… the almighty Fed has printed trillions of dollars in our name to buy worthless mortgage assets from “too big to fail” banks. It has lent these banks our hard-earned money at about 0% interest, so they could lend our own money back to us at 3%+. These banks also used our free money to ramp equity and commodity markets, which mostly benefited the top 1% of our population who owns 43% of financial wealth, and conveniently, also owns the Fed.

The latter has kept interest rates at next to nothing to punish savers and encourage speculation, making everything less affordable for average Americans who have seen their wages stay the same, decrease or disappear. What’s left standing is the perniciously powerful, highly secretive and entirely unaccountable Fed, who now epitomizes the state of American democracy.

– Ashvin Pandurangi

Are you wearing a shirt right now? Or anything with a collar for that matter? If so, you should flick the collar up, or “pop” it.

Why? Because our overlords at the Federal Reserve expect it in honour of her imperial majesty Janet Yellen, as she descends from her throne.

Yes, today is Janet Yellen’s last day as chair of the Federal Reserve System. Famed for stuffing fistfuls of credit down the throats of markets around the world, and inflating asset prices to altitudes that give me a nosebleed just looking at them, she’s finally calling time.

Make no mistake – one way or another, your life has been affected by Yellen. As master of the printing press for the global reserve currency, she effectively had an influence on the price of everything, even here in Britain.

And it wasn’t just her movements of the interest rate lever that influenced prices – every word she spoke in public was analysed to ascertain where she might lead monetary policy in the future, which market participants would attempt to decrypt and profit from.

Markets were enthralled by her. And now, as she leaves her role as chair, you too are expected to exalt her… by following her sense of dress.

Yes, don’t worry about looking like a schoolboy playing truant. Pop that collar folks, in honour of the woman who printed trillions of dollars and poured them into financial markets in an attempt to inflate away the debt of a bloated and decadent government, while simultaneously rewarding the wealthiest in society for doing nothing. What a hero.

The political and financial elite exist in what I see as an “ivory bubble” – they go to the same universities, study the same subjects under the same teachers, and read the same books. They hang around together, read the same research papers, and so on.

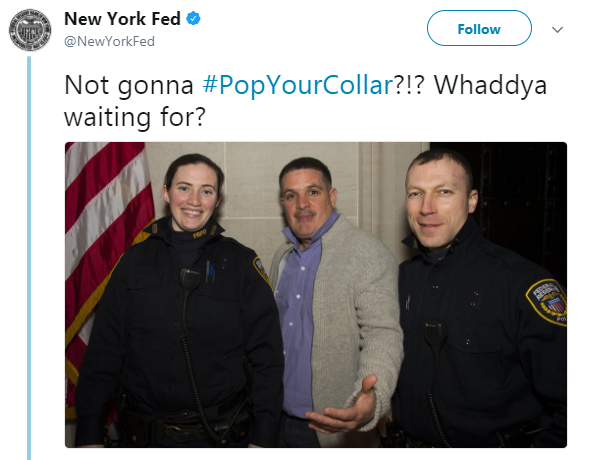

For a glimpse at what those inhabiting the lower depths of this bubble look like, I highly recommend taking a look at the original invitation to pop your collar here, and scrolling down. At the time of writing, The New York Fed has posted 21 images of the gormless worker bees hailing their queen, with no signs of stopping.

I quite liked this one.

Note the “Federal Reserve Police Department” patch on the officers. The Fed has its own police force, almost like a Roman emperor’s Praetorian Guard. Which fits pretty well actually, what with Yellen wearing emperor’s colours – purple and gold – on the front cover of Time magazine when she assumed the role of Fed chair.

The deification of central bankers is nothing new. Yellen’s predecessor, Ben Bernanke, was bluntly labelled “THE HERO” across the front cover of The Atlantic magazine in great green letters. This was possibly a following on from Time, who anointed Robert Rubin, Larry Summers and Alan Greenspan “The Three Marketeers”, as though they were a modern incarnation of Alexandre Dumas’ swashbuckling three musketeers.

I doubt Yellen’s replacement, Jerome Powell, will be similarly adored, mainly because he was picked by Donald Trump, who is detested by the press. However, that doesn’t mean that other members of the financial elite can’t be idolised in the meantime.

Christine Lagarde, managing director of the International Monetary Fund (IMF), is already no stranger to the limelight – and as you can see below, she appears to be rather popular among the financial elite.

Lagarde (left) and Yellen (right) at a meeting of G20 finance ministers and central bankers in February 2016

Lagarde (left) and Yellen (right) at a meeting of G20 finance ministers and central bankers in February 2016

It’ll be interesting to see what the IMF and its adoring groupies will want us to do when Lagarde steps down. Perhaps wear Hermès scarves in her honour? If wealth inequality continues to widen at the same pace as it has in the last few years, the only people still paying attention to Lagarde probably won’t mind the £300+ price tag…

What will Yellen do next? It remains to be seen, but if the actions of her predecessors are anything to go by, her future is looking incredibly lucrative.

Bernanke currently works as a senior adviser for Citadel, one of the biggest and most leveraged hedge funds on earth. Citadel’s founder, Ken Griffin, is known for paying himself more than a billion dollars a year – I expect Bernanke is being taken good care of.

It’s worth noting that Bernanke bailed out Citadel with hundreds of millions of dollars in taxpayer funds in 2008. Funny how these things work out, isn’t it?

All the best,

Boaz Shoshan

Editor, Southbank Investment Research

Related Articles:

Category: Central Banks