It’s above $9,700 now. The fact that you know what I’m talking about tells you a lot about the bitcoin mania. What other assets can you recognise by price alone?

With every surge, the cries of “bubble” grow louder. And the parabolic gains with remarkable volatility certainly make it a good argument.

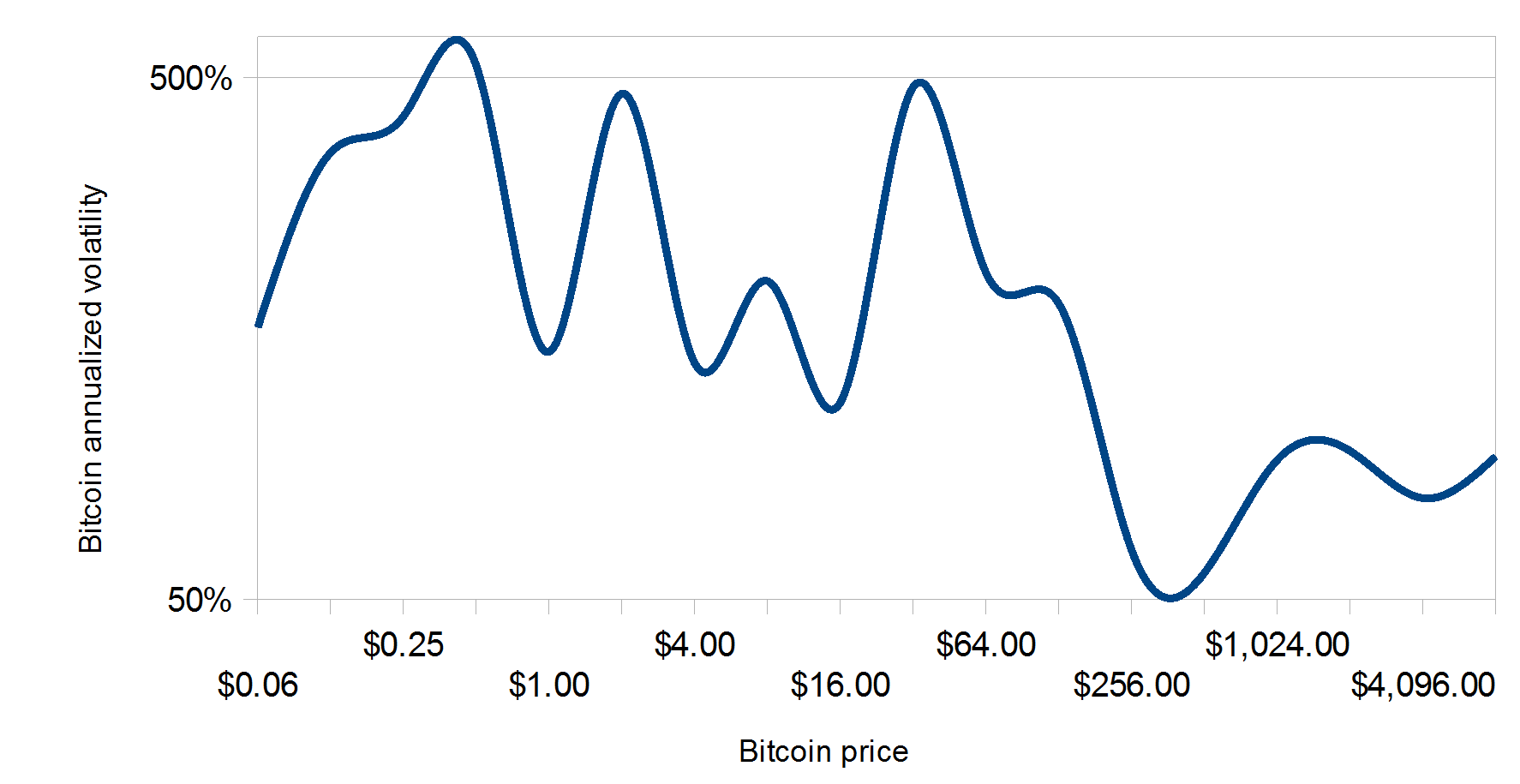

Except volatility isn’t growing. It’s falling.

The denominator in the calculation is outgrowing the numerator. The price of bitcoin is so high that the also growing dollar price movements are falling in percentage terms. It’s harder to double from $5,000 than $5. Not that the cryptocurrency isn’t closing in on $10,000.

But let’s turn away from the bitcoin price. There’s so much more to the story. And there are far better ways to make money out of it once you understand what’s really going on.

What if bitcoin’s effect isn’t just to make a bundle of speculators rich? What if it fundamentally changes the nature of money? What if the economy’s flows are about to be redirected entirely?

Rick Falkvinge, the CEO of Bitcoin Cash and founder of the Swedish Pirate Party, claimed that “bitcoin is an extinction-level event for banks”. The idea is that bitcoin will replace money and thereby the financial system.

Compare your pounds to bitcoin to see why that isn’t so absurd, in the long term

The financial system’s infrastructure is enormous and extraordinarily expensive. Bitcoin’s is so decentralised it doesn’t really exist in the same sense. And the costs are mostly born by those doing the mining – which is a self-rewarding action. The savings from a blockchain system are enormous. The effect of the internet on branch banking has been similar. But this time the change could be far greater.

Then there’s the issue of property rights. Do you own the money in your bank account? No, not really. You have a legal claim. A bank deposit is not a deposit, but a short-term loan to the bank. That’s what allows a bank to hold only a small amount of money ready for its depositors to use. And it’s why governments have to “guarantee deposits”. That should be a paradox.

