divided them into three categories by size.

The first three gold miners are the biggest gold-focused companies listed on the LSE. These tend to be diversified and that means you can buy and hold them for long periods of time. They tend to invest in new mines as well as bring their existing ones to production, keeping the companies rolling on steadily.

- Randgold Resources [LSE:RRS]

This is the major gold player on the LSE. Randgold is diversified by mining activity, but not by geography. It’s very focused on Africa with five gold mines there. Three are in Mali alone, increasing political risk.

The company continues to expand with exploration in a variety of Africa’s gold regions. It hopes to produce between 1.25 and 1.3 million ounces at a cash cost of production between $580 and $630 gold price per ounce. Unfortunately, the company doesn’t publish its AISC, which is higher than the cash cost of production.

The balance sheet value of the company has grown steadily while debt fell since 2012. Cash flow turned positive in 2013 and grew rapidly, leaving the company with an impressive cash holding of over $500 million in 2016. Dividends doubled to $1 per share since 2013, providing a decent dividend yield.

- Polymetal International [LSE:POLY]

This is a large gold and silver miner operating in Russia, Kazakhstan and Armenia. It pays a dividend, yielding above 2%. With nine subsidiaries or projects, the firm is diversified across mines, but all operate within the same three countries. They are a mixed bag of operating mines, exploration sites and development projects.

Production for 2017 is set to hit 1.4 million ounces at an AISC US$775-825, which is fairly low.

After four years near a breakeven point in terms of cash flow, the company’s profits have grown steadily for three years. Getting in and out of the stock shouldn’t be difficult with a £3.37 billion market cap and plenty of volume.

- Fresnillo [LSE:FRES]

Fresnillo is the largest gold company on the LSE by market cap and revenue. Then again, it is more diversified away from gold than the others I mention here. It’s the world’s largest silver miner by a long way, and other industrial metals feature as major parts of Fresnillo’s business too.

It operates in six locations across Mexico and is headquartered there, but the stock is listed on the LSE. It produces, develops and engages in what it calls “advanced exploration”. This suggests exploration that is less speculative than other firms might attempt.

The problem with Fresnillo, apart from its diversification away from gold, is that it had an enormous bumper year in 2016 in terms of profit. It’s unlikely to keep up in the foreseeable future.

But if you’re interested in the role of silver investing alongside gold, Fresnillo might suit you well.

Mid-tier gold stocks

The next three companies are mid-sized. These companies are trying to make it big, but carry plenty of risk. Liquidity for getting into the stock shouldn’t be a problem yet. But they might not survive indefinitely, so be sure to trade rather than invest.

- Acacia Mining [LSE:ACA]

This stock is a lesson in what political risk can do to a miner. The firm is heavily invested in Tanzania, making it the country’s largest gold miner. While most of the gold stock sector is up dozens of per cent for the year, this stock halved.

Why is obvious. The government decided to take advantage of the company’s overinvestment in one country and banned it from exporting gold and copper. Then a presidential committee accused the firm of underreporting gold exports. All this was probably just a bid for larger royalties.

The court case about those royalties is ongoing at the time of writing, but should soon be resolved. Be sure to check in on the result when you read this. Chances are, a compromise will return Acacia’s share price to previous highs. The firm is the subsidiary of the world’s largest gold miner, Barrick Gold, which should give it plenty of political clout in trying to resolve the problem.

With a market cap of £677 million after the crash, the stock still has plenty of volume. Its cash flow went positive last year after scraping by on net profit in the years before. This year’s political mess will do plenty of damage to cash flow and profitability.

If the political problems resolve themselves, the stock is cheap. In anticipation of the outcome, the share price is trending sideways. If you’re brave enough to trade political risk, this is the one for you.

- Highland Gold Mining [LSE:HGM]

This is a mid-sized gold producer with some exploration activities too. It operates in Russia and Kyrgyzstan. The market cap is £469 million with plenty of liquidity.

Highland has three operating mines and many more prospects. Its AISC is remarkably low at $652 an ounce, allowing the company to make a net profit last year.

The dividend has been very volatile, more than doubling for 2016 and lifting the dividend yield above 7% for owners at the time. If you like a gold stock that pays out its profits, this is a great option.

- Centamin [LSE:CEY]

With a market cap of £1.5 billion, this is a larger mid-tier gold producer. With its size comes some geographic diversification. The company operates in Australia, Egypt and central African countries.

The main mine is in Egypt and it’s the only operating gold mine in the country. The firm believes this gives it an advantage for further development there. It also has plenty of exploration and development projects in the rest of Africa.

With a $694/oz AISC in 2016 that is set to rise to $790 this year, the company’s costs are rising fast. But that’s thanks to exploration. Gold production surged 26% in the third quarter of 2017.

The real attraction here is the dividend and lack of debt. The board’s strategy is to deliver a minimum dividend of 30% of sustained cash flow. And the company has no debt.

Small-cap gold stocks

What about the real speculative punts? These tiny firms can deliver enormous returns, or disappear altogether. That’s the trade-off. Be warned, the lack of liquidity means you might have trouble getting in and out.

- Greatland Gold [LSE:GGP]

If you’re keen to avoid political risk, Greatland Gold is a great place to start. The company explores and develops gold and nickel sites in Tasmania and Western Australia. Australia is very unlikely to cause trouble, at least compared to the likes of Tanzania. But the miner is very small, with a market cap of just £54 million. Liquidity is a problem too.

Having been cash flow positive since 2014 is quite an achievement for this little minnow, but don’t let that fool you. Revenues are 0 as none of the mines produce yet, but there are five projects on the go.

The stock spiked hundreds of per cent in late 2017 in anticipation of revenues or takeovers. Perhaps we’ve missed the bus, or perhaps Greatland is destined for greater things.

- Trans-Siberian Gold [LSE:TSG]

Another minnow is Trans-Siberian Gold, with just a £46 million market cap. But it doesn’t seem to behave like a small firm. It’s producing gold from a mine on the Kamchatka Peninsula, Russia, and pays a strong dividend with over 5% yield last year. Revenue held steady with a growing profit and debt has consistently fallen.

The worry is where to from here. Exploration and development costs money. That means less dividends and/or dilution from fundraising is in the future.

The diversified option – a gold stock ETF

If you’d prefer a diversified play on gold stocks, the VanEck Vectors Gold Miners UCITS ETF GDX [LSE:GDX] is a great option. It holds a variety of gold stocks, reducing firm specific and geopolitical risk for you, as well as diversifying internationally. The world’s largest gold companies make up most of the ETF. But it will still leverage the gold price significantly.

Hopefully you found this guide useful to enrich your portfolio for 2018. If so, please share this guide and leave us a comment below with your thoughts.

Until next time,

Nick Hubble

Capital & Conflict

Related Articles:

- Time to Buy Energy Stocks

- North Korea War: 4 Stocks to Protect Your Wealth

- Discover the Best UK Penny Shares for 2018

Category: Investing in Gold