The Bank of Japan has done it! It’s shrunk its balance sheet. Without triggering mass financial panic.

Drawing money out of the economy tightens financial conditions in Japan. That’s not what central banks are supposed to be doing when inflation is below their target. And yet, the apathy of the market seems to suggest it’s not much of an event.

December’s drop in the balance sheet is the first reduction since Abenomics launched in 2012 to try and push growth and inflation in Japan. It’s done neither successfully. Despite the central bank’s balance sheet increasing fourfold since then.

So what does December’s retreat mean? Are the Japanese admitting defeat? Have they realised monetary policy doesn’t work after almost 40 years of trying it?

It’s not just the Japanese that are in a muddle. Each central bank around the world is in some sort of bizarre pickle.

The Americans began the same balance sheet reduction process a few months ago. They’ve hit their inflation and unemployment targets. But GDP growth and productivity languish.

In Europe, the European Central Bank is juggling divergent inflation in its various member states. Good luck with running the same monetary policy for vastly different nations.

The Bank of England’s Monetary Policy Committee voted to continue quantitative easing (QE) at a rate of £435 billion a year a few weeks ago. Despite runaway inflation forcing the governor to write an explanation.

It seems central bankers around the world just can’t get what they want. Today we look into why.

The terribly deep flaw in their thinking could mean an enormous change is afoot inside the world’s most powerful institutions.

And given their policies rescued your retirement in 2008, you need to know what’s going on.

The assumptions of central banking

For many dozens of years, central bankers have been managing the relationship between inflation and unemployment. Only to discover there isn’t one.

The last ten years proved the point. In fact, the relationship between inflation and unemployment has only held for a preciously short amount of time. And yet it continues to be the most influential economic theory around. That’s because it justifies monetary policy itself. The idea that governments can and must manage the economy.

I know that managing the economy through interest rates sounds like a stupid idea. But people used to believe in similar absurdities. We had the British government run telecoms, set wages, ration oil and coal, control rents and set the price of all sorts of consumables last century. These days, only the price and quantity of money remains when it comes to this sort of state intervention in the economy. How backwards.

But can that remain in the face of their key economic theory falling apart? And what does the world look like if central bankers realise they’re as lost and aimless as we’ve all known since the stagflation of the 1970s?

Central banks operate on a misunderstanding

It’s all down to the Phillips Curve – the relationship between inflation and unemployment.

If unemployment is too high, inflation will be too low because workers aren’t cashed up enough to spend and push up prices. If inflation is too high, it’s because too many workers have too many jobs and too much income, which pushes up prices.

This theory is stupid. It ignores something called supply and demand. If prices rise because workers are cashed up and can buy more, then production increases and increases supply. That returns prices to a lower level. As commodity traders will tell you, the cure for high prices is high prices. It incentivises supply. But to an economist, the cure for high prices is higher interest rates. Because they can’t help but meddle.

The idea of monetary policy is that central bankers can use the interest rate to manage where on the Phillips Curve we are. They’re always trying to balance inflation and unemployment. As they’re charged to do by the government, they like to remind us. As though the disastrous failures and unintended consequences are not their fault. More on that in a moment.

