My name is James Allen, and I’m a new publisher here at Southbank Investment Research. In fact, this is my first week here so I’m very much the new boy. I’ve been brought in to look at all the exciting things happening in the energy and commodity space. You see, I’ve spent the last decade or so analysing and reporting on the energy industry, both in London and New York. So much is happening within energy, which I’ll look to bring to your attention as I get a bit more settled into the company.

But what a week to join, and not just because of the snow that blanketed London as I arrived for my first day at work on Monday.

On Tuesday morning, following a day of getting to know everyone in the office, the WhatsApp on my phone pinged with two consecutive messages, both expounding an identical theme.

“Forget bitcoin. We now have bitgas.”

“We have a new bitcoin in town. It’s called the NBP.”

It didn’t take long to work out what my friends, both former colleagues inside the energy industry, were on about. An announced shutdown on Monday night of the North Sea’s most important oil and gas pipeline had been followed on Tuesday morning by an explosion at a major processing facility in Austria that acts as the main point of entry for Russian gas into Europe.

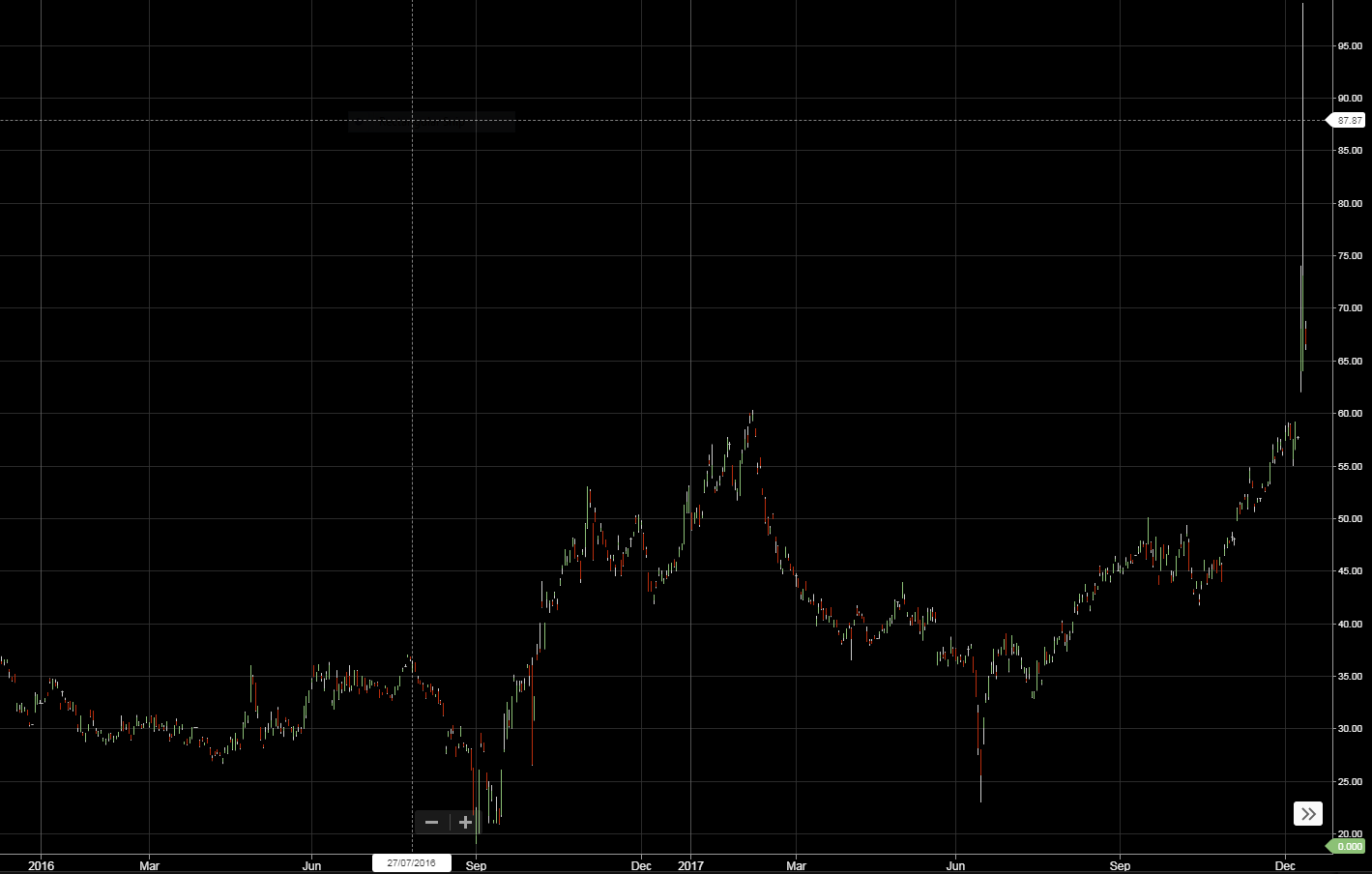

News of the crack in the Forties pipeline system, which will see the operator take it offline for weeks so that it can implement repairs, and the blast at the Baumgarten compressor station, sent benchmark prices for European gas soaring, with the resulting charts very much aping those of our favourite cryptocurrency.

