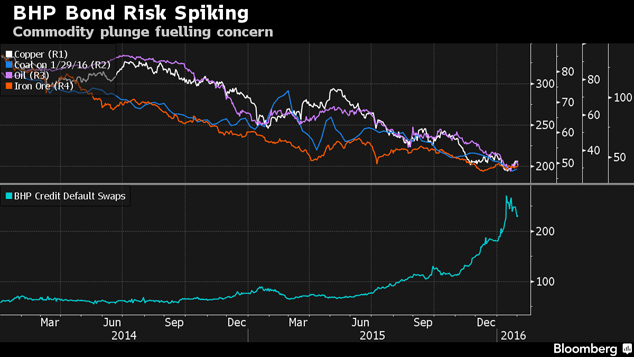

BHP Billiton’s (BHP) debt was cut to negative by ratings agency Standard & Poor’s (S&P) overnight. It went from A+ to A. The Melbourne-based miner reports full-year results on 23 February. S&P said poor results could result in a further downgrade. The cost of insuring BHP bonds against default have jumped, as you can see from the Bloomberg chart below.

What’s bad for BHP won’t be good news for the rest of the London-listed miners. Rio Tinto may be the exception. Alex Williams from MoneyWeek magazine pointed out this morning that Rio Tinto’s been paying down debt and, as the low-cost producer in iron ore, can stand the pain. BHP?

The trouble for the “Big Australian” is that it diversified its asset portfolio during the boom, especially into energy. It overpaid for shale gas assets in the US. That’s costing it now. And it may cost shareholders their dividends. Alex will have more when we record tomorrow’s podcast.

For companies like BHP and Anglo American, the spike in credit default swaps (CDS) would be worrisome. They’re not likely to be borrowing a lot of money any time soon. But it’s part of the capital flight story from China. As China goes, so go the commodity producers and big miners.

Category: Market updates