It’s all starting to look a bit dodgy in stockmarket land.

And, for that matter, it’s looking dodgy in the land of the government bond as well.

Commodities, meanwhile, have passed beyond dodgy and into the depths of despair.

And the financial asset that is property – that’s looking decidedly dodgy too.

So – is the end of the world nigh?

Again?

The slide in markets is hurting America more than Europe

Let’s start with some numbers.

At yesterday’s close, the Dow stood at 17,662 – down a little under 3%, or 618 points from its high of 18,280 at the beginning of March. It fell by 332 points yesterday.

It’s the same story in the S&P 500. It closed yesterday at 2,044, down 73 points from its highs of 2,117 on 2 March.

Of interest is the relative strength of the European stockmarkets – Germany’s DAX and France’s CAC in particular. Their highs came on 6 March, at the end of last week, and they’ve only seen two days of declines so far.

Right there in action you can see the boosting effect of currency devaluation on financial asset prices. Great for those who own European stocks – but not all Europeans do. Most of them just own euros, and they’re taking a hit (one they probably don’t even realise they’re taking).

Perhaps now that American assets are so expensive and European assets so cheap, we are seeing the start of this potential future trend I discussed on Monday – one that see capital flow back towards the continent.

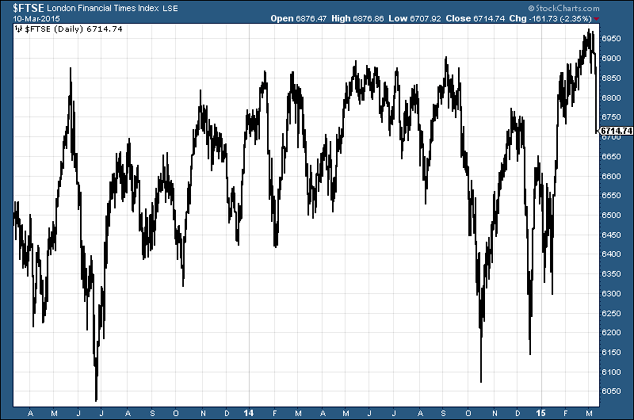

Meanwhile, the UK seems to be enjoying the worst of all worlds. The FTSE 100 is heavily geared to mining and oil giants, so it’s suffering for that. The pound has been weak against the US dollar – it’s now sitting at $1.50 – but not so weak that the case to send capital here is compelling (the cheap euro is far more persuasive). And the stockmarket has sold off. The FTSE flirted with all-time highs just a fortnight ago above 6,970 – since then, it’s fallen by 4% to 6,700.

US government bonds have been no place to hide. The 30-year bond price touched an amazing $162 at the end of January. Since then it has retreated a not-inconsiderable 7% to $150. It is now in negative territory for the year, in terms of price action.

It’s really easy to look at this and think it’s the start of something bigger, with cash – in the form of the ridiculously strong US dollar – the best place to hide. But does one really want to start buying US dollars with them already priced so high? (The euro is now at $1.07. My target for the year – which I thought was bold – of $1.08 has already been hit. Parity now looks like an obvious target, probably by about next Tuesday at this rate.)

It makes it all very difficult to know what to do.

Which markets look most vulnerable?

I’m currently short stocks in my trading account. Name an index, and I’m shorting it – Australia, Japan, the FTSE 100, the Dow Jones, the S&P 500 and the CAC40 – and I’m running my stops tight. In my more sensible investment account, I’m quite heavily into cash.

That’s as a result of a technical analysis strategy which I’m currently operating – one that is too technical to even begin to write readable copy about in Money Morning. And I’m certainly not recommending readers to go short on the basis of what I’m doing in a speculative, short-term trading account.

In all probability – crashes are a very rare thing, after all – this is just what they call ‘a correction’. I wouldn’t start battening down the hatches for 2008 part II just yet.

On the Dow, I’d suggest a reasonable target is the 17,000-17,400 area. This area was resistance on the way up in the autumn of 2014, and it was support during the sell-offs late last year and early this year.

The equivalent area on the S&P 500 is 1,920 to 2,020. (It’s amazing that we’re so high – it was not so long ago that I was making money shorting the S&P 500 at 1,300!)

If we go below those levels, I’d suggest a re-evaluation is in order, but it’s too early to panic, in my opinion – although the first rule of panicking is to panic first. We might not even reach my suggested areas of support.

European stocks, meanwhile, have had an incredible run this year. The CAC was at 4,100 in early January – it’s now over 20% higher, at 4,900. No wonder people are bagging profits and selling.

It’s a similar story with Germany’s DAX, which has gone from a low of 9,400 to 11,600. But bet against those (and I am, if only in the short term) and you’re effectively betting against the European Central Bank, which isn’t necessarily such a wise thing to do.

As for the FTSE 100, I haven’t a clue. I look at that chart and I may as well be looking at some kind of incomprehensible Cyrillic letting. It’s all over the place – 6,450-6,500 maybe? 6,100, if things get nasty.

Here’s the two-year chart. Can you tell me where that’s going?

Down, then up. Or is it up, then down?

It’s about as clear as the outcome of May’s election. Which might be the point.

In any case, I’m short, until I get stopped out.

So that is currently where I stand on stockmarkets – bearish in the short term. As for the intermediate term, as I write this, I’ve no particularly strong opinion. That will change, of course; it always does. But that’s where I currently stand.

• Dominic Frisby is the author of Life After The State and Bitcoin: the Future of Money.

Category: Market updates