In 2013, palladium was one of the few metals to actually rise in price, albeit by a measly few per cent.

I think it could be set for a much more exciting 2014.

Here’s why.

Palladium supplies are looking tight

Palladium was formally discovered in 1803, by the English chemist William Hyde Wollaston. He named it after the asteroid Pallas, which itself drew its name from Greek mythology. (Pallas was step-sister to Athena, goddess of wisdom).

The silvery-white metal is considered precious (it’s part of the platinum group), but its main uses are industrial. Demand came to 9.63 million ounces in 2013. More than 70% of this came from the vehicle industry, for use in catalytic converters. Another 23% or so came from other industries: including electronics, dentistry, medicine, hydrogen purification and fuel cells. Just over 4% was used in jewellery, and around 1% was bought by investors.

On the other side of the coin, just 6.43 million ounces was produced by mines in 2013, leaving a 3.2 million ounce difference. Of this, 2.46 million ounces was met by recycling. That still leaves a 740,000 ounce shortfall, to add the 1.15 million ounce shortfall in 2012 and the 1.185 million ounce shortfall in 2011.

So where does the ‘missing’ palladium come from? From the same place that seems to stockpile every other obscure metal – Russia. Nobody knows how much palladium the Russian government has – it’s a state secret – but some (palladium bulls) believe the level has shrunk considerably.

On the mining front, although palladium is less rare than other platinum group metals, there still aren’t many places that actually produce it. There’s the Bushveld near Johannesburg in South Africa; the Norilsk-Talnakh region in northern Russia; the Stillwater complex in Montana, USA; and the Thunder Bay district in Ontario, Canada. Some production comes from Zimbabwe – and that’s pretty much it. A full 80% of world palladium supply comes from South Africa and Russia.

Often palladium occurs with platinum, and the companies that mine both have had an almighty struggle in recent years. With declining ore grades (so you mine harder to get less metal, effectively), falling platinum group metal prices, increased labour costs, labour disputes and disruption, and a rising oil price, mining companies are struggling to make any money at all. Some have shut down, and funding for exploration has dried up. Zimbabwe looks to be the only region in the world where production is on the increase.

It all points to a strain on supply, just as demand looks like it may increase. Automotive and industrial demand is constant. Jewellery demand is falling, but this should be offset by the demand created by South Africa’s proposed new palladium exchange-traded fund (ETF). In fact, depending on its popularity, this ETF could really distort demand and cause shortfalls if increasing numbers of people want to get exposure to palladium.

Recycling supply is rising, but only by about 5% last year. The question is how long will Russian stockpiles last? Nobody knows except those who audit the Russian vaults – assuming they are audited.

Why I’d rather buy the metal than the miners

So how can you benefit from any supply squeeze? I’m not keen on the Russian and South African producers (if you are interested, the names to look for include Lonmin, Impala, Anglo Platinum and Norilisk).

That just leaves the American option, Stillwater (NYSE: SWC). The company is under new management. And hopefully its gaffes are behind it (why try and buy a copper company when you have the unique selling point of palladium?) The price action looks good. Its low at $10 was re-tested successfully, and it’s now trending higher.

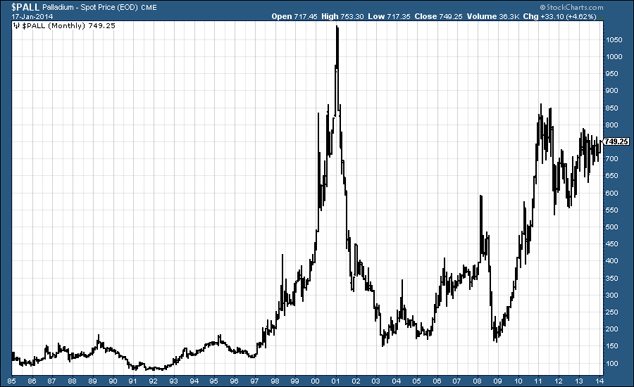

My inclination, though, is to bet on the metal, not the miner. Below we see a long-term price chart of palladium since 1985. Like most metals it was flat during the ‘80s and early ‘90s. But from 1999 to 2001 there was a frenzy, created largely by supply interruptions from Russia and speculators trying to exploit them. The price shot from below $300 to $1,090/oz in 24 months.

The price has never seen $1,000 since. In the commodities boom of 2006-08, it hit a high of $594/oz, and in the metals frenzy of late 2010-11 we saw $862/oz. The current price is $749.

Source: StockCharts.com

Here’s why I like it.

First there’s the upside potential: 2000-01 shows what is possible when there is a shortage of the metal.

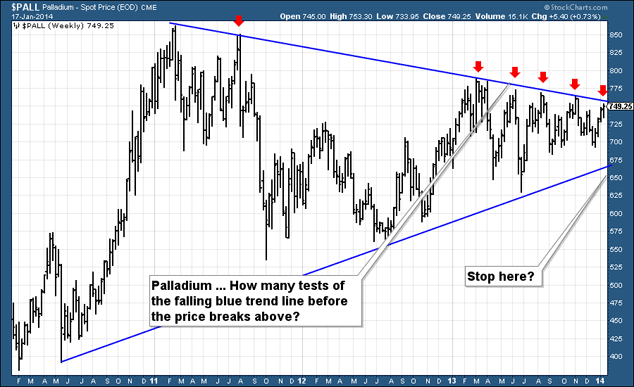

Since the sell-off of 2011, palladium has consolidated, while other metals were falling. It has displayed relative strength. Now a gentle uptrend is in place. The price is sitting above the shorter and longer-term moving averages, and they are sloping up. We are seeing higher and higher lows.

But we are also making lower highs. So the range has been tightening and getting smaller. Often a tighter range presages a big move one way or the other. The question is: which way?

Nobody knows. But the fact that there was an upward trend coming into this consolidation period is positive. The supply-demand situation is also positive.

I have defined this range with the two blue lines in the chart below. Meanwhile, I have marked with red arrows each time the upper line has been tested. My experience is that the more a line is tested, the less likely it is to hold.

Source: StockCharts.com

Palladium could, of course, move the other way. So I am using that lower trend line to identify an area to place my stop in case I am wrong. $650 is one possibility, or perhaps even tighter at $675, just below the lows of late last year.

An easier option for shorter-term holders is a London-listed palladium ETF – just be aware of currency risk, as it’s denominated in dollars.

And, of course, there’s the user-friendly, but easy-to-lose-your-shirt option that is the spreadbet. My colleague John Burford writes MoneyWeek Trader, a regular free email on spreadbetting – you can sign up for it here. Look to buy on pullbacks.

• Life After The State by Dominic Frisby is available at Amazon. An audiobook version is available here.

• Follow @dominicfrisby on Twitter.

Category: Market updates