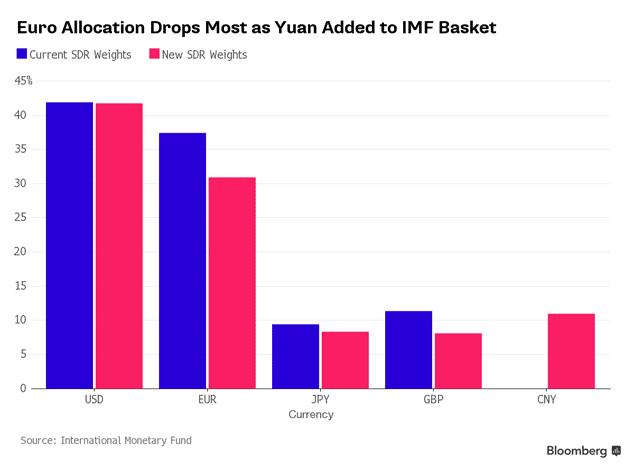

And the hits keep on coming to the European Union and the common currency. As expected, the International Monetary Fund (IMF) gave China a seat at the table in the room where the global monetary rules are made. The decision to include the yuan in the IMF’s special drawing rights (SDRs) doesn’t take effect until 1 October, 2016. But let the capital reallocations begin (most of them began years ago, to be honest).

The big movers on the currency table where the euro and the yuan. The US dollar retained its status as ‘first among equals’ with a 41.73% share of the SDR. The euro is second but dropped from a 37.4% share to 30.93%. Then newcomer China at 10.92%, followed by the yen at 8.33% and the pound at 8.09%.

Remember that the eurozone—those European states using the euro as a currency—is distinct from the European Union. Just as the European Union is distinct from Europe, a point Charlie Morris made eloquently in his recent MoneyWeek cover article. The EU is a 20th-century manifestation of the age-old idea of centralised and absolute power. Europe is a continent with thousands of years of history, dozens of languages and hundreds of cultures.

What holds the future?

There are 28 states in the European Union, 19 of which are in the eurozone. The combined population of eurozone countries is about 350 million, with a combined GDP of €10.1trn. Unemployment is high (especially among the youth) and economic growth is low (especially in southern Europe). Still, Europe itself is a common market with roughly 500 million relatively affluent and educated consumers.

It’s pointless to extrapolate economic and demographic trends from the SDR rebalancing, though. Nobody knows what the future holds. And at some level, the SDR is a monster. It’s a reserve currency made up of reserve currencies. You could make the argument that all the risks of fiat money are concentrated in one place.

But that is an argument for gold. And that argument is beyond the scope of today’s letter. The relevant question for investors is whether the euro’s demotion is another blow to the currency and, if so, whether that blow is a tradable trend, or a larger more structural threat to the euro’s very existence. Stay tuned!

Category: Geopolitics