It’s the beginning of a busy week. The Dutch elections are tomorrow. And both the Bank of England and Federal Reserve are due to announce their updated manipulation of interest rates on Wednesday. President Donald Trump is expected to send his first budget to Congress this week too.

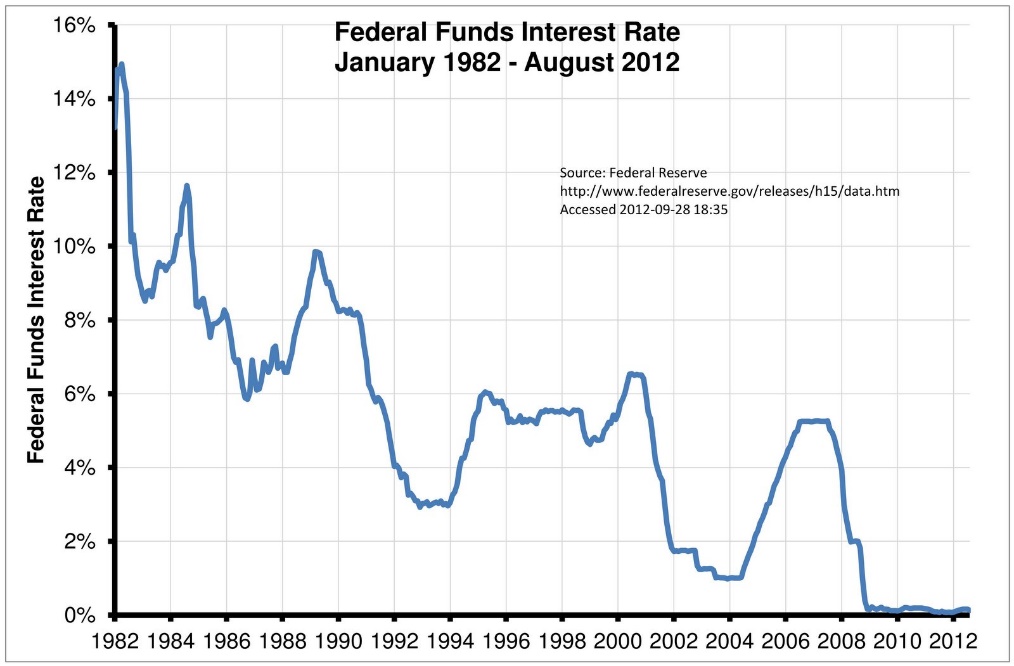

Today we’ll focus on the interest rates. Commentators predict the Federal Reserve will continue its gradual increases. The last time the Fed set out on an upward cycle it ended in the 2008 financial crisis. And things were looking far healthier in the 2000s than they are today.

In fact, the last three cycles of interest rate increases have ended in disaster. You can see the timing on the chart below. Back in 1989 the US had the savings and loans crisis. In 2001 the tech bubble. In 2008 the financial crisis.

What’ll it be this time around? My bet is Europe’s sovereign debt crisis will flare up again if central banks start to increase rates. Governments can’t afford an interest bill.

The Bank of England is expected to hold rates steady in the uncertainty of Brexit. That’s good news for mortgage holders in the UK.

But the big news on interest rates is elsewhere. Policymakers in the eurozone are in deep trouble. Tomorrow’s Capital & Conflict will issue an all-out alert for the monetary union. Today we have to set the scene. If you want to understand just why the next big event in Europe is one nobody sees coming, you’ll need to understand an inherent problem with the monetary union.

Sharing your interest rates

The idea that Greece and Germany should have the same interest rate probably sounded stupid at first. They’re two different countries with two different economies. Their inflation rates, growth rates, employment rates, savings rates – everything that determines what the interest rate should be – are different.

But politics trumps economics in Europe. And the politicians wanted the EU and its currency, the euro. In my opinion the EU was mainly about national politicians having a career resurgence after their voters got sick of them at the national level. But that’s another story.

The argument for a eurozone-wide monetary policy was that you couldn’t have differing interest rates inside the eurozone. It’d be weird because euro bank deposits would run to wherever interest rates are highest. There’d be never-ending bank runs as people in one country moved their deposits to the one with the highest rates.

