The high-yield and junk bond markets are acting as if the Fed has already raised US interest rates. The Fed doesn’t meet until tomorrow. But when momentum starts to roll over, the first things that head downhill usually appear in the highest-risk credit markets. That was one observation from last week’s podcast with Charlie Morris, Tim Price, Mike Hollings and Dominic Frisby.

If you didn’t get a chance to listen to it, it’s worth the time. One of the questions on the show was whether, if you’re a UK investor, it’s already a bear market. The FTSE 100 is down 8.7% year-to-date and 11.71% since 15 June. On a relative basis, the S&P 500 has done better.

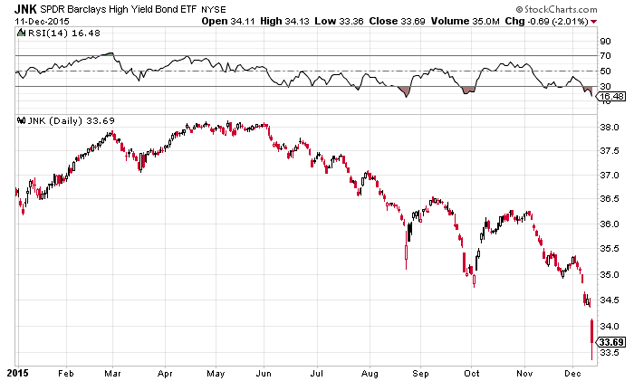

But as Tim Price pointed out last week (at around 1:27:30 of the show), if you take out the ‘FANGs’ (Facebook, Apple, Netflix, and Google) the S&P’s year-to-date performance is underwhelming. And if the chart below is a leading indicator – a signal from the market that things are about to get worse – then British investors better prepare for a bigger bear.

Human nature being what it is, everyone is expecting the next crisis to be like the last crisis. What’s the next Lehman? Where’s the next subprime? The ETF pictured above tracks (or is designed to track) the performance of the Barclays High Yield Bond ETF. The ticker symbol is JNK.

That’s not to say the ETF or the bond index it tracks are junk. That conclusion is beyond the scope of today’s e-letter. But the logic is simple: if rates are headed higher and bond prices lower, the first securities to feel the blow will be the ones that benefitted the most from high rates. Junk bonds.

DoubeLine Capital’s Jeff Gundlach puts it a bit more elegantly. He says that, “People are too long credit and the credit is melting down and the stock market is whistling through the graveyard. It is so similar to 2007, it’s scary.”

In a liquidation crisis, you want to be able to sell quickly. But just last week, investors in the Third Avenue Focused Credit Fund were blocked from withdrawing their money. The fund is being liquidated in an ‘orderly way.’ It has around $789m in assets, down from $2.4bn earlier this year, according to Marketwatch.com.

It’s one things for credit funds and high-yield junk funds to be liquidated. Investors are adults. Investing comes with risks. It’s the disorderly liquidation of all asset prices – the ones that have been going up since 2009 on easy credit – that you need to think about in 2016.

Category: Market updates