She’s only gone and done it. The prime minister’s letter notifying the EU of the UK’s intention to leave is in the mail.

Well, she couldn’t trust Royal Mail with something so important. And so the letter will be delivered in person by Sir Tim Barrow, Britain’s ambassador to the EU. The poor guy doesn’t know if he’s delivering his own redundancy letter or an implicit promotion…

The two-year period of negotiations begins today. Unless both the EU and UK seek to extend the time given for negotiations. So the two-year deadline is a bit of a red herring.

Brexit is exciting. But it’s what’s going to happen outside the negotiations in the next two years that’s the key to how negotiations develop. Europe is in trouble.

Europe’s banks are flailing

Do you remember all those bank stress tests we used to read about? Sick of bailing out billionaires, governments now require bankers to run their businesses safely. And they periodically test them for compliance by running a financial sector version of a war game.

Then the media tells us the banks are safe from another crisis… which is an obvious paradox because the banks themselves usually are the crisis.

The definition of safe is a bit arbitrary. Banks are tested for their “capital buffer” and how much capital they have. They have to maintain capital ratios at levels set in the Basel and Basel II agreements.

Unfortunately, it turns out all of this is misguided. The specific way governments have sought to make banks less risky doesn’t actually make them less risky. That’s according to new research from four academics at the American National Bureau of Economic Research.

The academic abstract is nice and clear. I’ve broken it down into chunks so we can take a look at what it means for you.

Higher capital ratios are unlikely to prevent a financial crisis. This is empirically true both for the entire history of advanced economies between 1870 and 2013 and for the post-WW2 period, and holds both within and between countries. We reach this startling conclusion using newly collected data on the liability side of banks’ balance sheets in 17 countries. A solvency indicator, the capital ratio has no value as a crisis predictor;

In other words, all those bank stress tests, regulations and trips to Basel to agree on capital rules were pointless. Banks fail even when they’re well capitalised.

It’s difficult to convey just how fundamental an assumption this contradicts. It’s one of the most basic tenets of bank financial management in theory and practice that capital keeps your bank safe in a crisis. But it’s wrong historically (like most of economic and financial theory and practice).

This sort of thing is nothing new. The value at risk (VAR) constraint which investment bankers and their regulators relied on before 2008, failed miserably too. When market prices went haywire in 2008, everyone blew up together because they all relied on the same VAR constraints.

Banking: how can we get it so wrong?

Banking is fraud. When you deposit money at the bank, the bank lends it out. It is now in two places at once – your account and the account of the person who borrowed it. Both of you can spend it at the same time. Until you both try to.

Should people demand their deposits out of the banking system, or should the borrower be unable to repay the funds, the fraud is exposed. It doesn’t matter how much capital the bank has kept, fraud is fraud. With two people claiming the same money, there’s going to be a disaster.

The academic transcript of the paper confirms this is the key issue. How much of your deposit is loaned out determines the likelihood of a bank crisis:

but we find that liquidity indicators such as the loan-to-deposit ratio and the share of non-deposit funding do signal financial fragility,

If the bank only lends a small portion of its deposits out, then the fraud is less likely to be exposed. People don’t usually withdraw all their money.

Non-deposit funding is important because these types of funding aren’t “on demand” like deposits. They can’t be withdrawn or spent by the people who own them like deposits can. The funds provided can be used by the investor or the bank’s borrower, but not both at the same time. It’s the non-fraudulent way of funding a bank.

Not that you can’t stuff it up too. Northern Rock showed how non-deposit funding can lead to a crisis as well. But that’s another story. Let’s focus on deposits.

The fraud of fractional reserve banking is only allowed with money and a government-granted banking licence. Deposit your garden furniture at a storage warehouse and it’s not allowed to lend it out. Deposit money with a company that doesn’t have a banking licence and it’s fraud for that company to lend it out. And deposit money with a company that has a bank licence and it can lend it out.

So how do you know when a crisis is coming?

If our financial system is based on a fraud, we shouldn’t be surprised it blows up every now and again. It doesn’t matter how many Basels we come up with to mess about with capital ratios.

