SODERMALM, STOCKHOLM – Happy hump day! A quick note before we begin: further to yesterday’s note, I want to know what your predictions are for 2021 – investment related, but not necessarily stock specific. Let me know here, and I’ll share them in a Capital & Conflict later in the week: [email protected].

The Brown Bottom cometh

Yesterday, Sam Volkering paid me for 60 beers. This wasn’t the result of me winning a bet, or for closing a significant pub tab, but rather the culmination of a project that began over a year ago with a dear reader of this letter.

Long-time subscribers to Capital & Conflict may remember a year ago that I proposed the brewing of a golden ale called Brown Bottom to commemorate the former chancellor’s avarice in selling the UK’s gold reserves at the bottom of the market (A golden ale for golden times – 5 March 2019).

The inspiration for this arrived when a Labour MP on the Public Accounts Committee suggested that a Wetherspoons should be opened in the Bank of England to boost government revenue. While it was a ridiculous idea and rightfully rejected in the interests of keeping the bank’s vaults safe, I wondered what kind of beers would be on offer inside such a pub (Boozing in the Bank of England – 28 January 2019).

I promptly received many amusing suggestions in my inbox describing the character of beers that should be available on tap in Threadneedle Street, like “Central Banks should provide the bubbles, Politicians should provide the froth… and if it’s got to be Export strength then the Germans should be the main player.”

But I was also contacted by brewers interested in making this dream a reality. And I’m proud to say that outside of my role here at Southbank Investment Research – I’ve been working with Cheddar Ales on the creation of a very special brew that will soon be hitting the market.

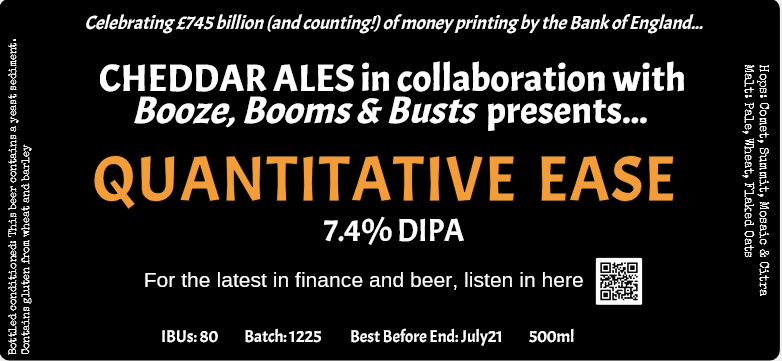

It’s a limited run double IPA called Quantitative Ease. At 7.4% ABV to match the £745 billion in quantitative easing conducted by the Bank of England and hopped to high hell, it’ll pack a punch. It’ll be released in less than a fortnight – I’ll let you know when it does. It’ll be a limited run, so you want some, you’ll need to get in fast…

None of the revenue will go to myself or Southbank Investment Research – it’ll all go to Cheddar Ales. Supporting small breweries when the government is slamming them so hard these days is a civic duty in my eyes, and I’m proud to be a part of this little project.

Here’s a sneak preview of the label:

Booze, Booms & Busts is a podcast I record with Sam Volkering where we discuss the markets while cracking open a couple of beers we haven’t had before and giving them a “credit rating” from investment grade to junk. We should be recording this week’s episode this evening, all being well.

Sam was very keen indeed on my idea for Quantitative Ease and asked me to buy him five cases (60 beers) for him ahead of time. Yesterday, he paid me – though not in pound sterling. In keeping with his bullish conviction on the future of money, he paid me in bitcoin. And it came to a round total of… ₿0.01147188.

Not a big number for 60 beers – and double IPAs, at that. But that’s the power of bitcoin – while the cost of everything in fiat money is going up, prices in bitcoin have kept going down. While paper money was created to be inflated away, bitcoin has been designed to deflate. Sam reckons the BTC he paid me will be worth significantly more than 60 beers in the near future (I suspect he promptly bought more BTC after he sent me)… but I’ll let him make his case to you himself.

Hopefully, we’ll be able to make more beers with Cheddar Ales in future, including the original idea for a Brown Bottom golden ale. Quantitative Ease is a trial run, and we’ll see how it goes before “falling further off the wagon”.

Though to do so may actually be quite risky – as we’ve linked the ABV to the amount of money printing conducted by the Bank of England, future editions of that beer (QE II perhaps) may need to be dangerously potent indeed…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Investing in Bitcoin