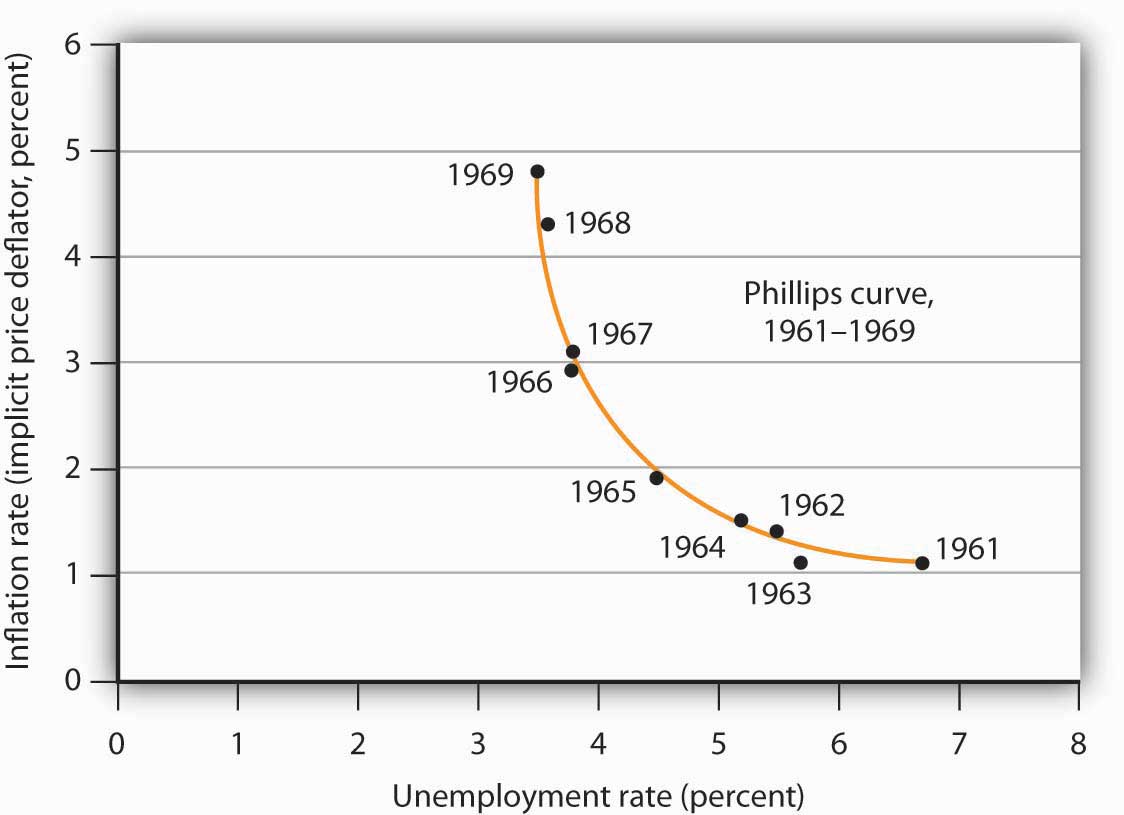

Here’s what the Phillips Curve is supposed to look like, from the US’ experiences in the 1960s:

Source: Macroeconomic Principles

Source: Macroeconomic Principles

The only problem is, the Phillips Curve has hardly ever looked like that. In the 70s we had stagflation. High inflation and high unemployment plagued developed nations at the same time. That’s in the top right-hand side of the chart, well off the Phillips Curve’s line.

In the late 2010s we’ve had low inflation despite low unemployment. Vexed again, to the bottom left-hand side this time.

Even when the Phillips Curve has looked decent, it’s just hidden problems building up elsewhere. Again, more on that below.

