A few years ago, the chief legal officer at BlackBerry boldly pronounced that the world has yet to experience its “cyber 9/11”, which would reveal just how much destruction the digital world can wreak upon our lives in the real world.

We’ve still yet to experience such an event – but the cyber space is teeming with ever greater volumes of malicious activity, and the lockdown has turned cyberspace into a hacker’s paradise. Those who have brought their work home with them rarely have as much cybersecurity as they would at their place of work, where tech specialists are employed to keep vital information safe. As a result, the lockdowns have inadvertently pushed trade secrets out of their vaults, and into much flimsier housing.

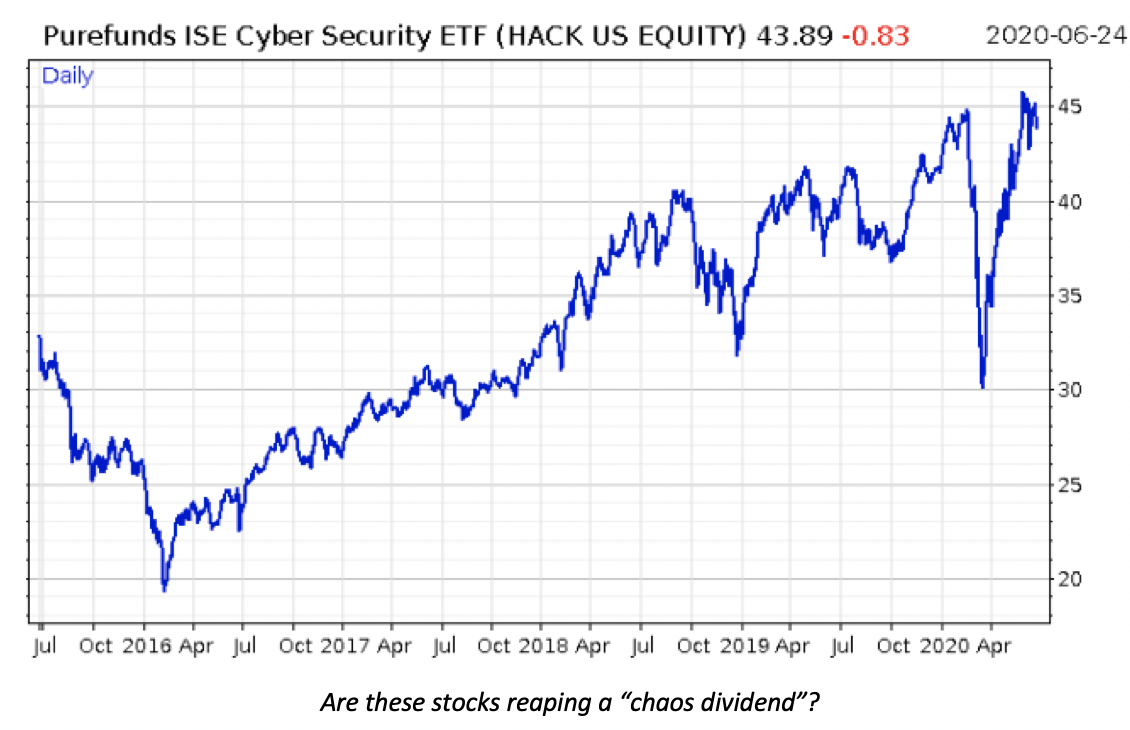

This presents an interesting opportunity for the cybersecurity sector, where “white hat” hackers use their skills to protect entities from malicious attack. The $HACK ETF, which contains a basket of cybersecurity stocks has crested to new all-time highs following the March crash:

Sam Volkering has been bullish on the cyber-sec space for years now, and I got him on our market broadcast to discuss the state of play today. Australia experienced a gigantic cyber-attack last week by what’s rumoured to be a state-backed actor (probably China, considering China’s extensive use of cyber-warfare and its deteriorating relationship with the Aussies), and it’s hard to imagine a future world where such attacks become less common, or less intense. But the more intense the digital conflict becomes, the more realistic that BlackBerry’s exec’s prediction of a “cyber-9/11” becomes…

All this and more in today’s market broadcast, free as always. Click here to tune in.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Uncategorised