Shakespeare got it half right, at least when it comes to commodity markets. “What’s past is prologue”, says Antonio in the The Tempest. Any playwright worth his salt would know that in financial markets, past performance is no guarantee of future results. But, when it comes to cycles, the past is worth keeping in mind.

And so it is today in the oil markets. Royal Dutch Shell reported a 44% decline in fourth quarter net profit, from $3.3bn to $1.8bn. It follows BP’s $6.4bn net loss earlier in the week. And to make matters worse, Standard and Poor’s (S&P) – the ratings agency always eager to kick a credit risk when it’s down – put energy titan ExxonMobil (NYSE:XOM) on “credit watch negative”.

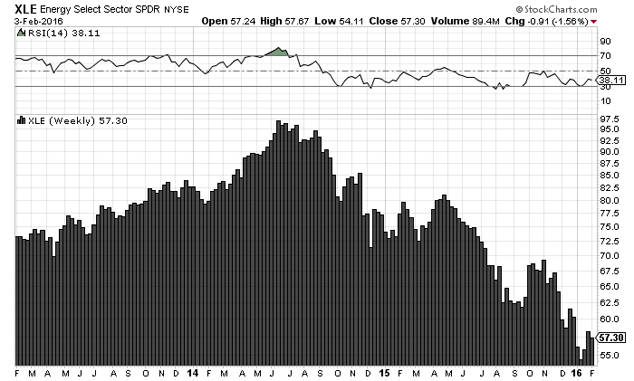

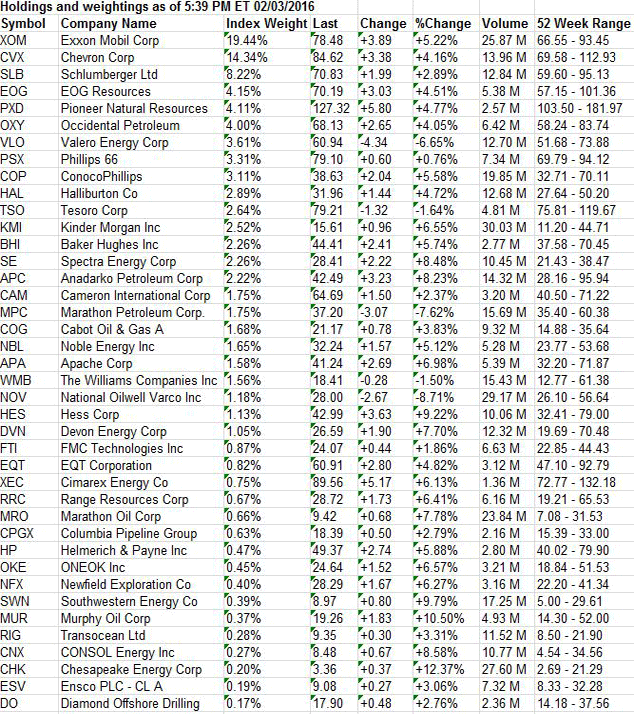

Riddle me this, dear reader… if it’s so bad in the oil patch right now, why is the XLE – the S&P 500 oil sector fund – not making new lows too? True, the fund was down yesterday. But if you look even further below, you’ll see that 35 of the 40 constituents that make up the fund rose on Wednesday. XOM was up 5.22% on the day.

This is the stock market doing what it was born to do: discounting the net present value of future cash flows and expressing that value as a price. Or in simpler terms: oil stocks are telling you that the fourth quarter was bad. But the fourth quarter was in the past. And the past was last year.

And this year? Well, past performance etc. But new readers of The Fleet Street Letter would be encouraged by the table above. Investment director Charlie Morris made buying a UK-listed energy fund the first addition to his “Whiskey” portfolio. Good timing Charlie!

Category: Market updates