Promise me something today. Okay, you don’t have to promise. But do your best.

Remember this: a better, wealthier, happier future with less human suffering is built by human beings trading in free markets, not governments or chairpersons of the Federal Reserve. Politicians don’t create jobs. Small business people and entrepreneurs do. Also, you don’t have to buy stocks at these prices if you don’t want to.

That’s a lot to remember, and you may not agree with all of it; in which case (since this is an investment e-letter first and foremost) remember the last part first. It’s a day in which the entire financial world will hinge on the every word of central bankers in New York and Washington. That is a sad and depressing day in capitalism.

But it is what it is. Let’s not lament or grieve. Let’s get on with it and take up a simple question in today’s letter: will tech companies become the surprising dividend payers in a rising interest rate world? And if they do, what’s your play?

German bank sells family silver

Before I take a deep dive into tech stocks that give cash back to shareholders, a coda to Monday’s note about Deutsche Bank. Put yourself in management’s shoes for a moment. Go on. It might be uncomfortable. But I promise you it will be worth it.

You know the US government is going to shake you down for around $5 billion or so – maybe more if it can get away with it. You know that stress tests in both North America and Europe have identified you as having inadequate capital to withstand another big banking shock. And you know everyone else knows this. What do you do next?

You need cash. You need to beef up the balance sheet. There are only a few ways to do that. You can sell more equity or debt. But that has implications for the capital structure of the company.

More importantly, that money will come from investors if they open their wallets for you. And investors are the same people who already know that you’re probably undercapitalised. It could be very expensive to bargain with people who know how badly you need the money. Same as it ever was.

Another strategy: you can sell off pieces of the business. That’s certainly an option. But it takes time. And you need the money now. The shortest route to more cash is to pick some of your finest, choicest assets and sell them right now to the highest bidder. The family silver… that old chest of drawers from grandma… your stamp collection… or $5 billion worth of your best corporate bonds!

Securitisation is the route Deutsche is going for, according to Bloomberg. There are two ways to describe it. One is that you’re selling assets to raise cash. The other is that you’re “offloading risk” to your customers. Bloomberg reports that, “The bank is structuring the transaction as a synthetic collateralised loan obligation, which means the firm would keep servicing loans while transferring risk to investors, said the person, who asked for anonymity because the deal is pending.”

Ah! The good old synthetic collateralised loan obligation (CLO)! It’s a second cousin of the synthetic collateralised debt obligation (CDO). It’s also a distant relation of residential mortgage-backed security (RMBS). All of them are descended from the same common ancestor: debt packaged up and sold as an asset to investors.

Same as it ever was.

If you’ve read Michael Lewis’s book The Big Short, you’ll recall how busy investment banks were in September 2008 selling off all their mortgage-backed bonds to customers. That was before the bonds were repriced (by the same investment banks) to reflect the crash in US house prices (and the fact that millions of Americans were missing their monthly mortgage payments and had negative equity). The bonds were only repriced after most of them were sold to investors. Is it the same today?

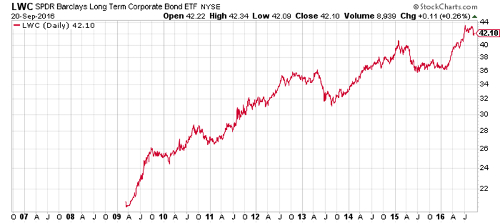

Not yet. In fact, someone could get a pretty good deal, depending what Deutsche has to sell. But I did note this morning that companies borrowed $207 billion in August, according to a September report from Moody’s. It was the highest amount of dollar-denominated corporate debt ever issued in a single month, according to the ratings agency. Now take a look at the chart below.

What do you do when interest rates are low? If you’re a corporation with a good credit rating, you lock in low rates and borrow. $171 billion of the August amount was investment grade. The other $36 billion was high yield. Low rates have driven down the yield on Moody’s Long-term Corporate Bond Index to 3.8%. That’s within 20 basis points of the lowest monthly average yield since 1956, according to ValueWalk.

