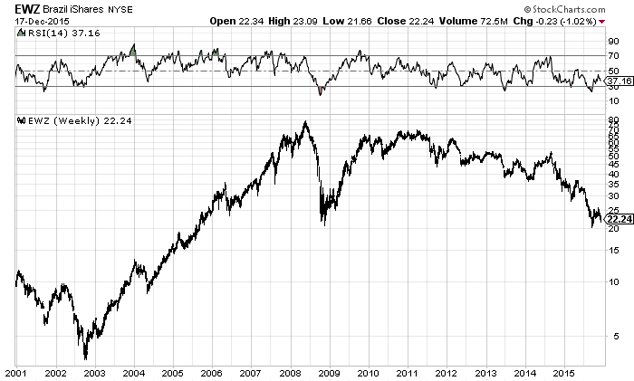

Take a look the chart below. It’s a long-term chart of the iShares Brazil ETF traded in New York. You can see the ETF has recently ‘bounced’ off the 2009 lows. But for how long?

Charlie Morris was in the office last week to talk about emerging markets. The question was whether they’re worth a look in 2016, or whether you should give them a wide berth. Charlie suggested that instead of looking at all emerging markets, we ought to look at the ones that look… interesting.

Luckily, Charlie has a friend who knows a thing or two about Brazil. Below you’ll find a note penned exclusively for Capital and Conflict by Adam Cleary. Adam is the chief investment officer at Cavenham Capital Limited. Enjoy!

I was recently in Brazil, writes Adam Cleary, and I came away with four observations:

Interest rates in Brazil are 14.25%

In the world today this is remarkable. Brazil is a real economy – like the ones we used to know. Not a pretend economy where rates cannot rise by even 0.25% without the system choking on 300% of GDP in unproductive debt. Interest rates are high but the Brazilian world does not end – high interest rates are a natural cyclical response to overconsumption and mal-investment – they permit capital to be rebuilt. If Brazil can tolerate interest rates at this level, it tells you it is a much more robust and healthy economy than most.

Brazil has a very large and robust private sector, which functions largely independently of the government

All the sound and fury around Petrobras, and the so-called Lava Jato corruption scandal is, for most of the large Brazilian corporates that operate on a global scale, precisely that – just noise. Brazilian politics has been compared to elephants mating: it is very messy, it takes place at a high level and no one can quite understand what is going on. This episode of the pantomime that is Brazilian politics is no different, and the details should be largely ignored.

There is universal consensus from investment banks that Brazil is a disaster and is in the ‘winter of despair’

Investment banks usually do the opposite of what they say and when they are all so carefully coordinated in their views it always makes me suspicious. The West rolls cheerfully downhill with exceeding smoothness, printing paper money and spending it: we are confidently told by the same banks that those Western economies are, er, ‘recovering’. They have recovered so much that seven years after the global financial crisis they have not even been able to raise rates by 0.1%.

Brazil, by contrast, has the fifth-largest population (200 million people), the sixth-largest domestic market and is one of the largest global producers and exporters of iron ore, oil, coffee, meat and sugar. It is larger than Europe and has almost the same population. Yet reading investment bank research notes one would think it was Ecuador – the cultural imperialism is palpable, and, frankly, almost risible.

Despite an endless stream of bad, negative ‘news’ from Western media, and a desperate dirge from Western investment banks, the Brazilian real seems to have found its level at around R$3.80 to the dollar

When something no longer goes down despite terrible news-flow and coordinated negative cheerleading it usually tells you it has found its level and is unlikely to fall much further.

Yes, oil and iron ore prices have gone below $40 and this is bad for Brazil. In oil we are back to levels of the early 1990s. Could it fall further? Yes, perhaps. Is a lot of it already in the price? I would think so. In addition, now that we seem to have confidently embarked on a third world war, oil and steel demand may just revive sooner than you think! And Brazil is a long way from the likely centre of the next global conflict – this will be a place where capital will gravitate. I recommend readers start taking a closer look at Brazil – and specifically at large, well established world-class corporates with substantial US dollar cash flows.

Category: Market updates