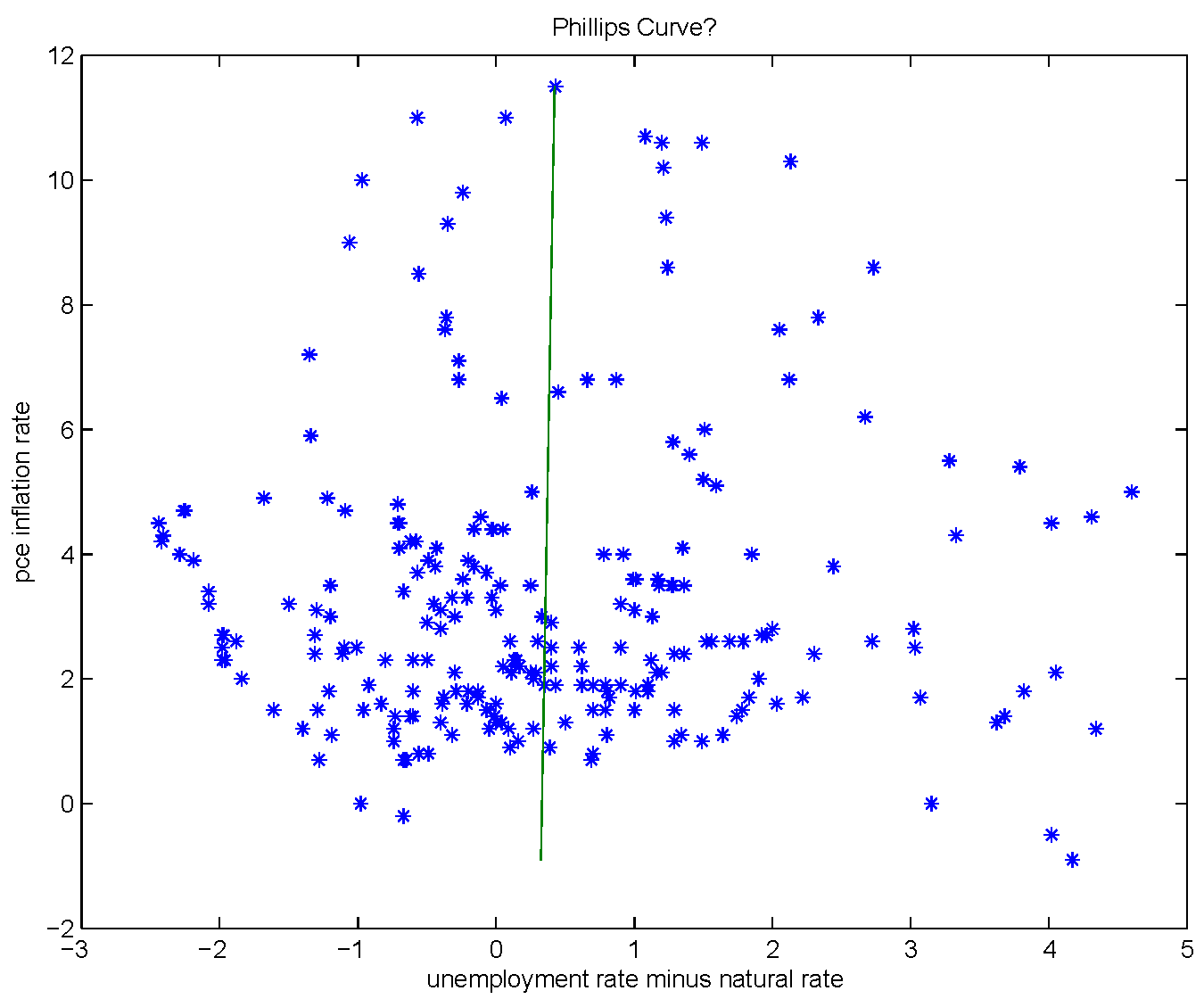

The scatterplot that gave the original Phillips Curve must look pretty random by now. The dots no longer make a line. The New Monetarist blog plots it like this from 1950 to 2013:

Do you see a Philips Curve or a random bundle of dots? Only an economist armed with an overpowered econometric software package could fit a line to that plot and declare a relationship between inflation and unemployment.

In fact, they have. And then created entire new sections of economics to explain why it doesn’t work very well, rather than just admitting it doesn’t work.

But perhaps the century old policy of monetary policy as an economic guidance tool is coming to an end? Without their justifying theory proving itself in practice, what are central bankers supposed to do now?

Monetary policy is just an experiment gone wrong

I’m discovering the beginnings of monetary policy in Britain at the moment. From a history of the Bank of England. And by watching Mary Poppins last night with some aspiring English speakers.

Disney illustrated how “Tuppence prudently, thriftily, frugally, invested in the, to be specific, in the Dawes, Tomes, Mousley, Grubbs Fidelity Fiduciary Bank” can become pound.

But it can also trigger a bank run, as the movie illustrated nicely. That’s the sort of thing that the Bank of England (BoE) took it upon itself to ease back in its early days. Except back then credit and money were still separate things. Someone had to have some gold or silver somewhere. So the BoE did.

Back when it was founded, the government had outsourced much of its money raising and financial activities to the BoE. Thereby it also provided the institution with an extraordinarily good credit rating. Good enough to back others when its own wasn’t great. Which it did successfully on many occasions out of national desperation.

The lender of last resort principle was formed by practice, not flimsy economic theory. Back then, last resort still meant something too. Each governor attempted to hold out for some time.

