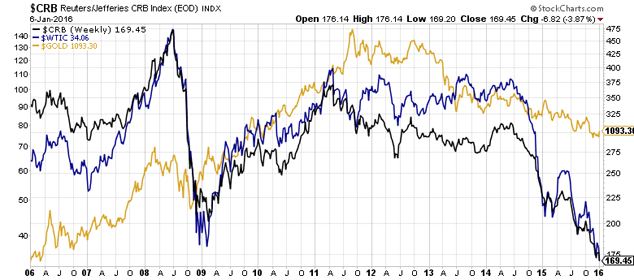

If there’s a silver lining to this week’s pasting, it’s that we’re one day closer to the bottom in resource and emerging markets. That market could, of course, still be a lot lower. But looking at the chart below reminded me of the Saturday garage sales I went to as a child. Check out the chart first.

The chart shows the CRB/Jefferies commodity index, West Texas Intermediate crude, and gold over the last ten years. You can see the CRB making a new ten-year low. It’s now down 64% from its 2008 high. This is a combination of commodity/China weakness and US dollar strength.

Oil and gold are down too. But the stories begin to get more complex for individual commodities. Oil finds itself caught in the crossfire of a shooting war between Iran and Saudi Arabia over control of pricing power in the global market. The Russians and Americans are firing at will as well. Let’s leave that issue aside since it’s the subject of a report Charlie’s working on. And he has something useful to say about it for investors whereas all I could do today is speculate.

And gold? Good old gold? Gold old, inert, sits there and yields nothing and looks pretty and has been money for around 5,000 years gold? Well, the trend doesn’t look great. But it’s being stubborn at around $1,093 an ounce.

I’m going to ask Charlie this on the podcast today: what would it mean if the yuan falls further, the dollar strengthens against other currencies, but the gold price remains steadfast? Stay tuned tomorrow for the answer.

Until then, you can think of commodity and emerging markets as a garage sale that is a few days away. When I was a kid, a friend’s mom used to drag us out of bed early on Saturday mornings to hit all the garage sales early. She wanted first crack at the best deals… a good-as-new sofa with only a little of the stuffing knocked out of it… or a perfectly usable patio set with just a few cracks in the glass table… or a lovely garden gnome.

She always got a good deal by being early. And that’s probably the main difference between yard sales and resource investing. You don’t want to be too early buying what you think are valuable resource companies at bargain prices. The price can always go lower.

But when the liquidating is done, and the numbers go from red to green, there is going to be a point this year where it pays to make a move on emerging-market stocks and resources. Charlie and I are working on that story too. Details next week.

Category: Market updates