This argument never held water.

Interest rates reflect risk too

After deposit confiscation in Cyprus, the bank crisis in Ireland and the capital controls in Greece it’s obvious that a euro deposit in banks around the EU are not the same. So differing interest rates in the various euro countries would’ve been just fine. Just as they are for sovereign bonds.

But that’s not what happened. Europe got the European Central Bank and its one size fits all policy instead. The politicians ignored the economic problems this creates. Remarkably, so did some of the central bankers. As the German central banker Otmar Issing put it, the problems associated with having a single interest rate in Europe are not the central banker’s problem:

Many (not all) of the concerns expounded in the preceding section are legitimate, and many of the diversity issues which they pose of relevance for policymaking, in general. Having said this, however, I shall surprise my reader by adding immediately that virtually none of these issues are of relevance for a central banker…

By sticking to inflation targeting at a eurozone-wide level come hell or high water, central bankers thought they’d excused themselves from responsibility for their monetary policies. But they didn’t realise their policies would exacerbate financial instability – cause financial crises. More on that in a second.

There is a deep deep problem here

You have inflation and government bond yields at a national level, but interest rate policy at an EU level. The result is precisely the absurdities which central banking is supposed to prevent.

Central banking is relied upon to be countercyclical. It’s supposed to dampen the booms and soften the busts. But if Belgium is stuck with Greece and Portugal’s interest rate it will do the exact opposite. The European Central Bank will exacerbate problems in Greece and Spain by having rates too high, while in Belgium inflation could be left to surge out of control. It already is surging, at 3% so far.

In other words, international central banking is simply not compatible with national financing and diverging inflation rates inside the union.

The end result is what you’ll discover in tomorrow’s Capital & Conflict. And it has me seriously worried that something will snap. It’s the first time in years that things have looked so precarious. And for once I simply don’t see a policy response that solves the problem, even temporarily.

But how do low interest rates cause problems? Why can’t Belgium just be allowed to boom on an interest rate that’s too low?

How low rates caused this malaise

In economics, it’s often hard to untangle cause and effect. That’s what lets policymakers and commentators have their cake and eat it too. For example, the same economist might argue that increasing the cost of cigarettes reduces their consumption, but increasing the minimum wages boosts employment. Apparently the same logic doesn’t apply to the two cases.

Claudio Borio from the Bank for International Settlements recently reversed a well-accepted cause and effect. Low interest rates around the world are supposed to be stimulating growth. But Borio says they might be what’s causing the economic malaise instead. He calls it the Financial Cycle Drag Hypothesis. Here’s the short version…

For the last 30 years our ability to produce things more efficiently and cheaply has surged. Often thanks to the development of economies previously stuck in the socialist doldrums. But also because of technology.

Unfortunately central banks are obsessed with keeping prices stable. They don’t understand that deflation is good if it’s driven by improvements in productivity – if it takes less and less to produce the same thing.

That’s why the world’s best economic times were during slow deflation

The irrational fear of deflation meant central bankers kept interest rates unnaturally low without realising it. They were fighting off good deflation. And that created the economic imbalances we have now.

Interest rates affect different parts of the economy differently. If rates are unnaturally low, they incentivise debt-laden ventures like property construction and deficit-financed government nincompoopery. Hence the housing bubbles and sovereign debt crises we’re having. They’re responses to central bank interest rates that are too low.

Meanwhile the industries that were supposed to soak up the resources for more productive enterprises are left high and dry. Hence our disappointing manufacturing sectors in the West.

The worst aspect of the low interest rate drug is the same as every other drug – it’s addictive. Once you start on the cycle of low interest rates, bubble, and bust, you’re incentivised to do the same thing all over again. It’s hard to let the economy reallocate resources by letting banks default and governments go bust. But if you breathe new life into them, they’ll do the same thing over again.

Over time you get a moribund economy addicted to interest rate cycles. And that’s where we started today’s Capital & Conflict.

But this depressing cycle needn’t bother you. If you understand it, you become one of the ones set to gain from the predictable booms and busts.

Be sure to open tomorrow’s Capital & Conflict for what I expect will be the next big issue facing your financial life.

Until next time,

Nick Hubble

Category: Central Banks