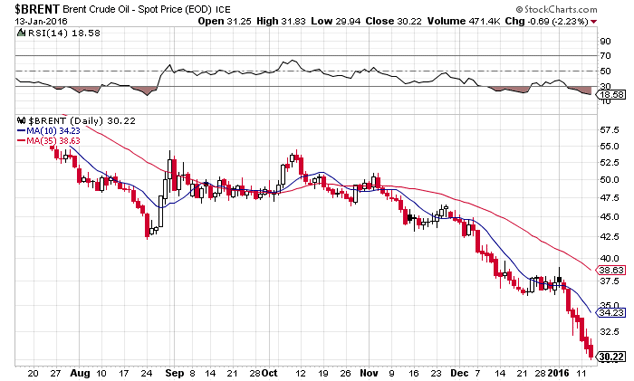

If only the resource companies had better lobbyists. BHP Billiton announced a pre-tax US$7.2bn write-down overnight. The after-tax hit is $4.9bn. The company took a hit on the $20bn it splurged on shale gas assets acquired in the US since 2012. The plunging oil price has hit hard.

If BHP were a bank, it could probably get some help from the Fed or the government. Banks have friends in high places. Mining companies don’t. When they make bad investment decisions, they have to take their losses. Some of them go out of business.

BHP isn’t going to go out of business. As miners go, it’s diversified, with iron ore, coal, gold, copper, uranium to go along with oil and gas assets. That diversification was designed to lessen its exposure to a fall in any one commodity. It has. But it’s also broadened its exposure to falls in all commodities. And that has punished the share price.

The London-listed shares have been in free-fall since early October of last year. They’re down 48% since 12 October. They’re down 70% since August of 2014 – when the oil price decline began in earnest. How much further could they fall?

If Charlie’s right, a lot. That’s not scientific. But in the meantime, two things to watch for: a dividend cut and a bottom in the miners. Blue-chip miners added dividends to their menu after the 2008 crisis in order to make their shares more appealing, and to appear less cyclical. There was plenty of cash to give back to shareholders anyway.

But BHP has written off $13bn in deals since then. It’s also spent $15bn expanding capacity in the “investment phase” of the mining boom. That may leave less cash for shareholders. I’ve asked Stephen Bland (of The Dividend Letter) whether the prospective cuts should worry income investors. I’ll report back next week.

The bottom line? Commodities and mining remain cyclical businesses. No amount of central bank intervention can destroy the business cycle. In fact, the intervention only makes the highs higher and the lows lower. And it provides bailouts for well-connected financial players while leaving everyone else to fend for themselves.

Category: Market updates