Behold the Wonder of this present Age,

A Famous RIVER now become a Stage.

Question not what I now declare to you,

The Thames is now both Fair and Market too…And though these sights be to our admiration,

Yet our sins, our sins, do call for lamentation.

Though such unusual Frosts to us are strange,

Perhaps it may predict some greater Change.– Written in a pamphlet distributed at a Frost Fair, 1684

A return to the investing environment of the 1970s is an idea we’ve explored often here at Southbank Investment Research. The decade of vast government intervention leading to high inflation and little economic growth (leading to the popularity of the term “stagflation” first coined in 1965) may not be exactly what we’re experiencing now – but it’s not all that hard to imagine it occurring again in the future.

… But that’s the 70s – what about a return to the 1700s?

We mentioned the return of privateering, in both its original and digital form earlier in the week, but the Bank of England (BoE) itself presented an even more overt comparison in its latest report, harking back to the days when the Thames froze over and folks would host “Frost Fairs” upon it….

No quarter

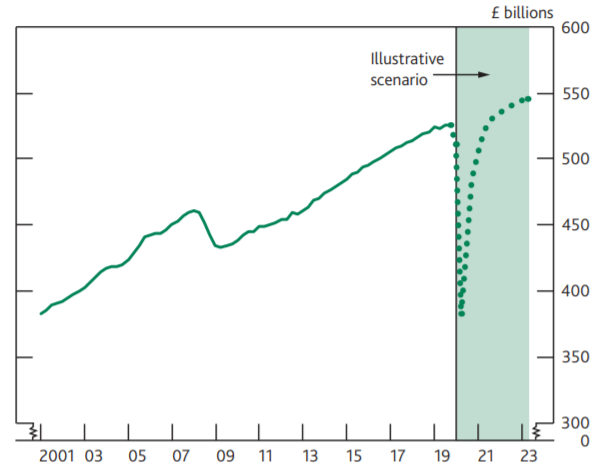

The BoE is expecting the UK economy to have shrunk by over a quarter once we reach the end of June – a quarter of economic activity evaporating under the lockdown:

While there are wide bands of uncertainty around any estimates of activity at the present time, UK GDP is expected to be close to 30% lower in 2020 Q2 than it was at the end of 2019. UK GDP is expected to have fallen by around 3% in 2020 Q1 and then to fall by a further 25% in Q2.

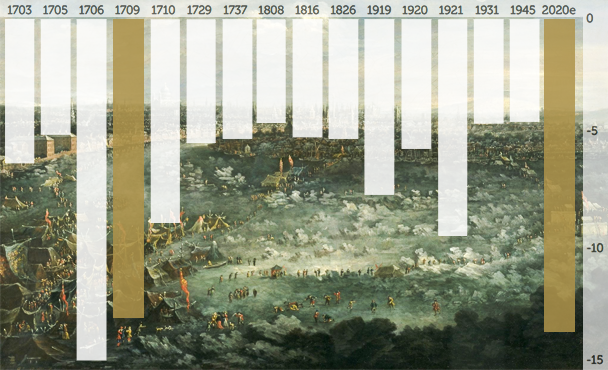

That 30% hit in the second quarter of the year it estimates, puts the total damage done to our economy as the worst in 300 years, with an equivalent level of damage last being taken in 1709.

These are the years in recorded history where the UK economy shrank by more than 4.5%:

Source: me, on Twitter

Source: me, on Twitter

Note that the financial crisis doesn’t even get a mention on that table. The earliest is the collapse in economic activity straight after the Second World War ended, when everybody was switching out from military to civilian roles. 1709, the closest comparison to now, was a time of “The Great Frost”, a brutal biting winter with temperatures of minus 12 degrees Celsius felt just in London.

The freezing of economic activity we see today is of an altogether different nature, but if the BoE’s sums are to be trusted, the end result appears similar. Businesses are being put on ice, and those which cannot bear the “cold” are failing, resulting in a contraction in the overall economy.

Statistics from the monetary authorities such as this, especially during such an exceptional event, are to be taken with a pinch of salt, however. And indeed, the BoE expects everything to be dandy and the UK economy to get right back on track to higher levels of economic growth soon after:

If the BoE is correct, we’ll only be reliving the 1700s for a little while. Perhaps we can get a Frost Fair in. It would be pretty ironic with all the global warming rhetoric (apparently Greta Thunberg is now an expert on pandemics as well) if we got another solar minimum now – the phenomenon which caused the extreme low temperatures causing the Great Frost in 1709.

I remember reading about the Frost Fairs when I was in primary school and finding the idea of a circus on ice very novel. The fairs were home to grand markets where all manner of commodities were sold, often at higher prices than on the shore thanks to the novelty of the fair. Kinda like offshore financial markets today, where interest rates are higher.

It wasn’t like they tried to keep the ice cool or anything either – vendors on the ice had to keep fires in their tents to stay warm. Knowing there’s only a few inches between you and a deep, freezing river must’ve given the experience an edge. But football games took place on the ice alongside bull and bearbaiting, and even the hounds and horses were brought on to the Thames for fox hunting, as one observer poetically described at one of the fairs:

But one thing more I needs to you must tell

The truth of which thousands do know full well,

There was fox-hunting on this frozen river,

Which may a memorandum be for ever.

For I do think, since Adam drew his breath,

No Fox was hunted on the ice to death.

We may not have hounds and horses tearing down the Thames after foxes… but once this particular “Frost” is over, we will have seen some awfully novel events take place. Novel enough to say that they haven’t been seen since Adam drew breath? That I can’t guarantee. But I’m sure it’ll be entertaining – and I’ll do my best to get ahead of it here at Capital & Conflict.

That’s all from me for today. But before I sign off, a little trivia for you. If we are heading back to the 1700s… how often would you guess the Royal Navy went to battle – on average – between 1714 and 1815? [email protected].

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Uncategorised