My point? When you get the lowest monthly average yields on corporate bonds since Anthony Eden was the prime minister and Dwight Eisenhower was president, you’ve reached an extreme low in corporate borrowing costs. Today – when all eyes are on the Bank of Japan and the Fed – would be a fitting day for a reversal.

The chart above, by the way, is a Barclays exchange-traded fund (ETF) designed to track a long-term corporate bond index. I include it here for illustration purposes only. And how good was the timing!? Wall Street came along with a new investment product at precisely the time interest rates were going where no rates had gone before (to 5,000 year lows and even negative)!

The ETF debuted just as Ben Bernanke took over the Fed and began shovelling wads of cash into financial markets (Bernanke was Time magazine’s Person of the Year in 2009). That cash kicked the bond bull market into overdrive. Because bond yields and prices move inversely, the lower yields went the higher bond prices went. You can see what happened in the ETF. Is all of that about to change? Inquiring holders of $10 trillion worth of negative-yielding government bonds would like to know.

Tech stocks: more like banks or utilities?

But let’s set aside the coming Sovereign Debt Depression for another day. Let’s talk desktop computing and Bill Gates. Did you see that Microsoft Corporation increased its dividend by 8% to 39 cents a share yesterday?

The tech giant’s board also approved a $40 billion share buyback programme. That’s a new plan, on top of 2016’s $40 billion share buyback programme. There are two facts worth pointing out.

First, Microsoft didn’t begin paying a dividend until February of 2003. That was right after the stock split 2-1. That was the point at which the company went from being a pure tech growth stock to something like a blue chip income stock with a “growth dividend”. The growth dividend isn’t the actual dividend. It’s the rising share price you get from a tech company with heaps of cash and low debt.

Since 2003, the company has generated a regular pile of cash. Much of that is housed offshore, to escape the US-taxman, which is why the company financed its recent acquisition of LinkedIn by selling nearly $20 billion in debt. The debt was cheap to sell at such low rates and investors couldn’t get enough of it.

But now it’s hard to know what to call Microsoft. It’s having an investment identity crisis. Is it an income stock? Is it a tech stock? Is it a growth stock? Is the company’s cash flow impervious to rising interest rates and therefore a play in a post-QE world? The chart below may have some answers.

Barron’s reports that Fidelity has launched an ETF that screens for dividend-paying stocks that are less sensitive to rising interest rates. Please note that is not the fund listed above. I’ll get to that in a moment. But about this new fund…

You can presume Fidelity doesn’t mean stocks that are emotionally sensitive. It means stocks and businesses that can endure, or even thrive, in the face of rising interest rates. The companies would have low debt, or non-interest rate sensitive debt. And their cash flows would not be negatively impacted by a rise in rates. Demand for their products and services would not be affected by rising consumer credit costs.

Do such companies exist? Well interestingly enough, 21% of the companies in the new ETF are tech stocks. Three – Apple, Microsoft, and Intel – are in the top ten holdings. There are other sectors represented of course, with stocks like Merck, ExxonMobil, and JP Morgan. But this is definitely not a portfolio of boring utilities. And the question remains: is “growth dividend” emerging in blue chip technology stocks because… well because they’re some of the only companies in the world still growing earnings?

Or, is the arrival of yet another new fund another stroke of marketing genius by Wall Street? It’s also fair to ask if there is such a thing as a company that can increase earnings – or at least maintain dividend payments – when interest rates rise. But here’s the proposition of the day: investors looking for growth over income could actually get both from tech stocks.

I’ll revisit that point tomorrow. And the chart? It shows that since 2009, the S&P 500 has trounced a regular Fidelity dividend ETF. All financial assets have done well since 2009, mind you. But the strong tailwind of QE has rewarded growth above income. That could all change in the next 24 hours.

Category: Economics