The Austrian business cycle theory (ABCT) explains how central bankers engineer the booms and busts they’re supposed to prevent or mitigate.

Ever since the theory was first derided by the German historical school economists, it was picked up by investors who find it rather useful. That’s because it has huge predictive power.

As with all cycle theories, the key question is what point we’re at now. Identify where you are in a cycle and you can position your investments to profit.

But first, what’s the theory?

As the rap explanation of ABCT explains, when trying to understand crises like 2008, “the place you should study isn’t the bust, it’s the boom”.

It’s best to explain with a metaphor. ABCT is rather similar to the alcohol cycle. You drink a bit at the beginning of a social event and it’s lots of fun. Then someone spikes the punch bowl. The party really gets going. Then it gets out of hand with some sort of disastrous event involving public displays of nudity, or broken furniture, bones or hearts. Usually all at once. Then there’s the hangover.

In the economics version of this cycle, the central bank spikes the punch bowl. At the beginning of the boom, interest rates are low, encouraging borrowing and investment. The boom gets out of hand and the central bank loses control. This stage is called a “crack-up boom”.

Eventually the central bank catches up with interest rates and the party is over. There is a crisis of some sort – usually financial – and then the economic malaise that follows is the hangover.

The central bank tries to restart the economy by offering a hair of the dog treatment with more low interest rates. Then the cycle repeats.

Most economic theories explain the boom and the bust separately. ABCT has one explanation for it all – the whole cycle. That’s why it has such predictive power. It repeats.

These days, ABCT has made its way into the mainstream. Although nobody will admit to it, they use the terminology they used to dismiss as wrong. Malinvestment, for example, is the investment driven by the central bank’s manipulation of interest rates, which is exposed as a mistake during a crisis. The ghost housing estates in Ireland and Nevada are prime examples.

But that still leaves us with the question: where are we in the cycle?

Boom or bust?

My friends at Cycles, Trends and Forecasts specialise in identifying cycles, pinpointing where we are in that cycle and then explaining how to profit.

I’m not sure if they’d subscribe to ABCT. People who study cycles tend to need no explanation for what’s going on. After all, who needs explanations when you can just use a cycle’s timing to predict markets like the property market and stockmarket?

As far as I can tell, the team at Cycles, Trends and Forecasts puts us at the beginning of a crack-up boom. The world’s central bankers are at various stages of winding down their crisis monetary support. GDP is ticking along and inflation is keeping pace. Stockmarkets are in an upward trend.

If they’ve picked the right point, the forecast is clear – a boom. The Cycles, Trends and Forecasts team is on record – the FTSE will hit 15,000 and the UK will feature a whole new property boom.

That sounds great.

But won’t central bankers reign in that sort of a boom by raising interest rates? Akhil Patel, the editor of Cycles, Trends and Forecasts, explained in his last weekly update how monetary policy doesn’t work quite as the mainstream theory would suggest.

According to Akhil, the historical evidence says low interest rates don’t stimulate debt like they’re supposed to. In fact, as the crack-up boom gets going, interest rate increases might actually stimulate borrowing rather than slow it.

This would mean central bankers fuel the bubble rather than taming it as they raise rates during a boom. It’s all to do with how banks really work – something you can read about in April’s edition of Cycles, Trends and Forecasts.

Akhil also identified the specific point at which interest rate hikes do swap from supporting borrowing to slowing it. But I can’t reveal his subscribers’ secrets. It does give them a warning for the beginning of the end of the boom though.

On the other side of the debate to Akhil we have Jim Rickards. He points out that the global economic expansion is getting rather old. And financial crises happen periodically. We’re overdue already.

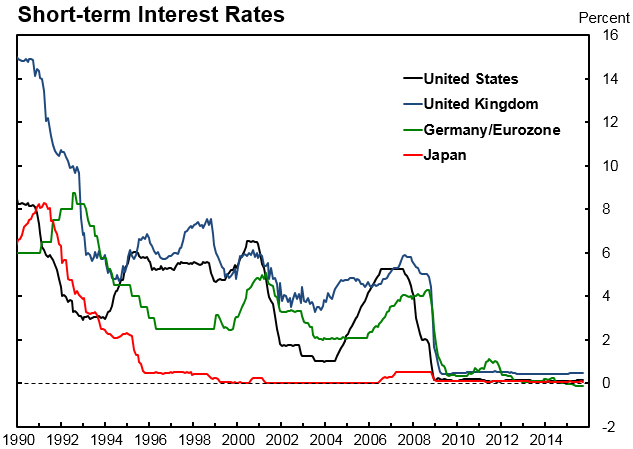

The problem is that central banks have barely started on their usual hiking cycle. Rates in develop economies are barely up much anywhere.

You need to think like an economist about this though. Interest rates have been in a downward trend since the 1980s. Each rate hike cycle peak has been lower than the last. So it’s no surprise if the current upward cycle is just a tiny increase.

And, perhaps most importantly, a rate hike from 0.25% to 0.5% is a doubling of rates, just as a 2.5% hike to 5% is.

Who will get it right? Are we in a crack-up boom, or have we already had it?

We’ll find out the hard way.

US pension mess is simmering on

General Motors (GM) released a slideshow detailing its expected financial developments in coming months. The slides include this remarkable statement: “Plan to raise approximately $3B of debt in the US to meet pension fund obligations.”

This is extraordinary for three reasons.

A major company borrowing money to pay out money to its pensioners? Pensions are supposed to be paid from invested assets. Why isn’t GM selling pension assets to meet its pension obligations?

Borrowing money to pay pension obligations smells like fraud and Ponzi schemes. Debt must be invested to generate a return so that it can be repaid. Borrowing money to meet pension obligations doesn’t generate a return, nor is it an investment. It’s a dangerous use of debt. It leaves the company worse off. And thereby worse off to meet future pension obligations.

GM declared bankruptcy during the financial crisis and yet it still has to meet pension obligations by borrowing. How can the company be in such a bad state so soon after bankruptcy? How did it emerge out of bankruptcy with a pension obligation it can’t meet?

This is just a symptom of how bizarre the pension system is getting in the US. Financial commentator and author Peter Atwater explained that “much of the $3 billion bond issue will be bought by pension funds of companies who issue debt to buy the debt of companies raising debt to fund pension plans”. In other words, companies are borrowing money from each other’s pension plans to fund each other’s pension plans. They’re doing it because they can’t fund them properly.

As a whole, the US pension scheme really is a Ponzi scheme. Pension funds are borrowing money off each other to meet each other’s pension claims. Within a single fund this would be fraud.

The selling pressure these funds could generate if they start to sell their remaining assets to meet pension obligations could be extraordinary. Just as the pension funds provided a steady inflow of funds into the financial markets as workers paid in, so will the money flow out again.

That makes this your problem too.

Until next time,

Nick Hubble

Capital & Conflict

Category: Central Banks