Global platinum supply is set to reach its lowest level in 14 years – just as demand is reaching its highest level in six.

Meanwhile, there is a ‘perfect storm’ for palladium.

Strikes in South Africa, tensions with Russia (now the world’s largest producer) and a supply-demand deficit that is now in its eighth successive year have sent the metal to 13-year highs.

We recommended palladium in early January and we’ve seen 20% gains since then.

And I don’t think the game’s over yet.

Today, we look at platinum and palladium.

Platinum supply shortage

Late last month 70,000 South African platinum miners went back to work after a five-month strike. It was the longest and most expensive strike in South African history.

You’d perhaps expect the platinum price to have sold off in reaction. But it did the opposite. The price spiked to new highs for the year. So why is this?

It’s because although the strike in South Africa may be over, its impact is not. According to the FT, some one million ounces were lost to the strike, and Thomson Reuters GFMS estimates that another 300,000 ounces will be lost as companies return to full production, a process that will take three months.

Whatever happens in South Africa is crucial. The country accounts for about 70% of world platinum mine supply.

World platinum supply will be about 5.6 million ounces in 2014. Of that, about four million ounces will come from South Africa, 750,000 ounces from Russia and 850,000 ounces from elsewhere (North America and Zimbabwe, mainly).

Zimbabwe, meanwhile, has its own problems. There has been a collapse in its biggest platinum mine – the Zimplats’ Bimha mine – and parts of it have been shut down, with the result that production is forecast to fall by 50%. The 45,000 ounces that will be lost equate to almost 1% of global output and 12% of Zimbabwe’s total supply. These are ‘significant structural problems’ – the mine supply is not coming back soon.

In addition to mine supply, about 2.2 million ounces are produced through recycling, which gives us a total supply of 7.8 million ounces.

Too much supply

On the other side of the equation, we have total world demand which stands at almost nine million ounces, leaving a rather large deficit of 1.22 million ounces, according to estimates by Johnson Matthey.

Platinum demand grew about 5% in 2013. It has grown at an average rate of 3% over the last ten years. That increased to 5% last year, and SocGen recently put out a note forecasting a 6% increase in demand this year. Why the increase?

The largest demand use for platinum is catalytic converters – 40%, or 3.4 million ounces. Jewellery demand accounts for almost another 40% (3.2 million ounces). There is industrial demand of about two million ounces, and a small amount of investment demand – 385,000 ounces in 2014 – although total exchange-traded fund (ETF) holdings amount to about three million ounces.

I think there’s a good chance that demand could continue to increase, particularly catalytic converter demand. European car sales, for example, are up 4.5% year on year (believe it or not). But we need to look to Asia and its growing middle class. They want cars.

China is the world’s largest car market. It posted a growth in sales of 9% to May of this year, according to the China Association of Automobile Manufacturers. Almost ten million new cars sold!

But you’ve seen the pictures – pollution in China’s cities is becoming a bigger issue every day. It’s not just China, it’s every city in the developing world. The World Health Organisation (WHO) has said air pollution is the world’s single largest environmental health risk.

To deal with this, China is imposing tighter and tighter standards on vehicle pollution. Last month, Beijing ordered the pollution-prone, so-called “pre-National III yellow-label” vehicles nationwide off the road. There are six million of these.

It all points to greater platinum demand.

It seems the car industry is moving ever closer to fuel-cell technology. If it does this successfully, that will not spell an end to platinum demand –because this, too, requires platinum as a catalyst to split hydrogen fuel cells into ions and electrons.

Palladium alternative?

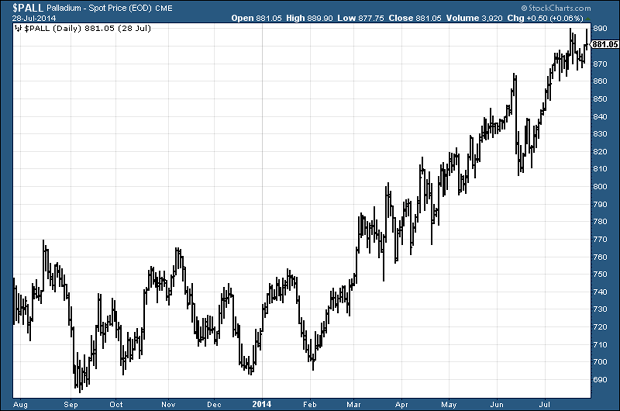

In previous periods of platinum supply deficit, industry has usually turned to palladium as a substitute. But the palladium price is going bananas. It’s the best-performing metal this year. Here’s the chart if you don’t believe me.