Gas prices for same-day delivery at the National Balancing Point (NBP) – the name of the UK’s natural gas market – jumped to their highest level since early 2013, from just 57p a unit before the shutdown of the Forties pipeline on Monday to nearly 100p on Tuesday afternoon. The front-month gas contract for January rose nearly 20%, hitting 74p, levels not seen since December 2013.

The events at Forties and Baumgarten delivered a brutal one-two punch combination squarely on the chin of the European gas market, leaving it on the ropes having receiving a few stiff blows to the body around the same time.

Britain, in particular, was striving to absorb the impact of power supply problems at Europe’s largest field, Troll in Norway, normally a dependable source of flexible supply, while one of the UK’s largest offshore sites – the ageing Morecambe field – was struggling to produce gas at its normal rate.

The timing of the outages could not have been worse

As I mentioned before, large parts of the UK were covered in snow, with the icy temperatures lifting gas demand in homes and businesses to their highest forecast levels since early 2013, placing the gas network under severe strain.

Although spot prices have since retreated, in part due to rising wind levels that have reduced demand from the power sector, prices for gas delivered next month and beyond are still extremely high. The Forties pipeline will be shut for weeks, potentially depriving the UK of up to 40mcm/day of gas, equivalent to around 12% of current winter demand.

The blast at Baumgarten, which transports the equivalent of a 10th of Europe’s gas demand, immediately saw Russian gas flows into Europe fall by around 100bcm, resulting in Italy, which relies heavily on its neighbours for natural gas, declaring a state of emergency in its gas market. Although the firm behind the hub has already managed to divert flows, the disruption may continue to restrict outright capacity, meaning any further cold spells could see difficulties in European countries, including the UK, meeting demand.

And I see spikes like this becoming much more prevalent this winter and beyond, especially in Britain. The UK is running out of its own indigenous gas supplies so it’s increasingly reliant on importing supplies from overseas, either via pipeline from Europe or on tankers carrying liquefied natural gas (LNG). But the UK is not the only game in town in the LNG market, with countries in Asia currently prepared to pay even more to encourage tankers to arrive on its shores.

The UK received only one shipment of LNG in November, way down on India’s 13

As of today, the prospect of the UK receiving another cargo from its main LNG supplier, Qatar, before the year’s end is virtually zero due to high demand in eastern Asia, although it does look like a cargo is on the way from Russia’s recently launched Yamal terminal.

In normal winters all these factors might not have been so influential, but this winter the UK is coping with diminished storage capacity, leaving the country with limited supply flexibility. The country’s largest storage site, Rough, is being permanently decommissioned after deteriorating pipelines made it unsafe to operate. The Rough facility, built to stockpile UK energy supplies, was able to meet as much as 10% of peak winter demand, but that is now much reduced as it pumps out its last remaining fuel.

That leaves the UK gas market uniquely vulnerable to bitcoin-type price spikes such as the one seen this week as buyers desperately scramble for gas from any available source, effectively forming a tug-of-war with traders on the continent and beyond to secure spare gas supplies.

Although this spells bad news both to small suppliers in Britain that failed to buy enough gas in advance of the spike and to consumers potentially facing higher gas bills, it’s very much good news for pipeline suppliers in Norway, which will becoming increasingly vital for the UK to help meet its demand, and exporters in the US, which is set to ramp up its production of LNG. It also could reignite the campaign to untap Britain’s reserves of shale gas, potentially a boon to companies such as Cuadrilla, IGas and Third Energy, which have already ploughed millions into developing sites which contain potentially huge reserves of unconventional gas.

In the future, I’ll be looking to spell out some of the opportunities that you, too, can take advantage of as the UK tries to insulate its infrastructure from future gas shortages.

All the best,

James Allen

Capital & Conflict

Related Articles:

- Time to Buy Energy Stocks

- Guide to Understanding the Price of Gold

- Discover the Best UK Penny Shares for 2018

Category: Economics