Brexit pros and cons: Your guide to leaving the EU

Brexit is the most important and divisive event in British politics in decades. At least it could be. We don’t really know what it means yet. Let alone the outcome.

Britain voted to leave the EU. And our government gave the EU formal notice of our intention to leave. But nobody knows where we’re actually going.

- What will life be like outside the EU?

- What will change when British politicians are back in charge of Britain?

- What will our relationship with the EU look like after we leave?

- How will Gibraltar and Northern Ireland fare?

- Will Brexit affect Scottish independence?

And the most important of all…

How will Britain look the day after Brexit?

There are some things we do know. And they do give us hints about our future outside the EU. This guide introduces you to the facts, figures and people you need to know to understand Brexit. You’ll find out:

- What does Brexit really mean?

- Who are the lead negotiators of Brexit?

- What is the effect on the economy?

- How will monetary policy change?

- What are the prospects for the pound?

- How will Brexit affect the stock and property markets?

Brexit itself is symbolic. But these questions show how it will matter to you. So let’s dig in…

The end of Europe Fair Warning: you might not like what you read in this report. Discover why Europe is doomed politically and financially and what this means for your money. Capital & Conflict is published by Southbank Investment Research Limited. |

Brexit’s changes to the law

Britain has voted to leave the EU. But what does that actually mean? We didn’t really vote for anything. Just against Brussels.

This creates a huge amount of uncertainty. Not just because our trade ties and freedom of movement with Europe are at risk. But because we don’t know what British policies will look like when they replace the EU’s.

The key question is to what extent we continue to comply with EU rules. Matching or remaining a part of aspects of EU law has the benefit of synchronising us with a major trading partner. But those laws are often awful.

A 2010 study by the House of Commons Library estimated between 14% and 17% of our laws come from the EU. Under Brexit, European law will no longer trump British law. We’ll be free to make our own policies. But what will they be? And which areas will they cover?

Control over immigration policies were the key issue of the referendum. Continental Europe is suffering under freedom of movement and an open-door policy for refugees. Brits feel the strain too, although immigration is less of a problem here. Still, we’re likely to sure up our borders and become selective about immigration.

Agriculture will come back under our control. British farmers’ EU subsidies will likely be replaced. And the political popularity of food security suggests they’ll have to be substantial.

The EU’s overzealous employment law is tangling business in red tape. Just complying is expensive. Under our own sovereignty, Britain could free up employment and generate a huge amount of jobs. Productivity could jump as well.

The enforcement of policing and the structure of our human rights institutions could change too. Currently, Brits must be delivered to foreign courts inside the EU if accused of a crime there. But these courts can severely lack the sort of civil rights supposedly guaranteed under EU law.

Britain could become a centre for technology if it implements the right policies on types of innovation that the EU stifles. The same goes for small business policies and regulation, which are currently a mix of EU and national rules.

But by far the most important part of leaving the EU will be trade. It’s the one area that requires cooperation from Europe. But that cooperation might not be forthcoming.

And without decent trade ties our economy could be in trouble.

The Brexit negotiators

To understand the Brexit negotiations with Europe you’ll need to understand who the negotiators are. They might be the key to unlocking how things will unfold.

Eurosceptic campaigners often bring up several poster children as examples of EU failures. What’s remarkable is that the EU has appointed as its lead negotiator for Brexit someone who was in charge of many of those failed policies.

Michel Barnier has had an interesting career to say the least. Having lost the vote on the European Constitution, he became the French agriculture minister, pushed for the creation of a European defence force, rewrote the rejected), European constitution into the Treaty of Lisbon (which his own voters then rejected), went on to regulate the banks at the onset of the European sovereign debt crisis and became the Commissioner for Entrepreneurship in the EU. Barnier typifies the EU’s grand ambitions in the face of repeated rejection.

On the other side of the negotiation table we have someone equally interesting.

Britain’s lead negotiator is David Davis. He claims to have made £1,000 betting on the Brexit referendum. He grew up on a council estate in London. After being disinherited for becoming a Communist, Davis joined the SAS reserve, founded a university radio station and went to Harvard. He was Minister of State for Europe in the 90s, Conservative Party chairman recently and Chairman of the Federation of Conservative Students during his studies. In the first round ballot for Conservative Party leadership, he came first and beat David Cameron. But not in round two.

Now that you know the cast of this unfolding drama, let’s take a look at the plot…

The economic effect of Brexit

It’s important to note when we’re looking at the economy, that Brexit hasn’t happened yet. There has been no change to trade policy or our relationship with the EU. Therefore economic data is more a representation of people’s confidence and outlook.

Of course, before the vote we were told the uncertainty alone would be enough to damage the economy. That hasn’t been the case. In fact, each of these predictions of disaster from credible mainstream professionals and policy-makers was diametrically wrong. The British economy has been doing well on most counts.

We’ll know more about the longer-term outlook for the economy as time goes on. Much of it will depend on the outcome of negotiations. And the policies that Britain pursues in place of EU prescriptions. But in the meantime, the expected knock to growth brought on by uncertainty hasn’t materialised.

|

Your bank does NOT want you to know this Exposed: Hidden flaw in UK banking system Is the UK financial system now the most fragile in the Western world? Click here to read this urgent report Capital at risk. A regulated product issued by Southbank Investment Research Ltd. |

Monetary policy and mortgages

The Bank of England responded to Britain’s “Leave” vote in a predictable way. It promised more easy money: lower rates and more money printing (quantitative easing). But then it reversed its decision after criticism from Prime Minister Theresa May and the lack of an economic shock after the vote.

