Bitcoin’s price looks and smells like a bubble. But the media’s takedown attempt is turning ridiculous. Here are three headlines from the Financial Times’ homepage this morning:

Bitcoin: a poxy currency

Bitcoin: an investment mania for the fake news era

Bitcoin is a faith-based asset for a populist era

Poxy? Fake news? Faith-based?

Do you see the allusions they’re making?

Guilty by association is an ad hominem fallacy. That’s a way of saying “crap argument”.

Bitcoin is no disease. It has very real benefits that no Dutch tulip could match. Even if you ground it down and smoked it. And the article headlined “fake news” only mentions fake news twice, including in the headline. It’s a bit odd to associate Donald Trump’s supporters with something complex after denigrating them as dumb for so long.

Investors’ Pick: Guide to Understanding the Price of Gold

Perhaps the media’s militant bitcoin bashing is the real bubble here. Scepticism is still more powerful than the bitcoin boom in the mainstream world. As an expert on scepticism, you always worry when there’s too much of it around.

Unfortunately, it’s not just the media cracking down on bitcoin. Unable to watch the cryptocurrency boom go its own way, governments are gradually stepping in. They want to regulate bitcoin and its cousins.

I’m not sure who is advocating for this policy. I don’t know which voters are supposed to benefit. I can’t work out which interest group is offering campaign donations. They can’t possibly be as wealthy as bitcoin investors. The first politician to accept bitcoin donations as a sign of their position on this would do well…

Perhaps the reason behind the crackdowns around the world is simple. As Ronald Reagan explained, “Government’s view of the economy could be summed up in a few short phrases: if it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidise it.”

Bitcoin certainly has been moving. And taxing it may prove difficult without regulating it first. That’s the path Her Majesty’s Treasury is going down. The UK government wants to apply the rules it applies to the rest of the financial system to bitcoin.

The Telegraph reports on the “Bitcoin crackdown: Treasury to act amid fears of money laundering and tax avoidance”.

The good news is that there is still time to get in anonymously. The rules won’t apply until next year. I’m surprised the announcement didn’t cause a huge rally in the bitcoin price as people rushed in while they still can. Anonymous wallets not previously connected to identities could be worth a fortune soon.

Instead, the bitcoin price took a hit as the government went public with the EU wide laws. (If ever there was an opportunity to make the UK economy boom while the EU stabs itself in the foot.)

The mixed news for bitcoin owners is that this move acknowledges bitcoin’s ability to be money. Or just potential to be, if that statement makes you grumpy. (Yes, I still prefer gold too.) The threat is a terrifying one for governments.

The bad news is, bitcoin’s days outside the financial system are numbered. Having applied for a bank account in the UK over a period of several weeks, this is a painful statement for me.

Speaking of the financial system, where is it on all this?

The financial system’s bitcoin inertia

If you think that the mainstream financial system is the one pushing the laws against bitcoin currencies, you might be right. Competition crushes profits. Except big firms can make far too much money from the bubble to wish it away.

The American NASQAQ exchange has plans to launch a way to trade bitcoin on its systems. Its announcement followed speculation the COMEX in Chicago, the world’s biggest derivatives exchange, would offer bitcoin futures soon. Interestingly, the new contracts will allow people to short the bitcoin price too.

I visited a friend’s fintech business in Sydney today. (Yes, the road trip from Perth to Queensland continues.) He’s settled in one of Sydney’s incubator offices. The place was noticeable for its lack of cryptocurrency related startups. My friend spoke of the natural tension between the fintech startups and the funders of the incubator space – banks and finance companies…

Despite the enormous potential of cryptocurrency technology to cut costs for major finance companies, the lambasting from them continues. The CEO of one of the world’s largest banks called it a fraud. “Bitcoin just shows you how much demand for money laundering there is in the world,” said the CEO of BlackRock, the world’s biggest funds management company.

But here is my all time favourite analysis of bitcoin, from the FT:

Joseph Stiglitz, the Nobel Prize-winning US economist, has said it ought to be outlawed. “Bitcoin is successful only because of its potential for circumvention, lack of oversight,” he said this week. “It doesn’t serve any socially useful function.”