Incidentally, these days the BoE is busy with other issues. Recent policies at the Old Lady of Threadneedle Street have little to do with monetary policy, financial markets or economics. Instead, the BoE is wrangling over how to reduce gender-specific language in its policy documents…

My relatives in Germany were in fits over this one. No doubt the Spanish are too. Many languages assign gender specific articles to everything. The Spanish have “el” and “la”. The Germans “der”, “die” und “das”. Perhaps there’ll be a politically correct movement to make everything a “das” in Germany. The Spanish will be thrown out of the EU for their defiant gender discrimination.

Back to monetary policy. How the BoE went from lender of last resort to first-class economy manipulator is set for coming chapters of my book. But I’m worried I won’t finish it in time. Before history moves faster than I can read.

If people realise the Phillips Curve doesn’t hold, that leaves modern monetary policy back where it was in the most recent chapter I’ve read. Back before monetary policy was used to manipulate the economy into providing a more preferable result. When the bank was just a lender of last resort to the government and banking system. In other words, the last 100 years of monetary policy were just an experiment gone wrong.

Without a Phillips Curve to work by, monetary policy meddling is lost and aimless. That might not stop them from trying, but it’ll leave them without a map to do it by.

Without their Phillips Curve map, central bankers are just a bailout mechanism like they were about 100 years ago. Back then, even this role was heavily debated.

In fact, the BoE’s history is a terribly convoluted mess. Economic theory plays little to no part. There is no single narrative that makes any sense because the players in the game change too often. And the few things that don’t change remain so without justification.

Such as why the night watch still wandered around with Guy Fawkes lanterns in the 20th century. One of the BoE’s early female employees recalled “I once asked them, […] why they did this and they seemed hardly to know, except that it was an immemorial custom.” One day, Mark Carney might tell us the same thing when we ask him why he was using interest rates to try and manage the Phillips Curve.

The same confusion applies to the history of the Phillips Curve, by the way. The New Zealander Almarin Phillips actually suggested the relationship was between wage growth and unemployment, no inflation mentioned. This is blatantly obvious – basic supply and demand.

The whole inflation side of things was tacked on later by an American economist whose textbooks we still use in universities. As far as I can tell, it was some sort of observational assumption that we’ve now disproved with stagflation and low inflation and low unemployment at the same time. But the disproven theory still justifies the existence of monetary policy.

A trade-off without benefits

Manipulating interest rates to influence inflation and unemployment, however unsuccessful, has other consequences. We’ve put up with them thanks to the supposed benefits of monetary policy. But as those prove illusory, what happens next?

If central bankers can’t control inflation or unemployment, why put up with the problems they create? Like asset bubbles, debt booms, inequality and explicit backdoor bailouts for bankers that encourage absurd levels of risk?

Let’s look into some. You’ll be very familiar with bubbles after 2008. And the moral hazard of having a bailout ready to go for any banker who bets too big. What about the other consequences?

