The coordinated scare campaign to bully Britain into staying in the European Union has begun. It’s an impressive coalition of Eurocrats, British politicians and multi-national banks. And to be fair, it’s possible to have a genuine disagreement on what’s best for Britain without being a villain. But there are some pretty good villains to choose from, if you’re looking.

At a forum in London, “Brexit” was “war gamed” to test different outcomes of the upcoming negotiation. Former Irish Prime Minister John Burton said “Brexit” would be “an unfriendly act”.

Then there was a thinly veiled threat to the City from former EU trade commissioner Karel de Gucht, who said, “How can you expect after leaving the European economy that that economy would accept its financial centre is outside its borders?”#

A punishing response

But it was former Polish deputy minister Leszek Balcerowicz who made it clear that “Brexit” would trigger a punishing response by the EU. Britain would be made an example of to prevent “Brexit” from giving any other countries ideas. The former deputy minister said:

We should not encourage other populist forces campaigning on exit such as National Front in France or Podemos in Spain. This is a very important consideration. This is in the interests of Europe that we do not encourage other EU countries to leave. The common interest of remaining members is to deter other exits. This should have an impact on the terms Britain gets.

Lord Stuart Rose, the former head of Marks and Spencer and the head of the Britain Stronger in Europe group, took a decidedly less provocative tone. It was still a bit of fear mongering. But it’s the kind of fear mongering we can all understand: it’s a risk when you trade the devil you know for the devil you don’t.

“There are imperfections”

He said, “but, by and large, [the EU] serves us well. What we don’t know is, what are we exchanging it for? The reality that we have got today against the risk of what we might not have tomorrow.”

Can you quantify the risk of leaving? Will the Italians and the French steal business from the City? Maybe expat Britons living and working in Europe will be forced to leave or to provide papers? Will companies based in the UK pack up shop and leave for the EU? It’s simple human nature to prefer the status quo unless you’re absolutely sure you’re trading it in for something better.

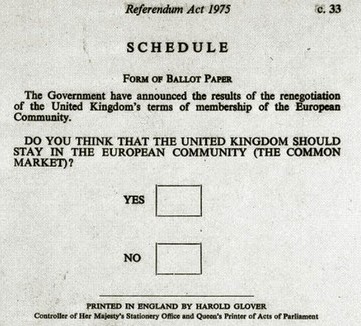

But have a look at what the original ballot looked like in 1975. Does that look like you were joining a European Court of Justice? Or ever closer union? A common currency? The end of national parliamentary sovereignty? It doesn’t look like that to me.

The EU took that consent and ran with it. They took more than they were given and ran further than anyone expected. And now, Britain is threatened with punishment if it doesn’t stay in a deal it never agreed to.

Guess where they were

When the votes were counted after the last referendum they were clear. 17.3 million Britons, or 67% of those who voted, voted “Yes”. Only 32% voted “No’. And of the 68 “counting areas” in England (47), Scotland (12), Wales (8) and Northern Ireland (1), the “No” vote had a majority in only two areas. Can you guess where they were?

In the Western Isles of Scotland, 70.5% of the voters said “No”. In the Shetlands, it was 56.3% voting “No”. Between them, they accounted for about 20,000 “No” votes. Meanwhile, Britons could never have imagined the Common Market was always designed to be “ever closer political union”.

My prediction: “stay” will win in a similar landslide this time around. Fear is a powerful emotion. The unknown scares people. And most people I’ve spoken to don’t see the referendum as a portfolio or pocket book issue. They see it as a political or immigration issue.

Category: Brexit