Johnson Matthey and Commerzbank both project a palladium supply shortfall of 1.6 million ounces this year – higher than that of platinum. Mining output will fall by 5%, just as demand will rise by 11% (including 7.1 million ounces from the vehicle sector).

And what happens if Putin decides to get nasty with his palladium? Russia is the world’s largest producer.

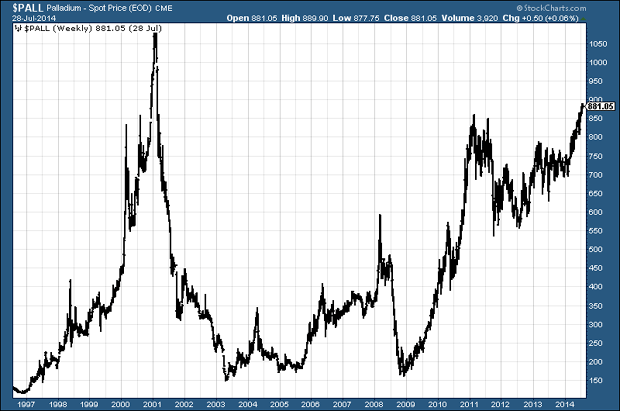

This chart shows 18 years of the palladium price. You can see the huge spike in 2000-2001, just as most other metals were bottoming out. Palladium has always done its own thing.

When palladium starts moving like this, it’s a risky thing to buy into. It’s not unlike silver in its volatility. But now we’ve broken above $850, I would have thought a test of $1,000 is likely – and perhaps even the 2000 highs, eventually.

At some stage there’s going to be huge shorting opportunity – but I suspect we’re a way off that yet.

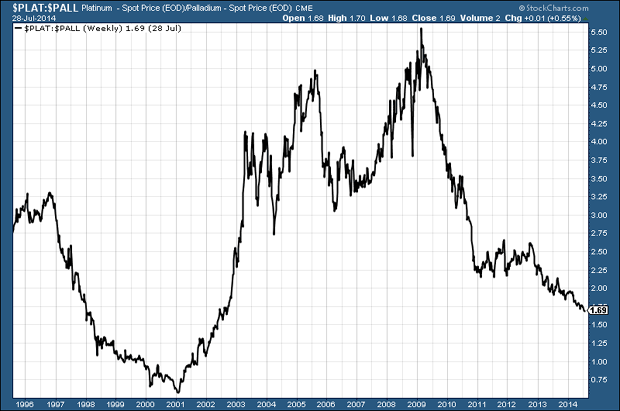

Another thing to consider is the ratio between platinum and palladium.

Currently it stands at 1.7 ounces of palladium to an ounce of platinum – multi-year lows – and it looks like it’s headed lower. It’s amazing to think that in 2000 and 2001 palladium was actually more expensive than platinum, while in 2009 you could buy 5.5 ounces of palladium with an ounce of platinum.

In the very short term, the leverage of palladium means that more gains will probably be made – but with the slightly bigger picture in mind, I’d have to say I favour platinum, based on the ratio above.

So how could you profit?

One of the rules I have made in my investment career, as a result of some nasty experiences, is to avoid Russian companies. Another is to avoid South African miners. This means – company-wise – if you want a pure PGM (platinum group metal) producer play you are left with Stillwater (NYSE: SWC), which operates in North America. Stillwater has come under new management, so it’s a rather better prospect than a few years back. But over the last 12 months the share price has doubled, and that makes me feel defensive.

Instead of a producer, you could invest in a company that is looking for new platinum deposits – an explorer. There are plenty of these, but investing in an explorer opens up a whole new set of risks.

So the best route, in my opinion, is via the metal itself. You can buy the physical platinum from the likes of Goldcore and Goldmoney. Or you can buy one of the platinum ETFs through your broker (these track the platinum price, but are denominated in dollars, so watch what you pay) or, if you want some leverage, there is the option to spread bet.

As always – whatever you decide to do – manage your risk.

Category: Market updates