Bitcoin, on the other hand, is yours. You own it. It’s in your possession.

That’s not to say some bitcoin exchanges aren’t behaving like banks. Their customers rarely withdraw their bitcoin into wallets. Which opens the opportunity for fraud similar to what banks do.

But, used properly, you can own bitcoin and have digital possession of it, without impeding your ability to spend or move it. Large amounts too. The far stronger property rights are a major attraction in a fragile financial system.

Next there’s the international nature of the cryptocurrencies

I’m willing to accept bitcoin isn’t a currency yet, by the way. More on that in a moment. Assuming the bitcoin system matures, its international nature is a big advantage in the same way the euro is advantageous for trade and travel.

The speed of transactions, a major embarrassment for the global financial system, is another impressive advantage. Nowadays, some financial institutions offer the same speed as bitcoin for some transactions. But they are not transferring assets, just doing the accounting faster. The settlement between banks still happens far later.

Then there’s the ability of a government to interfere. Bitcoin won’t have bank holidays, Sundays, ATM withdrawal limits, transaction limits, pending payments or branch closures.

So, on many measures, bitcoin comes out on top of traditional digital money. But it also has huge disadvantages. The exchange rate fluctuates enormously. The institutions are not established and trusted. The convenience of using bitcoin can’t compete with cash.

You have no recourse for wrongdoing

What you have to notice about those three, and others, is that they are fixable. Perhaps not easily so. And perhaps it’ll take time. But bitcoin does have the potential to overcome its disadvantages. Our government-run currencies cannot overcome most of their disadvantages.

So the debate about cryptocurrencies shouldn’t be about what they are now, but what they’ll become.

Even if you argue bitcoin won’t make it, it’s tough to ignore the innovation in cryptocurrencies and blockchain outside of bitcoin. Even if bitcoin isn’t the cryptocurrency that triggers a monetary revolution, some other system could.

The next question is who controls the new currency. Does anyone? Is there just one currency?

Bitcoin’s power has already scored victories over the governments of Venezuela, Zimbabwe and China. It’s shown how governments can no longer control international wealth flows and transactions.

But if bitcoin catches on within domestic markets too, governments lose control over taxation, monetary policy, financial regulation and more. The entire economy could easily turn into a black market that’s more secure than the government system.

The new stockmarket

Companies are using cryptocurrencies to raise funds. Usually in conjunction with some sort of application they’re building with cryptocurrencies or blockchain.

Instead of buying shares in the company, you buy its cryptocurrency with the promise of being able to use it on its platform later. The company uses these funds to finance the development of the platform.

These cryptocurrencies trade with each other, creating a type of stockmarket.

Major corporations haven’t entered this market much yet. But when they do, things will get extraordinarily interesting.

Ask yourself, who do you trust more: the government, or Microsoft, Apple, Tesco and other major corporations?

If companies can raise funds outside the heavily regulated investment market, and trustworthy major companies begin to tap into this, it bypasses a huge proportion of the global financial system.

Company coins and scams

You might, for example, buy a few thousand Tesco coins, which the company issues to finance your new local store. Then you can spend those coins in store. At no point have you entered the banking or financial system. In the same way, companies can finance the creation of phones, computer games, phone apps, cars and thousands of other products and services.

Again, it’s important to remember that many or most early initiatives will fail. There will be plenty of fraud. Blockchain’s biggest backers and users have admitted this themselves. PYMNTS.com mentioned two:

Two top bitcoin rivals are in agreement: Many initial coin offerings (ICO) are fraudulent.

According to news from CNBC, both Joseph Lubin, co-founder of Ethereum, and Brad Garlinghouse, CEO of Ripple, have issued warnings about the rise in fraudulent projects that offer little value to investors.

While many ICO sales are used to back “high-quality projects, there have been a lot of copycat projects where people copy all the same materials (and) don’t intend to deliver any value to the people buying the tokens,” Lubin said during an interview while attending the Singapore FinTech Festival.

Bypassing the financial system

Still, there’s no question that bypassing the financial system has enormous benefits. For companies and buyers. So eventually trustworthy players will get in on the action. My bet is on computer game companies to lead this space.

I began this article by pointing out that the parabolic price gains from cryptocurrencies might not be the big story here. The internet revolutionised the entire economy. The world’s biggest retailer has no shops, it’s online. The world’s biggest media and advertising companies operate almost entirely online. The world’s biggest taxi company doesn’t own cars, it’s just online. Computer game companies sell entirely online too.

Owning Alibaba, Uber and Google shares would’ve lit a fire under your portfolio. Perhaps in a more sustainable way than buying bitcoin.

Under this view of the world, it’s all about sifting through the noise to find the promising companies who stand to benefit most from cryptocurrencies and blockchain. And building the non-existent expertise to do so.

When I say non-existent, I mean brand new. Although perhaps the team at Revolutionary Tech Investor think their years of experience in the area is actually quite a long time. It is in the world of cryptos, anyway.

I’ve seen the early workings of reports they’ve prepared for you about the best way to profit from all the changes that are afoot. It turns out that the ability of blockchain technology won’t just change money and currencies, but business models. With the same potential profits. Extraordinary ones.

Despite all the bad news for cryptocurrencies, the technology behind them is set to revolutionise the economy. The stockmarket may yet prove to be the better way to profit from the blockchain boom. Find out precisely which stocks could match bitcoin’s returns.

Until next time,

Nick Hubble

Capital & Conflict

Related Articles:

Category: Investing in Bitcoin