Usually when you write an article, you hope for lots of comments. Comments are a good sign. You’ve struck a nerve. People feel compelled to have their say.

Comments lead to discussion, which brings in more readers. You can say to your boss: “Look how many people are reading my article,” and ask for a pay rise.

Tweets are good too. Facebook ‘likes’, Google+ recommendations, shares – any kind of social media approbation you can think of.

So when an article gets ignored or overlooked, you skulk back to your bunker and feel rather bad about things.

Except in this instance …

Why I’m glad everyone ignored my story about uranium

Writers dream of the glory that is bestowed upon the high-profile social commentator. They want the column in the broadsheet that gets them a thousand comments for every article. They want to be invited onto the BBC to hold court about this or that issue, and for that interview to then go viral. They want to be paid fortunes for uttering their opinions.

But these great intellectuals don’t put their money where their mouth is. Yours truly, however, does.

Back in early December, I posted this article on uranium. I suggested that a ‘stealth bull market’ might be underway.

Barely a uranium company attended Mines and Money (one of the world’s biggest mining conferences) last year, for example. Investor interest was close to zero. Hardly any mines can make money at current prices, funding has disappeared and that means there’s going to end up being a shortfall in supply. Because nobody gives a fig about uranium any more.

Do you know what? Nobody gave a fig about my article either. Nil comments. Not one. The big zero. Two likes on Facebook – one of them from me. Four tweets – one from me, one from my mum, one from MoneyWeek and one random.

The proud, egotistical Dominic Frisby harrumphed. I should have written something about gold or house prices – or, better still, both. (I believe one ‘house prices measured in gold’ article still holds MoneyWeek’s ‘most commented’ record.)

But the proud, egotistical Dominic Frisby is a rotten investor. One of the first rules of investing is that ego and pride should both be left at the door, along with opinions, prejudices, biases and bigotries. Humility is everything. And if you’re not humble, it won’t be long before Mr Market teaches you to be.

The canny Dominic Frisby, who, believe it or not, does appear on occasion, had a rather different interpretation. Zero interest is an extremely positive sign.

As a buyer, there’s nobody to compete with for stock. You can get it cheaply. You can buy it quietly. You can take your time. There are plenty of people still to enter the market and then shout “buy uranium!” once they’ve taken a position.

Uranium has bottomed out

I’m not saying uranium is going to shoot up from here. Memories of the 2006 bubble still linger. Bubbles take many years to unwind. But I am saying that the low is in – at least in my opinion.

The uranium price itself (or rather the uranium oxide price) is mired at around $35 a pound. After two years of post-Fukushima declines from a high of about $70/lb, it has been flat at $35/lb since July.

It’s hard to see how the price can fall much lower from here. Most deposits are unviable at $35/lb. Broadly speaking, $50/lb is the cut-off – so development of new mines has all but stalled. Exploration has all but dried up.

Current uranium production stands at about 130 million pounds a year, while usage stands at around 180 million. The shortfall is made up from old Russian military stockpiles. How long will these last? Your guess is as good as mine.

But electricity consumption is on the increase worldwide and more reactors are being built, so demand will at least remain steady, if not grow.

So how can you benefit? It’s still too early in the cycle to buy explorers and developers. The way to play it is either to go for the metal itself, via the Toronto-listed Uranium Participation Corp (TSX: U), or to go for a large producer.

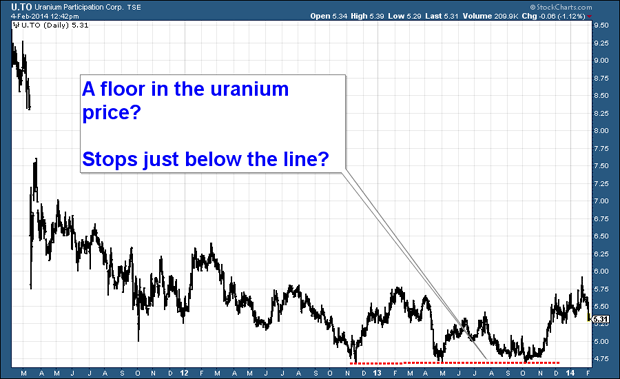

Below, is a chart of Uranium Participation Corp, which tracks the uranium price. You can see the falls in 2011, the long grind lower and then that ‘triple bottom’ – a low in late 2012, re-tested successfully in March 2013 and again last October – where I have drawn the dotted red line.

If you were to buy this stock, the obvious place for a stop is just below that red line.

Source: StockCharts.com

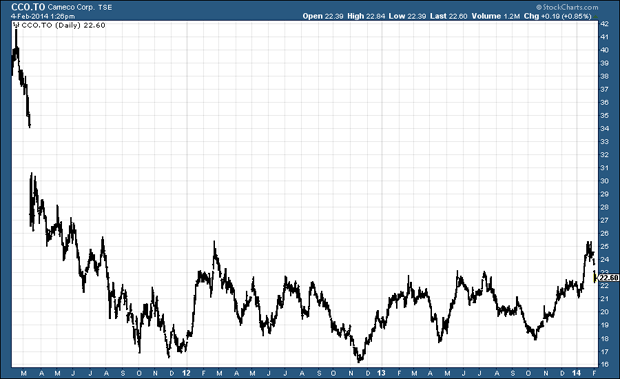

Alternatively, there’s a US-listed exchange-traded fund which tracks uranium miners and developers. But I still favour the world’s largest pure-play producer, Cameco (TSX: CCO; NYSE: CCJ). I recommended it back in December, since when it’s had a pop and a pullback.

Anything can go wrong in mining, and it usually does, particularly if the metal in question is uranium. So make sure you have a clear exit strategy. But C$21-22 seems a reasonable entry point. There’s resistance at $25. I have $30 as an eventual target.

My stop-loss is just below the late 2012 lows at C$16. But I’d be surprised to see it fall below $18.

Here’s the chart. What do you think?

Source: StockCharts.com

• Life After The State by Dominic Frisby is available at Amazon. An audiobook version is available here.

• Follow @dominicfrisby on Twitter.

Category: Market updates