A detailed investigation into the risks of an emerging-market bond crisis is beyond the scope of today’s letter. But a picture will suffice. And rather than a thousand words, ten will do: the next financial crisis could come from emerging market bonds.

Some US$5trn in new bonds has been issued in emerging markets since 2009, according to a report published earlier this year by the Bank for International Settlements (BIS). This is dollar-denominated debt. What does that mean?

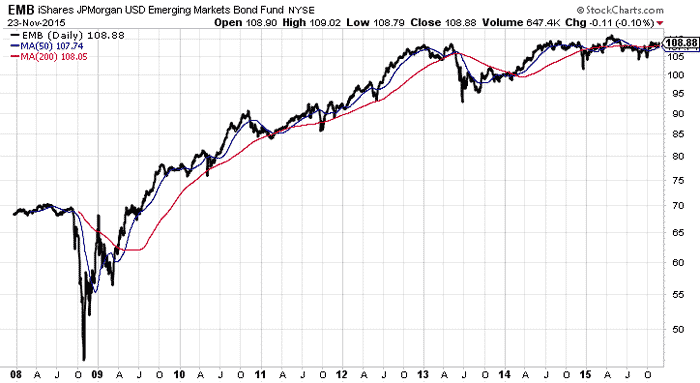

Well, when US interest rates go up (as everyone expects it to at next month’s meeting of the Federal Reserve Open Market Committee), then it gets more expensive to pay back your dollar borrowings. It’s even worse if you’re, say, a commodity/exporting country whose currency is in free-fall to begin with. Now take a look at the chart below.

The security in question is irrelevant from a trading or investment perspective. It’s an index tracking emerging-market bonds issued in US dollars. Note that it went public in 2008, during the birth pangs of the last credit crisis. Then crash.

And now? The short-term momentum is down. But what about the long-term? On a technical basis, the chart isn’t definitive. It seldom is. What about the fundamentals?

Ninety nine global companies have defaulted on their debt in 2015, according to a story in the Financial Times. That’s the second largest number of defaults in more than ten years. It trails only 222 defaults in 2002.

The intriguing fact is that US companies account for 62 of the defaults. Most of those come from the ‘shale patch’. The crashing oil price has utterly destroyed the leveraged energy speculators. But what about the wider global credit market in 2016?

A credit crisis always begins in some peripheral market. That’s where bad risk-taking gets punished first. As liquidity retreats, cracks emerge. The bigger the crack, the bigger the break. With US interest rates apparently headed up, and the dollar with them, the cracks are getting larger.

Category: Market updates