It must’ve been lonely back in 2006. Warning about the housing bubble back then got you laughed at. Or worse.

By the time I showed up on the scene at Southbank Investment Research’s Australian sister in 2010, sceptics had a bit more credibility. We’d just been vindicated in most of the English-speaking world, and southern Europe. Everyone talked about bubbles, Austrian economics and central banks.

The only Republican presidential candidate to poll ahead of Obama during the primaries had first warned about the housing bubble in 2001 in a speech in Congress. That was when the policies which triggered the bubble began inflating it. He used Austrian economics in his analysis and wanted to shut down the Federal Reserve.

The strange thing is, these days our warnings of 2006 are coming out of surprising places. Most surprising of all, central banks themselves.

“It increasingly feels uncomfortable to have low volatility in the markets on the one hand while on the other hand there are risks in the global economy,” Klaas Knot told Bloomberg. He’s not some commentator or hedge fund manager, but on the European Central Bank Governing Council and the president of the Dutch central bank.

Ravi Menon, managing director of the Monetary Authority of Singapore, continues our tour of concerned central bankers around the world, also profiled on Bloomberg:

“The markets have been amazingly resilient to episodes of risks,” Menon told Bloomberg Television’s Haslinda Amin. “There has been hardly a response to some of the risks that have been manifesting, so I do think those risks are being underestimated. Excessive exuberance is always, in and of itself, cause for concern.”

What are central bankers so worried about?

The only thing our Bank of England governor Mark Carney warns anyone about is Brexit. Others point at North Korea, debt in China, sovereign debt in Europe, dodgy debt in Italy, and of course Donald Trump.

But those are just potential triggers for a crisis, like symptoms of the actual problem. What central bankers are really worried about is that the market isn’t worried about what it should be worried about.

Central bankers are like parents watching their children cross the road. Having spent over a trillion dollars pushing them up since 2008, central bankers are worried the market will get run over by the first crisis that comes flying around the corner.

Of course, the reason the markets are clueless about risks is entirely due to the overprotective parenting in the first place. The only thing investors and investment bankers know for sure is that central bankers will save them if things look iffy.

And so, ironically, the only true risk is that central bankers won’t show up to pay the hospital bill when things go wrong.

The short version of all this is that central bankers are worried about two things: complacency and the pace of withdrawal of support from central banks.

It’s ironic because it’s the lack of withdrawal that causes the complacency. But central bankers are trying to push for less complacency before withdrawing. It simply does not work that way.

The market’s resilience is based on an ever-imminent rescue

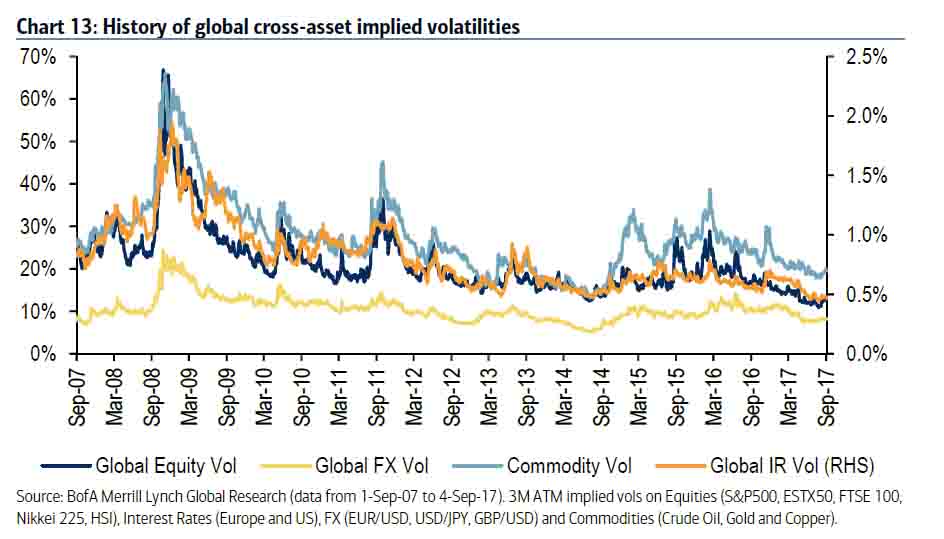

As Menon explained above, we’ve had plenty of bad events these last few years. But nothing seems to dent stockmarkets. Volatility is at extraordinary lows across all sorts of asset classes:

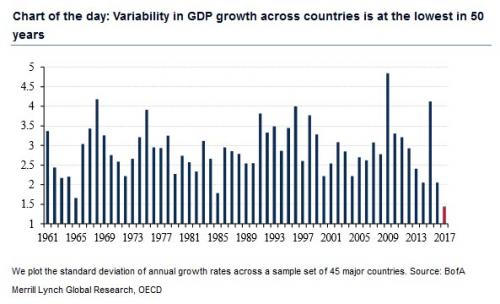

The same applies to GDP growth. The world’s economies are in sync when it comes to economic activity:

Source: Zerohedge

Source: Zerohedge

I wish the second chart had popped up before my conference speech. It covered these issues to point out that central bankers are in total control, for now.

It doesn’t pay to bet against them, yet

To find out what I think you should do instead, click here. My stock tip just announced record profits yesterday!

Years ago, I read about an experiment that makes the point I’m trying to, but in a far better way. A bunch of biologists designed the perfect growing environment for a selection of trees. A glass dome with optimised soil, air and water. Everything was managed to make life blissful for the plants. The trees shot up.

When they removed the glass dome, the trees all fell over. They weren’t used to any wind, so their root systems and whatever else holds up a tree were weak.

Central bankers have built a glass dome over the market. They now have a fragile, boring and weak infrastructure to facilitate capitalism. Capitalism is many things, but none of them gel well with fragility, calm and weakness.

The world’s most managed market misses

China illustrated how all this works in action on Monday. The world’s most managed financial market took a surprise hit. Government bonds tumbled to a three-year low.

The China Caixin PMI index didn’t produce a surprise, revealing manufacturing activity was fine in October. So what went wrong?

The end of the Communist Party’s conference seems to be what blew a hole in the stock and bond market. It’s the narrative that’s revealing.

During the conference, nothing was allowed to go wrong. The market had to go up. And the Communist Party leaders ensured it did.

But the media explains that the new crop of leaders is set to clamp down on financial excess in China. That’s bad news for stocks and bonds. It also shows you the big weakness of a central bank funded utopia in the West. At some point, political reality might turn on fake stability. People will throw rocks at the glass dome.

When? Perhaps when people realise that even central bankers can’t plug their pension gaps. Or when those who don’t own vast amounts of stocks, but do suffer under inflation, get sick of central bankers’ policies.

If central bankers manage to engineer the inflation they want, but financial markets are still addicted to quantitative easing (QE) and low interest rates, what will central bankers do?

Politics, not economics, pose the biggest threat to economic stability these days. Brexit illustrated how this plays out nicely when things reach a fever pitch.

Until next time,

Nick Hubble

Capital & Conflict

Related Articles:

Category: Central Banks