What does this mean for mortgages? At first glance, the lack of monetary policy action might seem bad for mortgage holders. But remember that extreme monetary policy has the potential to get out of hand. A more responsible hand is likely to result in more stable interest rates in the future.

Britain’s ability to run its own monetary policy is an excellent example why leaving the EU could be a good idea. The same arguments apply to the European currency as the Union. There are benefits and costs to joining the euro. But having an independent monetary policy gives Britain and independence worth having.

Countries in Southern Europe are increasingly blaming the shared currency and monetary policy for their woes. But things are only getting started. The ECB is legally prevented from bailing out individual nations from their debt loads.

And that will trigger the biggest single default of all time.

Brexit’s effect on the pound

The pound has been on the sharp end of the Brexit saga. As a highly liquid global market, currencies are the first place to respond to new data, political posturing and legal wrangling over how Britain should leave the EU.

The pound fell to a low of $1.18 against the dollar – suffering a flash crash on the way down – having been at $1.70 a year before.

The pound’s fall has acted as a pressure valve for the effects of Brexit. It boosted our stock and property markets, as you’ll see in a moment.

Recently, central banks in emerging markets revealed they planned to lessen their exposure to the euro and increase their holdings of the pound because of political instability in Europe.

The pound’s steady recovery since Brexit reveals that the pressure valve has done its job and now reflects the improving prospects of Brexit Britain.

Over on the continent, nations struggling with actual economic problems can’t access the same sort of pressure valve. They’re stuck in the euro, which reflects the economic prospects of Germany as much as Greece and Italy. Once the people realise this, they’ll want to leave.

In one country, politicians who blamed the euro for their economic malaise are now in power. It’s only a matter of time before they leave, triggering financial chaos when they refuse to repay their debt in euro.

Brexit’s effect on the stockmarket

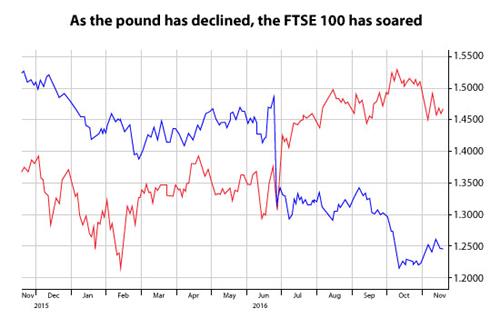

The falling pound was like rocket fuel for the FTSE 100. It soared in the aftermath of the vote, as the pound sank.

These two trends are connected. The FTSE 100 is stuffed full of companies with huge overseas earnings. A falling currency is great news for these firms. If you’re in any doubt of that, just look at the following chart. It shows the pound (blue line) dropping as the FTSE 100 (red line) jumps.

Investment in the UK after Brexit

Britain became the world’s number two destination for foreign investment in 2016 according to the United Nations. While the rest of the world saw a whopping 13% decline, and Europe a 29% decline, British foreign direct investment quintupled.

The low pound probably did some good in attracting new business to the UK. It makes Britain a cost-effective place to do business for foreigners.

Several large deals contributed to the surge. Apple, Google, Amazon and Nissan all announced significant investment in the UK recently. CFOs of local firms are slowly warming to Brexit too, according to quarterly polls.

Property prices after Brexit

The falling pound has also made UK property cheaper for overseas buyers – which is one of the reasons the market has shown strength since the vote.

After falling in July and August, asking prices rose in both September and October. In particular, the market outside of London has performed well.

However, reduced immigration could put the demand for UK property at risk in the long term. And the rising pound has triggered property price falls where it had previously encouraged the market.

Another feature of Brexit is the rebalancing of property prices across the UK. They’re falling in London, but rising in other major cities across the nation.

Gibraltar, Northern Ireland and Scotland

Where does Brexit leave Britain’s overseas territories? Some are more connected to the EU than Britain in many ways. And will the Scots demand independence over Brexit?

Hopefully these issues will force leaders to reach decent compromises. People in Gibraltar and Northern Ireland obviously shouldn’t be shut off from Europe. But neither should the heartland of the UK for that matter.

If the EU plays hardball with the UK, it has to justify the terrible effect this would have on Northern Ireland and Gibraltar, which is very hard to do. But making exceptions for them exposes the hypocrisy of a tough deal with Britain – it benefits nobody.

Scottish independence will force British politicians to reach a compromise in much the same way. Without a deal that keeps the Scots happy, they face losing the country.

The consequences of Brexit

Is Brexit a good thing? Only hindsight will tell us. And even then, the answer is unlikely to be clear-cut. But it is clear that you need to understand what’s going on. All the issues outlined above affect you, often directly. You can stay up to date by subscribing to Capital & Conflict and be in the know about Brexit.

Before you go, I’d like to remind you about this warning. Brexit will expose what leaving the EU means for a country. Just as escaping the euro has shown countries the power of keeping their own monetary policy, Brexit could show how leaving the EU gives the people back the power to govern themselves.

If other European nations look on and realise leaving the EU is beneficial, or at least nowhere near as awful as their leaders make out, then the EU could crumble. That might sound good to Brexiteers. But it isn’t that simple.

For a member of the Eurozone to leave the EU and the euro, they’d likely have to default on their euro denominated debt. Such a default would make the Greek sovereign debt crisis of 2012 look boring.

Britain, as a major global financial centre, would ironically enough be at the centre of the financial carnage this would trigger. Our fate is tied to that of Europe, Brexit or not.

And it might be Brexit itself which triggers the biggest bankruptcy of all time.

|

This market event will change everything There’s a time bomb buried in the financial system – and it’s about to explode. When it does, you NEED a plan to protect your money and profit from the fallout. Capital at risk. Forecasts are not a reliable indicator of future results. This is a regulated product from Southbank Investment Research. |