You’ll forgive me if I’m fascinated by the idea of negative interest rates. You could argue it’s not as big a deal as it seems. You would definitely lose money on a negative-yielding bond, but only if you hold to maturity. If your intention is to flip the bond for a capital gain, you’re not too worried.

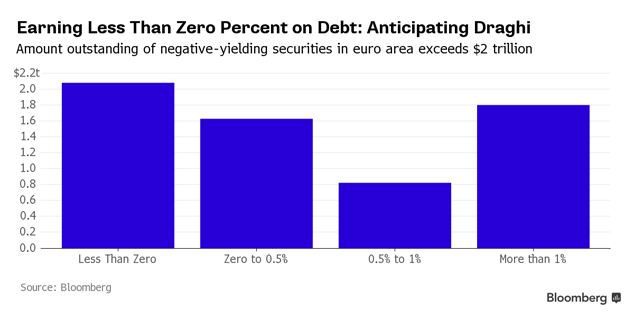

It depends on the length of the maturity, of course. Most of the negative-yielding debt featured in the chart below is shorter term. For example, rates on sovereign German, Austrian, and Dutch bonds reached record lows in late November. German two-year rates hit negative 0.394%. Dutch rates hit negative 0.375%. And Austrian rates hit negative 0.326%.

Take a look at the chart below from Bloomberg

It’s not the ‘utter insanity’ I mentioned yesterday. But I’d say it’s… an eye-opener. The data comes from the Bloomberg Euro Sovereign Bond Index. It shows that there is over $2trn in negative-yielding sovereign debt in Europe. That’s a greater amount than sovereign debt that pays a yield of more than one per cent.

Are you beginning to see how this financial repression business works? Low rates enable the financing of perpetual sovereign debt and deficits. Running those deficits is the only way the modern welfare state can pay for itself—by borrowing from the future and punishing savers, pensioners, and those on a fixed income. The transfer payments made by the welfare state go to voters who are happy to keep voting themselves other people’s money.

It’s pretty elegant, in its own way. It’s theft without an obvious victim. And there is a subtle kind of violence to low interest rates. You know you’re being mugged. But there’s not much you can do about it.

Category: Central Banks