Remember, if fraud is the problem then it’s the level of the fraud that determines how likely it is to be exposed. If the bank keeps most of your deposit and only loans out a little, it’s unlikely you’ll ever notice. That’s because most people keep their money inside the banking system. And if the bank funds itself with something other than deposits, it’s safer (from this particular issue anyway).

According to the same study, credit growth has predictive power. That’s because a sudden increase in lending is often synonymous with bad lending. If there is a sudden boom, that’s probably because of some sort of bubble in the economy. Or banks have lowered lending standards like in the sub-prime mess.

When bubble turns to bust, the loans that created the bubble aren’t paid back. The bank fails because it has a depositor who wants their money back and a borrower who spent that money without the ability to pay it back. As the study put it, it’s “credit growth on the asset side of the balance sheet” that predicts a banking crisis. And it’s the quality of lending that triggers the crisis itself.

The thing is, if banks are well capitalised, they can restart their fraudulent efforts again quickly after the crisis:

However, higher capital buffers have social benefits in terms of macro-stability: recoveries from financial crisis recessions are much quicker with higher bank capital.

So capital ratios aren’t completely useless after all. If you want a re-run of the same fraudulent business model again.

Apply all this to Europe

Let’s assume there’s something to the academic study. Where does Europe stand?

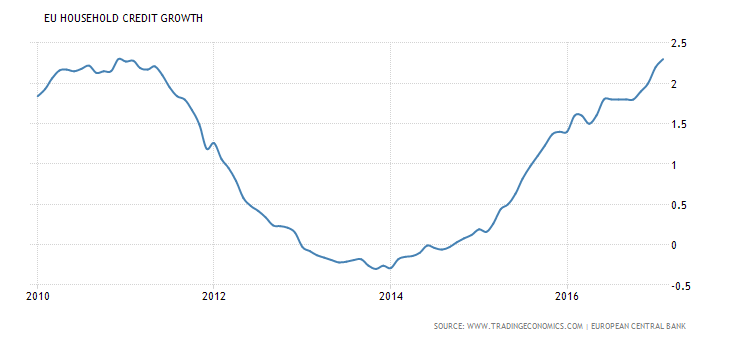

Well credit growth is back to where it was during the European debt crisis.

The chairman of the European Banking Authority is so worried about the level of bad loans in Europe that he wants governments to buy around €1 trillion worth at their market value. The idea is to create certainty in the banking system. If the banks get some cash for their dodgy loans, at least everyone knows where they stand.

Otherwise, the chairman worries Europe is heading for a lost decade like Japan’s in the 1990s. The Japanese are famous for not acknowledging bad debts. They just keep working crazy hours like nothing is wrong.

The thing is that Europe’s bad loans are about 5.4% of the total. That’s three times Japan and the US’ level. And a third of the total is in Italy alone. But don’t worry, Italian banks are unusually well capitalised.

Wait a minute… didn’t we just learn capital isn’t what prevents a crisis? It’s about deposits and the quality of your lending.

Italian banks are famously dependent on deposits, alongside the Spanish and Brazilians. And I just mentioned Italy’s bad loans, which are known as the sofferenze. That translates to suffering, misery and pain.

I’d say it’s time to protect yourself from the coming fallout. Here’s how.

Incidentally, London’s status as a financial sector helps it source non-deposit funding. For the banks that choose to use it anyway.

Why Europe’s financial capital will never be in Europe

Bad lending isn’t the only way the EU continues to strangle itself. The spat over London’s status as Europe’s financial hub is a major Brexit talking point. It’s also incredibly funny.

One of the EU’s regulators is warning city firms they can’t do business in Europe without a genuine office presence there. No, it’s not an editorial mistake. Office presence, not official presence.

The EU wants to ensure that the bankers serving Europe work and reside in Europe. They’ll cancel the financial “passport” of British financial firms if they don’t have staff and operations inside the EU.

What century do these people live in?

Until next time,

Nick Hubble

Category: The End of Europe