Sometimes things are simple. Perhaps this is one of those times.

Stocks are crashing, bonds are stumbling, and investors are worrying. When will it stop?

Last week we tried to take stock of what happened so far. And how it happened.

Today, you’ll discover a simple reason that explains why stocks and bonds fell. Whether it’s correct or not is for you to decide.

The recovery rally on Friday bounced off important trend lines and moving averages. That suggests the dust is settling on a 10% correction in stocks worldwide. It amounts to almost $5 trillion in losses.

In the US, the speed of the correction was faster than any since the 1950s, reports Bloomberg.

Momentum trading algorithms, overvaluation, stop losses and pension fund rebalancing all featured as possible explanations for the speed. Most agree that the jump in bond market interest rates has investors in other markets spooked.

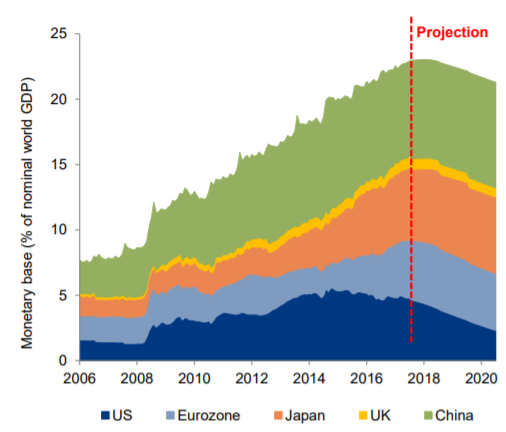

But if you ask why markets fell, the answer lies in the bigger picture of things. This chart from the German insurer Allianz makes a painfully straightforward case. Central banks around the world have finally begun to reverse quantitative easing (QE):

Some, like the US, have been winding down for years now. But most have only just begun their planned QT – quantitative tightening. Put them together and the recent crash coincides nicely with the peak.

If central bank QE made stocks and bonds go up, then QT will make them go down. Simple, right?

Perhaps. But this theory also comes with plenty of consequences and awkward conclusions.

For example, the chart suggests QT will sink the stock and bond markets for years.

But then again, if central bank policy affects financial markets to the extent the chart suggests, then a proper crash is nigh impossible. That was the theme of my speech at the War on You conference in October last year.

“Central bankers don’t control stocks. Stocks control central bankers,” I told the audience. In other words, central bankers will do whatever it takes to enforce financial market stability. No more, no less.

Last week the manipulators discovered they can’t reduce their support for markets as much as they thought. Like a drug addict in rehab, stocks revolted at the lack of methadone. But in the end, the correction will just be a hiccup in the grand scheme of their market manipulation. They’ll just slow down or delay their QT and stocks will go back up.

The key question for investors, if you buy all this, is when to buy the dip. If stocks are only allowed to fall so far before central bankers act, then how far?

The Powell Put

The debate on how far markets will be allowed to fall is called the Powell Put. The new chair of the Federal Reserve will eventually step in to save both bonds and stocks. After all, Jerome Powell’s predecessors and colleagues around the world did.

But when exactly? At what point does the Powell Put come alive?

Nobody knows because he’s so new. His first speech hasn’t happened yet. The stockmarket’s plunge began the day of his swearing-in.

Comments from Powell’s fellow central bankers at the Federal Reserve might be what spooked the markets. Three of them told the media the stock crash doesn’t have them worried, yet. Traders interpreted this to mean the Powell Put is lower than anticipated. Central bankers won’t intervene until markets go much lower.

Austrian central banker Ewald Nowotny made it clear the same applies in Europe:

“Behind [the stock market correction] there is an expectation in markets that central banks will increasingly raise interest rates, and there are certain good reasons for that. The U.S. is expanding. However, one has to say that the task of central banks isn’t to satisfy markets but to ensure overall economic stability. So if necessary, interest rates will have to rise and markets will adapt to that.”

What about the opposite view though? As Capital & Conflict’s publisher Nick O’Connor asked me, “Can central bankers really control interest rates for everyone?”

In other words, can the market snap somewhere that central bankers don’t control?

Proper crash potential

If you’re going to predict a proper crash, not just a 10% correction, you have to argue along one of two lines. The central bankers could allow a crash to occur because preventing it would lead to something worse. Or central bankers don’t have the power to prevent the crash.

In the first category we have inflation. If central bankers decide the economy is more important than financial markets, they might hike interest rates to keep down inflation while watching stocks and bonds crash.

This scenario promises plenty of volatility as investors swap back and forth between bonds and shares. Shares protect you better from inflation, bonds are a safer haven.

According to my professional development required reading, a world with rising interest rates benefits financial stocks while harming highly leveraged ones. You can rebalance your portfolio accordingly.

Which central bank is most likely to prioritise inflation over financial assets? Probably the European Central Bank (ecb). It has to set a single monetary policy for a booming Germany and a struggling Italy. The Germans won’t stand for 0% rates while their inflation rate surges, no matter how much Italy is struggling.

But what about the second possibility? Could central banks lose control of markets?

The markets central bankers can’t rescue

It’s tough to find many constraints on central bankers’ power. Especially to prevent a crash in stock or bond markets.

In Europe, the ECB is constrained by several rules. It can’t buy more than a third of its member nations’ outstanding bonds, for example. And the rate of purchases must be in proportion to each other.

The other central banks don’t really have limits. The Japanese have been buying their local stocks indirectly. The Swiss central bank has been buying foreign stocks directly.

What’s supposed to give way here is usually the currency. When central banks create this much money, their country’s currency is supposed to crash relative to their peers.

Again, in Europe that’s a bit of a problem. Most of the trade inside the eurozone is with other eurozone members. Devaluation is not an option that has much effect.

Do you see the conclusion emerging? If the central bankers are to lose control, it’ll be in Europe. Whether it’s inflation in the north or the inability to bail out nations because of internal rules, Europe is the weakest link.

Until next time,

Nick Hubble,

Capital & Conflict

Related Articles:

Category: Central Banks