“Way back”… in what feels like a year ago at the beginning of March, we noted how with every day that passed, a CEO of a major corporation was quitting their job. The exodus of executives was so great, that it was on par with that which occurred during the financial crisis – though this time, they clearly got their timing just right. The WuFlu was one hell of a bullet to dodge, and land safely in retirement…

These days, it’s not a new C-suite departure that we see arrive on our news feeds every day, but another stimulus programme or bailout. It may even have its own acronym. A billion here, a trillion there (in the States at least)… ever more money, just appearing seemingly out of nowhere which we never knew we had.

Estimates for the amount of money the government will spend above what it earns, standing at £55 billion pre-WuFlu, now ranges between £200 billion and £500 billion depending how badly our economy takes the shock therapy.

£1.6 billion being flushed into the bureaucracy that is Transport for London is merely the latest of measures to “keep the economy alive”. No doubt there will be more in the near future. And while few in the public eye want to mention it fearing the self-righteous ire of the luvvie in lockdown, deep down they know that this all comes with a cost.

As Alasdair Macleod recently wrote over at GoldMoney:

Those receiving subsidies and loan guarantees are no doubt grateful, though they probably see it as the government’s duty and their right. But someone has to pay for it. In the past, by the redistribution of wealth through taxes it meant that the haves were taxed to give financial support to the have-nots, at least that was the story. Today, through monetary debasement nearly everyone benefits from monetary redistribution.

This is not a costless exercise. Governments are no longer robbing Peter to pay Paul, they are robbing Peter to pay Peter as well. You would think this is widely understood, but the Peters are so distracted by the apparent benefits they might or might not get that they don’t see the cost. They fail to appreciate that printing money is not just the marginal source of finance for excess government spending, but it has now become mainstream…

Macleod is referring to the fact that by expanding the money supply as both the government and central bank are working together to do, those that are benefiting from the government’s actions are also being harmed by it, but not in an overt manner. The capital the government is borrowing and distributing though its stimulus programmes and bailouts would have otherwise been efficiently allocated to whichever sector of the market needed it… but we will never see what that would have looked like, which makes the damage invisible.

Our role here at Capital & Conflict is not to complain however, but to try and connect the dots and get a glimpse of what the future might look like. On this, we turn to the Bank of England (BoE) and its role in printing the money our “Conservative” government wishes to distribute to those it favours.

Among the few exceptions we Brits do to a greater extreme than the Americans is allow our central bank more freedom in what it does with the printing press. The Federal Reserve is limited in its legal capacity to only purchase debts that are guaranteed by the US government (in recent days it has worked with the Treasury to get around this). But here in the UK, the parameters as to what the BoE can do are much looser.

So far both here and in the US, when the government wants to spend money it doesn’t have, it turns to the bond (debt) market to borrow the cash. Central banks then make this borrowing dynamic much easier by printing money to buy the debts from the folks who lent the money to the government in the first place in the private sector.

Thus far, the private sector lender has always existed in the “loop” of the government requiring money. There has always been a private entity with capital who has decided to lend their money to the government first, before the central bank has shown up and printed money to buy it. The market still has some kind of a say in this lending agreement to the government.

The next evolution of this, where central banks cut out the middleman and just print money to lend to the government, has yet to occur. But we’ve got close.

Such a process is given the technical term of “monetary financing” (as money itself would be providing the government with the funds it needs). This was something the new governor of the BoE took to the pages of the Financial Times to say he would not do at the beginning of April:

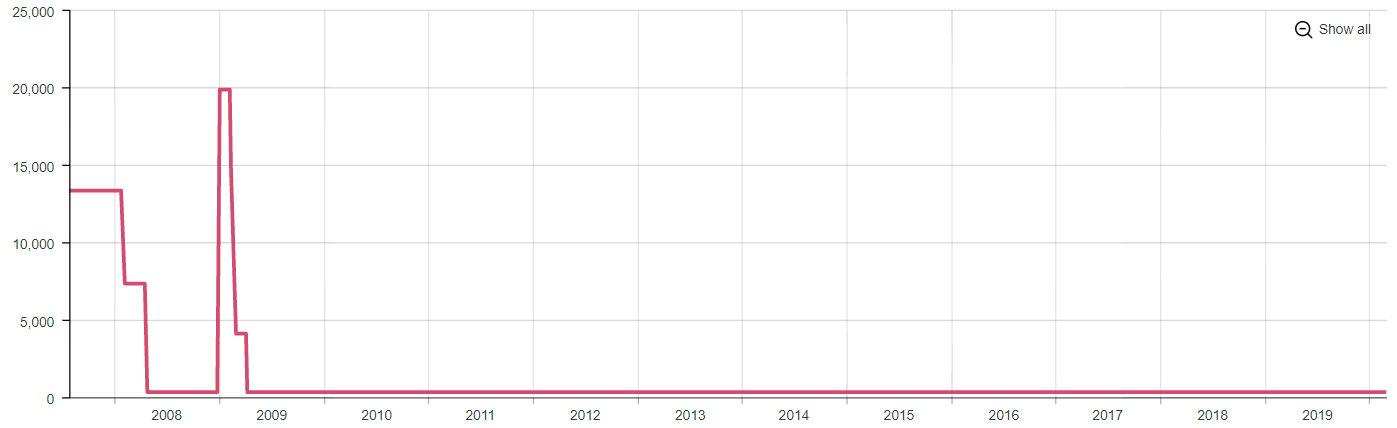

In fairness, the BoE, while opening the door to this form of money printing, has yet to actually facilitate it: the government has not yet decided to use its overdraft. The government did do this at the beginning of 2009, where the Treasury was granted a bottomless bank account at the BoE and proceeded to spend £20 billion out of it. The Treasury paid this back however, and the BoE restricted the account – known as the “Ways and Means” – once again, putting a bottom on it. The government has been able to borrow from the private sector – “the middleman” – for all of the money it needs so far.

As you can see, the government’s overdraft at the BoE has remained flat, even though at the beginning of April the BoE removed its limit:

Government overdraft with the BoE, millions (£)

Government overdraft with the BoE, millions (£)

Source: Bank of England

The “monetary financing” that Bailey was referring to in his piece in the FT would mean the government effectively defaulting on that overdraft, or simply running it in perpetuity rather than paying it back. We’re a way off that yet… but with the Treasury writing billions in cheques by the day, that overdraft facility must be looking ever friendlier.

If the private sector empties its pockets, this overdraft will be used just like it was in early 2009. The thing is, after the financial crisis there was an attempt at a reduction in spending, which is now political suicide. Once that credit line is tapped, spending printed money “straight from the source” will be incredibly hard to stop…

That’s all from me for this week – I’ll be back on Monday.

Wishing you a good weekend!

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Uncategorised