Bitcoin’s ability to hide from the financial system and government is its greatest socially useful function!

That function saved lives in Venezuela and Zimbabwe. It kept drug users out of the hands of the law while they wait for prohibition to end. Chinese have been able to escape the draconian capital controls of their rulers. South Koreans have secured their wealth out of the reaches of Kim Jong-un’s missiles. Families around the world have sent money to each other in defiance of sanctions supposed to punish their dictators.

Circumvention of the government and a lack of government oversight brought you the revolutions of this world. They enabled the liberties we enjoy. They are the most important accountability mechanism we have. The Brexit referendum showed voting isn’t working well…

If governments make the mistake of forgetting they can be the enemy of the people, they become the enemy of the people.

The real way to measure whether bitcoin is in a bubble

Sure, the bitcoin price chart is parabolic. News stories can’t be updated fast enough to keep up with the price. It makes their scepticism look ridiculous when the price is already far higher than they doubted over.

But when an asset has not yet reached saturation in users, and the supply is inherently limited, then its price cannot be the measure of bubbliness. It’s merely a measure of volume.

That’s the sort of convoluted statement you’re not supposed to make in a newsletter. So now I have to explain it.

Imagine declaring the internet was in a bubble with 250 million users in 1999 because the number of users had grown parabolically. You’d be missing the point on every level.

The internet’s potential number of users is… well, everyone. Only the wildest dreamers among tech stock owners said so in 1999.

But the supply of tech stocks is unlimited. Bitcoin’s supply is fixed. That’s why the price is the pressure valve. The pressure valve for volume.

I’ll try explaining it in a different way.

The bitcoin price is the result of two factors. First, the number of users, because they all have to pile in by buying. Once in, the question becomes the number of transactions that bitcoin can be used for.

