Over the next ten or 15 years, which metal – based on the current rates of discovery and production – do you think we’ll end up running low on?

Gold? Silver? Platinum? Copper? Iron? Uranium, maybe?

Actually, it’s the least glamorous metal of the lot: dowdy old lead. And not far behind it in the shortfall stakes comes zinc.

Does that mean it’s time to invest?

Spending on mining has shot up – but metal discoveries haven’t

Richard Schodde, managing director of MinEx consulting, gave a very interesting presentation at the Geological Society of South Africa’s 2013 GeoForum conference earlier this month.

In 2001-02, less than $3bn was spent worldwide exploring for minerals. Then came the commodities boom.

Spending shot up. By 2012, spending on exploration had hit nearly $30bn – an all-time high.

Yet, for all that extra money, the rate of new discoveries did not rise by anything like as much. For example, spending on ‘non-ferrous’ metals (ie those other than iron ore) rose eight-fold. But the number of discoveries merely tripled.

In other words, an awful lot of the new money was not converted into metal. This is unusual. In the past, there has been a better correlation between spending and metal discovery.

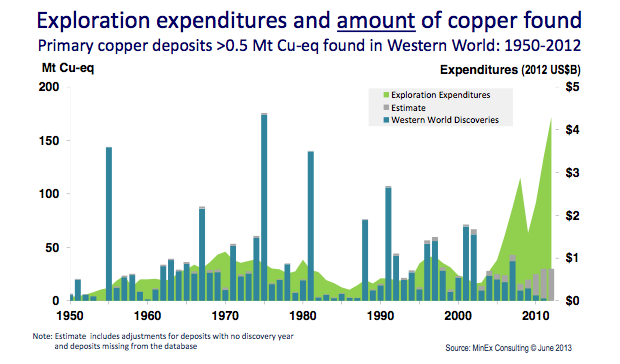

The chart below looks specifically at copper. Don’t worry if it looks a little confusing. The light green shaded area shows the huge rise in spending.

And those blue and grey bars, which tail off rather pitifully even as the green area spikes, show the quantity of copper discovered. As you can see, all that money failed to produce much extra metal.

It’s partly because – as with oil – metal is getting harder and harder to find. Miners have to explore more remote or politically risky areas. They’re also having to drill deeper underground.

Then there’s production costs. Oil prices remain high. Drill rigs are more than twice as expensive as they were ten years ago. Salaries have almost tripled. In 2002, an exploration manager in Australia would be on A$70,000 a year. Last year, the average was A$250,000.

But it can’t all be pinned on rising costs. A lot is just bad management. Like most boom industries, miners were guilty of horrendous excess. I’m not just talking about the billions wasted on projects that came to nothing.

I often met with junior mining executives who had flown over from Canada to raise funds in London. They’d step off a first class flight and check into the Savoy. Not enough money was spent on the ground, and too much went on expense accounts, cars, and other items that do not warrant mention in a upstanding column such as this one.

Those days are over. Exploration spending is thought to be down by 20% overall. And in Canada and Australia’s junior mining markets, funding has all but dried up. Schodde expects exploration spending to drop by about 35% by 2020. But I suspect it will fall a lot harder and faster than that.

Zinc and lead are going to be in short supply

However, that spells opportunity for investors.

As a rule of thumb, for supplies of a metal to be sustainable, miners need to find about twice as much of the mineral as is currently being mined.

So if a thousand units of metal are mined a year, the industry needs to find another two thousand a year (bearing in mind that not all of this will be recoverable). Otherwise there will be shortages.

But if there’s no money for exploration, there’ll be no new discoveries.

Looking at current discovery rates, Shodde has done his sums on which metals will face the biggest supply shortfalls. He reckons that, in the next decade, copper discoveries will amount to about 1.7 times production. That’s tight, but broadly balanced.

Uranium discoveries will sit at twice annual production, and so are in balance. Gold supply is a little tighter, with discoveries amounting to 1.5 times production.

But the discovery-to-production ratio for zinc is 0.7. And for lead, it’s 0.5. That points to a huge shortfall. Discovery rates won’t even match current production, let alone maintain future supplies.

This means more money will have to be spent on exploration – and with more success at finding metal this time. Trouble is, there is no appetite for exploration investment at present. Too many people have had their fingers burned.

Sure, all it will take is for a couple of winners to emerge, and the appetite for risk will bounce back. But – and here’s the vicious circle – someone will have to fund those winners in the first place.

What’s most likely to encourage investment is that lead and zinc prices will rise, due to the pending shortages. Rising metal prices usually lead to more investment in exploration. And so the boom-bust cycle that has blighted mining for all eternity continues to turn.

So get ready to buy lead and zinc, folks!

The best bets among lead and zinc miners

I don’t currently own positions in any of these stocks myself. But it’s worth building a watch list now, so you can be ready.

Zinc and lead tend to occur together (along with silver). So any company that mines zinc will often mine lead too. Nyrstar (Euronext: NYR) is probably the purest large-cap play.

If you’re looking for tiddlers, there’s Aim-listed ZincOx Resources (LSE: ZOX). I have a fondness for this company, which I owned many moons ago – although I’m glad I don’t now. It was a £3 stock before 2008 – now it’s down at 14p. It’s on the wrong end of a very long trend – I don’t know if this is the end. But it would make a rather beautiful ‘double bottom’ if it is.

You could also consider Connemara Mining (LSE: CON), which is developing the Irish Stonepark zinc and lead property in Limerick in a joint venture with Teck Resources, and holds various other prospecting licences in Ireland.

And Donner Metals (TSX-V: DON) trades for pennies on Canada’s venture exchange. Donner has good assets, but it’s starved of funds. The danger is that it could have to issue shares to raise more money, diluting existing holders.

The other option is to play the zinc price via a spreadbet.

As for when to buy – it might not be quite time to jump in just yet, unless you can’t resist bottom-fishing. I’d rather see the relentless declines that have blighted mining flatten out over a period of weeks, and the moving averages turn up.

Somebody else can have the first 10-20%, as far as I’m concerned – I’m not taking the risk. But I do want to be onboard for the longer-term trend. I’ll update you when and if I get a ‘buy’ signal.

Category: Market updates