In recent years there has been an amazing transfer of wealth to the US.

The US dollar and stock markets have been strong, money has flowed there. And so there has been in vast increase in America’s net worth and spending power.

In simple terms, the US dollar now has more buying power, and US-dollar denominated assets are worth more.

But for how long?

The US has outperformed massively since 2011

Let’s take the round number that is 1 January 2011 as our start date. As UK investors, we tend to think in sterling, so we’ll use the pound as our base currency. I’ll also use round numbers for the sake of simplicity. And, remember, in the insidious process of wealth transfer, there is no currency hedging.

So let’s say I had £1,000 invested in the FTSE 100. The FTSE 100 stood at about 5,900 on 1 January, 2011. It’s now 6,950. So we’re about 17.5% richer.

What about the eurozone? We’ll use France as our European barometer – it’s done better than some eurozone nations, and worse than others. So say we’d taken our £1,000 and invested it in France’s CAC stock market.

At our start date, one pound would buy you €1.13. So £1,000 would have turned into around €1,130 invested in the CAC. Since then, the CAC is up by just under 30%. So that €1,130 has turned into €1,458.

But the euro has weakened against sterling since then. So divide that by today’s euro/sterling exchange rate and your £1,000 has become just £1,049. We’re only 5% richer.

How about Japan? On 1 January, 2011, £1,000 bought you ¥120,000. Slap it on the Nikkei, and it’s risen by a whopping 80% (I was surprised too!) to become ¥216,000. But convert it back to pounds at today’s rate of ¥183 to the pound, and your £1,000 is now £1,180. We’re 18% better off – not bad, but not 80%.

Finally, Uncle Sam. £1,000 bought you $1,550 back at the start of 2011. Shall we stick it on the Dow (which has risen by 60%), or the S&P 500 (which has risen by 70%)? The S&P is more of a benchmark, but the Dow, with 30 companies, is more reflective of the CAC, which has 40. I’m going to split the difference and say 65%.

So our $1,550 is now $2,560. Meanwhile, the dollar has also strengthened against the pound (a little). So if which, divided by the current exchange rate of 1.51, is now £1,690. We’re almost 70% better off.

I know the start date is arbitrary and the stats are simplistic, but they illustrate the considerable outperformance of the US – and thus how much wealthier it has become. It has delivered more than ten times the return of the French market, in sterling terms at least.

If there’s one thing these numbers teach us, it’s this: when dabbling in foreign stocks, make sure you hedge!

How the strong US dollar could trigger the next phase of the currency wars

With all that foreign money buying US dollars, US stocks, US bonds – or any US-denominated asset – a colossal shift in (paper) wealth has taken place. The US now has a great deal of potential purchasing power.

But there is a flip side to all of this. It also means the US is considerably more expensive than it was, while other nations are considerably cheaper.

Sometimes they might seem like different worlds, but the financial economy does affect the real economy, and vice versa. In fact, one of the main reasons for deliberate currency devaluation is to boost exports (and growth) at the expense of trading competitors. And it already appears that the ‘expense’ of US goods is, after a great spell, pricing buyers out.

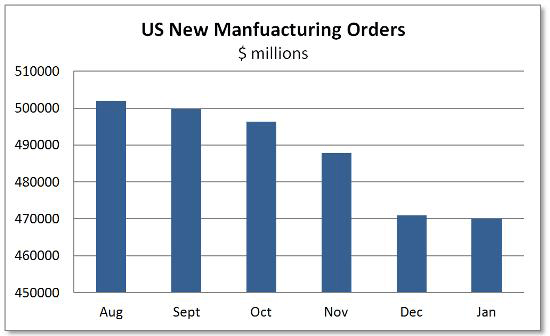

Late last week, the Federal Reserve reported another slowdown for American manufacturing – the sixth month in a row. Author John Rubino posts the following chart on his blog:

I know the start date is arbitrary and the stats are simplistic, but they illustrate the considerable outperformance of the US – and thus how much wealthier it has become. It has delivered more than ten times the return of the French market, in sterling terms at least.

A change in narrative and a slip towards slower growth, even recession, could bring the amazing bull market in American stocks to a close.

Looking further ahead – and there are a lot of ifs and buts, of course – one has to consider what the Fed’s reaction to this would be. Its current inclination is towards tightening. But an economic slowdown, an end to the bull market, a change in narrative, and an overvalued dollar might eventually lead to the point at which the Fed starts loosening again.

Now that would be very interesting. As Rubino notes, with interest rates already so low, America too would then be dabbling in negative numbers. What then for this great monetary experiment?

Over the coming months, it’s worth keeping an eye out for signs of US slowdown and European improvement. That could herald the next phase of the currency wars.

Meanwhile, I know my colleagues at MoneyWeek magazine would favour European stocks over US ones on the basis of this disparity in valuations.

• Dominic Frisby is the author of Life After The State and Bitcoin: the Future of Money.

•

Category: Market updates