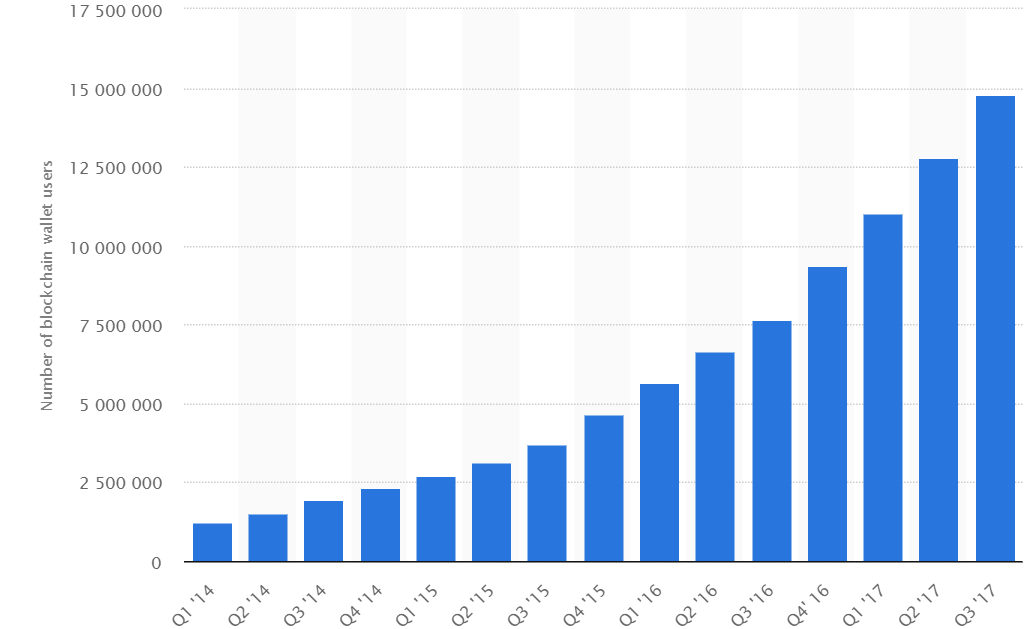

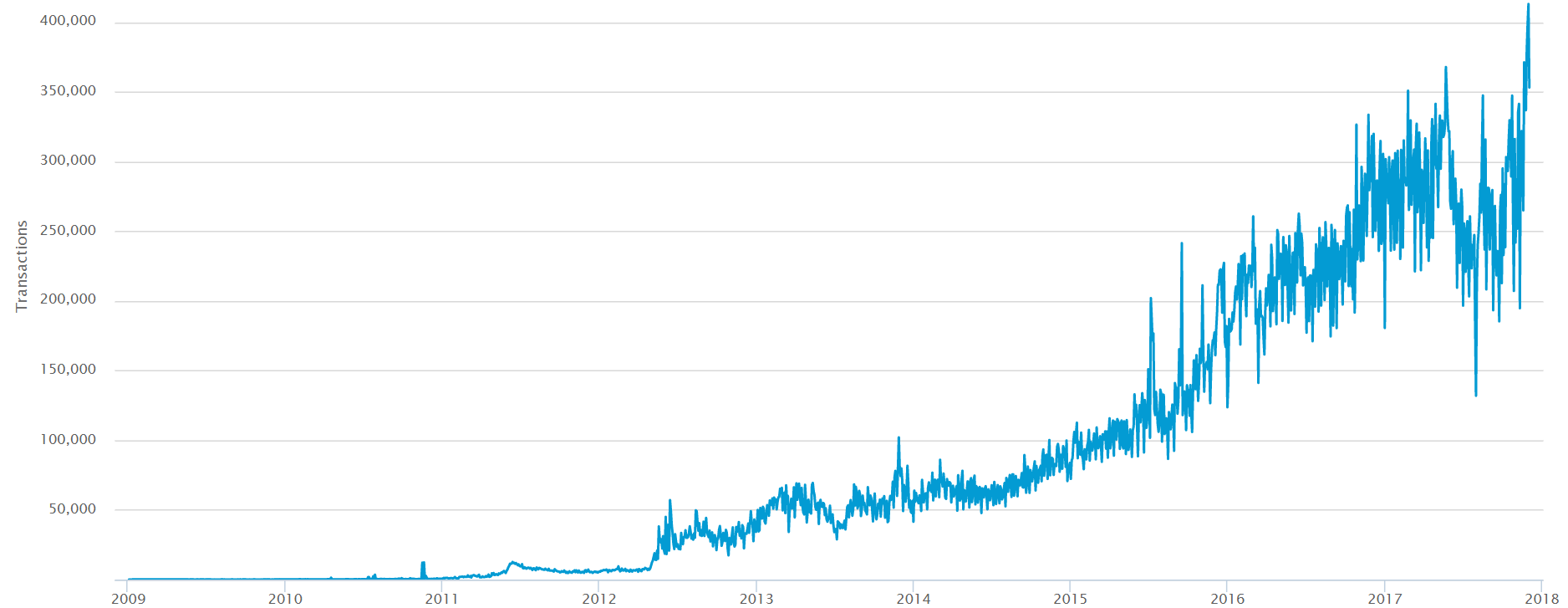

For the bitcoin boom to be diagnosed a bubble, the number of users or transactions has to be on an unsustainable trajectory. That is very, very, very, very, very far from the case when it comes to the number of users. And even further when it comes to transactions.

The number of bitcoin wallets is a fraction of its global potential, and growing steadily. The exponential trend is barely beginning.

Number of wallets (users)

Source: Statista 2017

Source: Statista 2017

The number of transactions has been volatile, but not growing unsustainably. Remarkable given the number of vendors now accepting them, and the growth in wallets.

Number of transactions

Source: Blockchain.info

Source: Blockchain.info

Bitcoin’s problem is the difficulty in using them. But as I’ve explained before, that’s solvable.

In fact, I bet that the real money will be made by investing in companies that profit from the bitcoin usage and innovation boom.

Focusing on the price of bitcoin to establish whether it’s a bubble is missing the point. The price is an outcome of other factors. The number of users and transactions are what you need to watch. Neither exhibit bubble indications.

What do you think about the “crypto-bubble”? Leave your comments below.

Until next time,

Nick Hubble

Capital & Conflict

Related Articles:

- Bitcoin offers you a holiday in South Korea

- Are ICOs the new Stockmarket?

- Financial zombie apocalypse

Category: Investing in Bitcoin