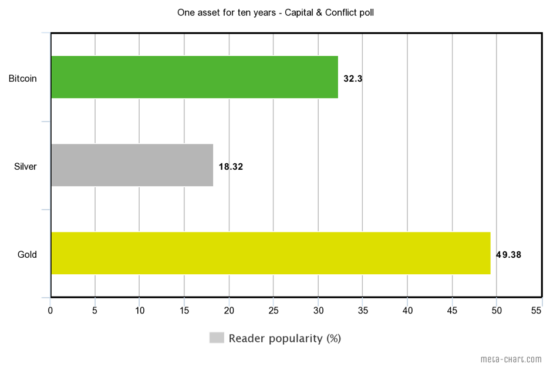

Gold, silver, or bitcoin… if you had to hold only one of these assets for the next decade, which one would you choose?

That’s what I asked you last week. The results have since come back, and it turns out…

Almost half of you are gold bugs…

Almost a third are bitcoiners…

And almost a fifth are silverists…

I’m taking many liberties and generalising of course. I only gave you three options and if you hated all of them you probably didn’t answer the poll.

I’m taking many liberties and generalising of course. I only gave you three options and if you hated all of them you probably didn’t answer the poll.

But I’m fascinated by the results nonetheless. I’m actually quite surprised how many of you picked bitcoin, as aside from this poll I’ve been going through the feedback from our recent survey and found a few of you don’t like me writing about crypto and bitcoin very much.

I understand why some of you aren’t keen on crypto. The space has been riddled with scandal almost since it was born, and when you add its extreme volatility and lack of legal recourse, for many investors the digital asset space represents a wild and deadly frontier where they simply do not wish to tread.

On top of that, many investors who did dare to venture into the space were so scarred by the great crypto crash of 2018 that they don’t want to see bitcoin’s face darken their door ever again. And I understand that too. While I made a packet and a half in the 2017 bull run, I lost a ton in 2018 when the crash hit. I did a full post-mortem on my mistakes at the time earlier in the year which you can read here: How I lost thousands in one of the greatest bull markets in history.

(Ironically, in that same letter where I detail the errors I made back in 2018, I also describe how I was betting at the time of writing that the VIX – the stockmarket volatility index – had peaked in the present day. When that was published on the third of March, the VIX was around 36. In the next two weeks it would soar to 82. Not my best trade…)

However… all that said, our role at Southbank Investment Research is to try and find out the investment opportunities at the fringe that will become the success stories of the future – and help you get in on them before anybody else, so you ride the trend to riches. And as you’ll discover in our crypto docuseries, the sector didn’t just stop innovating when the crash occurred in 2018. It kept developing and evolving through the chaos, and the projects that managed to weather the storm and come out on the other side have some very interesting tech to bring to the table today.

While we’re on the topic of that Capital & Conflict survey, some congratulations are in order: to the lucky three who filled in our survey and have just won a year’s subscription to The Fleet Street Letter Monthly Alert. An email will have reached you by now and we can announce the names in tomorrow’s letter.

Just as I enjoy reading your feedback to my scribblings which you send to my inbox (for new readers: [email protected]), it’s been great reading the feedback from our survey – both positive and the negative. Under the suggestion box for how Capital & Conflict might be improved, I was very amused by the comments of “Bit pessimistic”, and “[can I] get this in French ♡”. Sadly, I’m afraid I cannot help in either regard…

A reader writes in:

Thanks for all your ongoing commentary across different markets and asset classes. I am subscribed to quite a few of Southbank’s publications.

Question for you on crypto – despite the vast amount of wild commentary everywhere, I can’t quite seem to find a thesis (including from Sam Volkering) why owning a coin that uses a particular algorithm, that may or may not succeed in the future, provides any value to my ‘coin’ which is potentially unlimited in quantity. Do I have a stake in this software and its potential uses? When MS DOS gained mass adoption, I didn’t get rich because my PC was running on the same operating system!

My fear is that potential uses of the software are getting confused with future value of a ‘coin’….

This is a very fair question, and worth bearing in mind for any investor considering a journey into the wild frontier. As these digital tokens being minted do not confer legal rights to assets or cashflows in the same way stocks or bonds do… what are you actually buying?

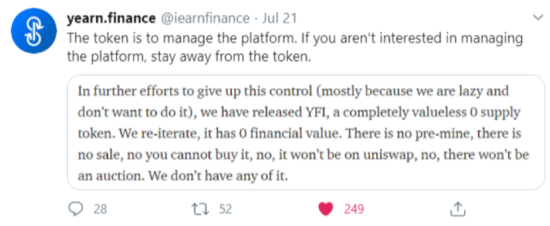

Some folks really don’t care, and that to my eyes is very risky. Remember YFI, that token I mentioned in yesterday’s note that went up 2,000% in 24 hours? That token was not intended for speculation, or even (from what I can tell) as a cash-raising tool – the tokens themselves are for “governance” – used to regulate the Yearn network.

The enormous boom in YFI actually led to the developers taking to Twitter to tell people not to buy the tokens unless they were actually interested in helping manage the network:

To my eyes, if you’re interested in buying a crypto token, it needs to have actual utility and thus some inherent or potential value. That’s one of the reasons I like bitcoin so much, as its intended utility is so straightforward: it’s trying to be a form of money, a means of exchange. When you look for its utility, you need only take a look at what you can buy with it.

But when it comes to the value of “governance”, like in the cause of YFI, things get a lot more complicated. Power itself – control and influence over something – is hard to put a price on… but crypto has succeeded in creating a market for it.

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Investing in Bitcoin