I’ll come straight to the point.

I think it’s time to be buying the miners again.

Not straight away. But over the summer, look for pullbacks in the likes of BHP Billiton, Glencore Xstrata, Vedanta and Anglo American and get long.

Here’s why.

Mining has gone from feast to famine – is it time for a turn?

Mining is extremely cyclical. Feast follows famine and famine follows feast as sure as night follows day. You’d think the sector would learn, but it never seems to.

You get periods of huge over-investment. They begin as metal prices start to rise. Existing supply can’t match demand. Mines that are already producing metal become very profitable for their owners. Low-grade, high-cost mines start to become viable.

Investment comes in. Speculative money starts moving into exploration. New discoveries are made – and the people involved make fortunes: from the investors who funded the exploration to the geologists who found the rocks.

And, as a result of the fortunes made, everyone starts getting involved in exploration and fortunes start pouring in. Canadian ‘lifestyle’ companies emerge around ‘moose pasture’ – projects that everybody surely knows will never ever be turned into a mine.

At real extremes, geologists are driving to work in Maseratis, while cables get stolen or the flashing from roofs to be melted down into scrap.

This is where we were in 2011.

But a certain point reality dawns. Production reaches a point at which supply exceeds demand. The metal warehouses are full. People start selling. Their thoughts turn from boom to bust – “metals shouldn’t be that expensive”, “that company is totally unviable”, “this is excessive”.

A downtrend begins. Metal prices fall. Those low-grade projects become unviable again and are shut down. Projects are written off. Jobs are lost. Maseratis are sold. Funding for exploration dries up altogether. And no new discoveries are made.

That purging describes the sector over the last three years.

But this misery doesn’t go on forever either – any more than the boom does – and eventually we reach a point where supply has fallen short of demand again. And so the mining cycle reverses.

We may not see another boom – but the worst is over for this cycle

I think it’ll be a long time before we see another mining boom like 2003-07 or 2009-10 again – though who knows what kind of speculative bubbles lie around the corner in this world of artificially easy money. But I do think the worst is over and the low is in.

We’ve had the write-offs. We’ve had the paucity of new discoveries. Funding for exploration has disappeared. Many (though not enough for my liking) of those lifestyle ‘moose pasture’ companies have gone under. In short, the foundations for the next up-cycle are in place.

Really boring metals such as lead and zinc are suffering from chronic underinvestment. It’s something I wrote about a year ago. Zinc prices have now risen to a 35-month high, with stockpiles in London having fallen 29% this year to their lowest level since 2010.

Morgan Stanley put out a report yesterday saying that zinc will see “continued outperformance as the deficit intensifies and global auto sector strength drives demand”. As well as zinc, it notes that copper and lead already face supply shortfalls. Nickel – up 40% this year – and aluminium are heading for shortfalls too.

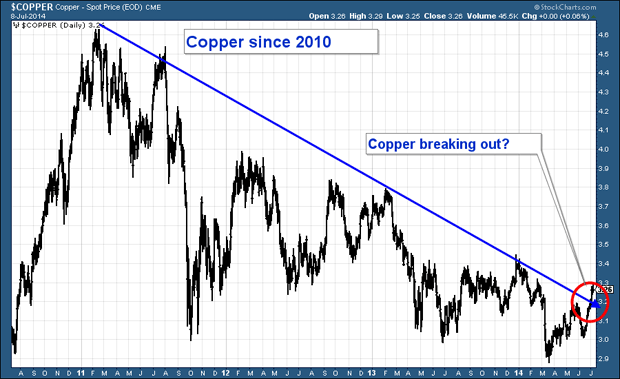

Copper looks very interesting now, I must say. A few months ago I suggested it was at a crossroads – and recommended a short position as long as it remained below the falling blue trend line in the chart below.

However, copper has broken out in the other direction and the stop has been triggered. The call was wrong – but the risk was well managed.

You can look at just about any metal you like – uranium, platinum, palladium, rare earth metals – and argue that the fundamentals are there for supply shortages to emerge, and thus ignite a nice run in the companies that mine them.

Obviously, the small-cap end of the mining sector is where the biggest gains are made. But the simplest, safest way to play it all is via one of the large-caps. They move first in the cycle and the tiddlers move later.

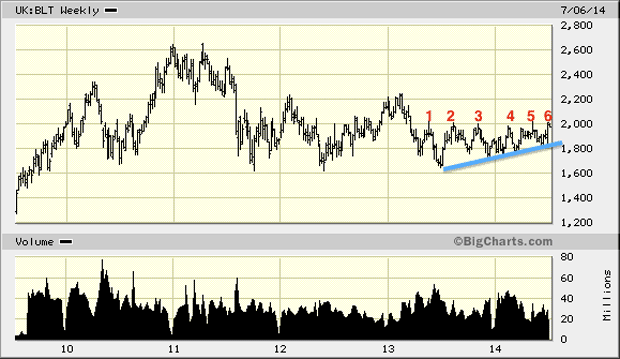

In the chart below, we see the largest of them all, BHP Billiton (LSE: BLT), since 2009. Over the last three years it has gone nowhere. 1,600p has been the low – tested three times. But since 2013, the lows have got steadily higher – as identified by that rising blue trendline.

Meanwhile 2,000p has been resistance. But that resistance has been re-tested six times now. As I’m forever saying, the more a level is tested, the less likely it is to hold. We’re testing it again now.

Once we’re through 2,000p I suggest we’ll be at 2,200 before you know it. From there we’ll have to review the situation again.

Most of the large-cap miners listed on the FTSE have similar price patterns. And it’s my view that this sector is getting going again.

You can make a lot of money in a mining boom. You want to be exposed to it. It’s my view that the first step in a mining up-cycle is underway. Look for pullbacks over the summer, get long and enjoy the ride.

Category: Market updates