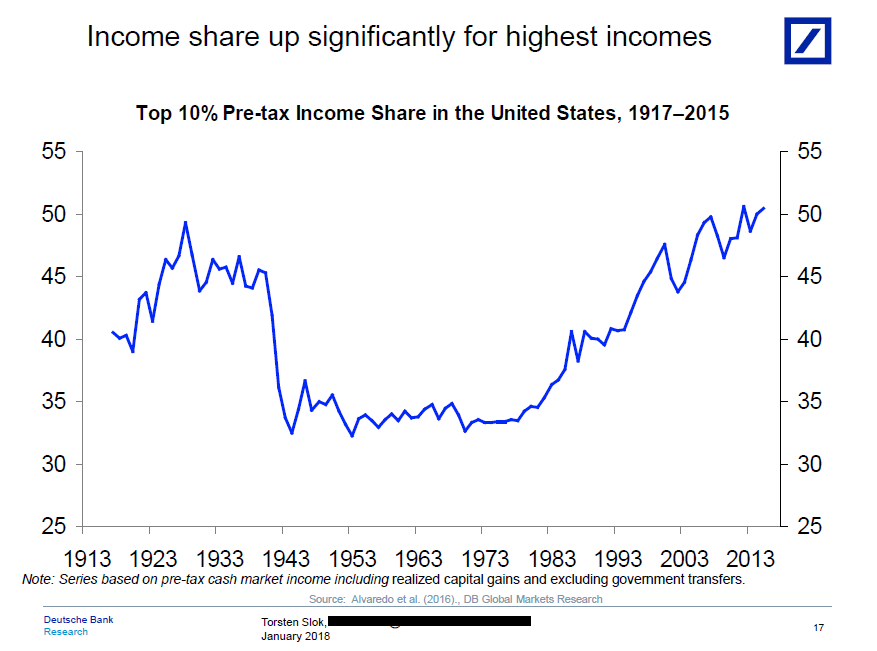

Inequality is one. In the 70s, the experiment with monetary policy unrestrained by the gold standard began around the world. It has delivered steady gains in inequality since. This chart from Goldman Sachs shows how an increasing share of income has accrued to the top 10% of taxpayers in the US.

Without gold to hold back money-printing, inflation, bailouts, debt and financialisaton have boosted the wealthy. Capital gains did well, incomes did not.

But inequality is a mild problem compared to debt.

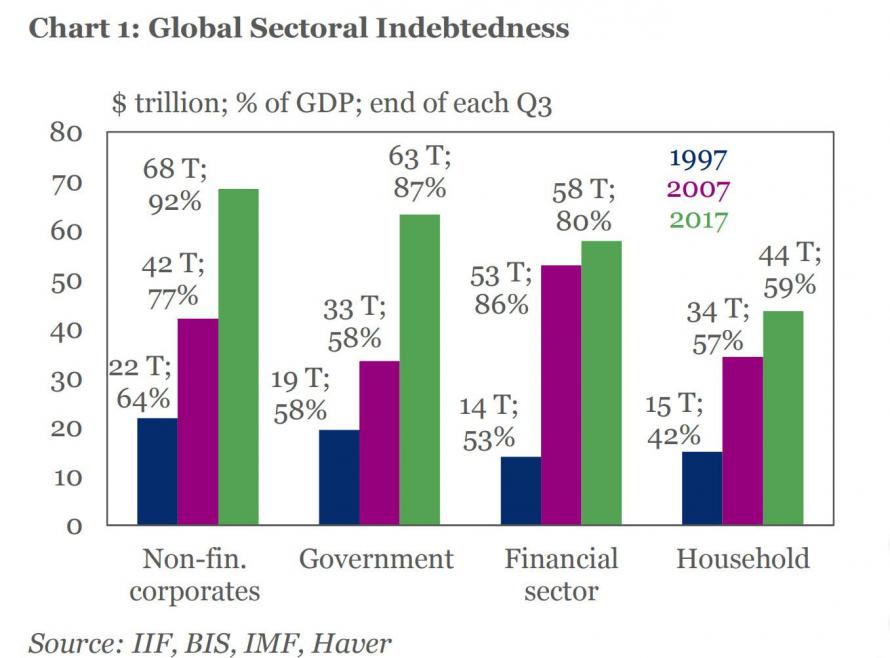

The Institute of International Finance (IIF) has global debt to GDP at 318% this month.

Yes, this debt boom is a side effect of monetary policy too. Lowering interest rates since the 80s to try and squeeze a little more growth out of the economy has really just encouraged borrowing, not growth.

This chart, also from the IIF, but from four months ago, shows which areas of debt have grown.

The problem with debt is that it is growth borrowed from the future. It reduces future growth because it has to be paid back. Plus interest.

What I don’t understand here is who is paying all the interest now. If debt is three times bigger than GDP, and average interest rates are at, say 3%, then it takes 9% of GDP just to pay the interest. At 2% rates, it takes 6% of global GDP.

Imagine what rate hikes would do in a world with 318% debt to GDP.

And doesn’t this level of debt prove the financial sector is a parasite that has outgrown its host? Something we need a global financial crisis to fix. Like the one in 2008.

Except the governments of the world and their central bankers quickly put a stop to that…

To summarise this fiasco, just like all other government policies which meddled in the economy, central banking is a mistake. The economic theories which justify it are wrong. The goals haven’t been achieved. The unintended consequences are a nightmare.

If people begin to realise this, central banking will come under fire. But will they?

Until next time,

Nick Hubble

Capital & Conflict

Related Articles:

- 9 GOLD Stocks that you should BUY now

- The next decade’s most important chart

- Financial World is jumping on Bitcoin bandwagon

Category: Central Banks