Charlie Morris of The Fleet Street Letter bought a glass of wine in Chamonix with bitcoin.

It’s not a terribly remarkable event to you and me. But this one event might enlighten us about the future price performance of bitcoin and its cousins. And that can be a rather profitable enlightenment.

Even with cryptocurrency prices jumping about all over the place lately, instead of just soaring like we’re used to, the investment pitch remains intact.

The volatility you’re seeing is nothing new. Newcomers to the crypto world are in angst over the sort of price action long-time investors have got used to.

The loss of faith recently is a great example of why you need a steady hand to guide you in your cryptocurrency investing decisions. You can find one here, along with his advice on what to buy and sell.

My question for you today is why Charlie bought bitcoin in the first place.

Was it to get hands-on experience in the cryptocurrency world? As part of investigations for his subscribers at The Fleet Street Letter?

“Buy bitcoin” featured in one The Fleet Street Letter headline back in March, when the crypto was around $1,000. It’s over $11,000 now.

Or did Charlie buy bitcoin to buy wine in Chamonix?

I suggest it was the former. But what if it were the latter?

What if buying wine in Chamonix with bitcoin were easier than with pounds?

The (potential) power of bitcoin

It’s a trick question. You can’t buy wine in Chamonix with pounds. Especially since the Brexit referendum. You’ll probably get thrown out of the chalet for asking. I’d love to see them try that with Charlie, a former Grenadier Guard.

Given the cost and time it takes to convert your pounds to euro, bitcoin could be favourable as a travel currency. You can spend it anywhere in the world, it’s easy to carry with you, fast and reliable.

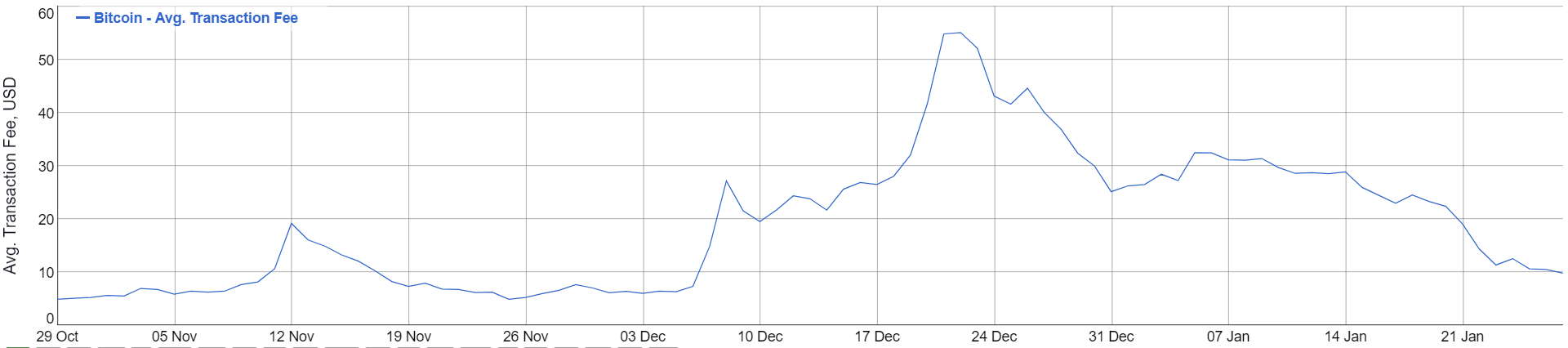

The only problem is, none of those things are terribly true at the moment. The cost, speed and security of bitcoin is coming up terribly short. Here’s a chart which tells you the average cost of a bitcoin transaction in the last three months.

Currently the cost is at US$10, but it hit over $50 in December.

What costs are associated with the transfer? It looks like the cryptocurrency exchanges are the culprit. They’re charging whopping fees for simple transactions.

What about the time it takes to complete a transaction? That stood at 78 minutes in December, spiking to 1,188 minutes at one point according to CNBC.

So has bitcoin failed miserably? It has for now. You’d be nuts to use it to buy wine in Chamonix. Unless it was a really expensive bottle.

But the costs are largely due to absurd regulatory requirements on the bitcoin exchanges, driving up costs. And the security requirements to run an exchange are enormous too. Not because of bitcoin, but because of the financial system. After all, these exchanges connect the bitcoin world with the financial system. You can’t automatically accuse bitcoin of being flawed because the exchanges are.

But what if the world changed? What if bitcoin became an efficient system?

Bitcoin is destined to go the way of the toilet

Back when the French emperor installed the first version of the modern toilet in his Chateaux, he probably didn’t envision even his lowest subjects having one within a few centuries. Let alone villages around the country having sewage networks.

Bitcoin is destined to go the way of the toilet. What is cumbersome, expensive and new now will become widely adopted and useful. This is a process, not an event.

And the process is well underway.

Take for example yesterday’s news out of Japan. A cryptocurrency exchange was hacked and 523 million XEM were stolen from 260,000 customers. That’s about £366 million.

But it’s what happened next that’s interesting. The exchange promises to refund customers the lost amount. There’s some doubt it’ll pull it off. But this is the first sign of credibility and stability from a major exchange. It didn’t even ask for a bailout like banks did in 2008.

If the theft sounds outrageous, the Financial Times puts it into perspective:

The scale of the theft is comparable to the £292m ($414m) City bonds robbery in 1990, the $500m Gardner art heist the same year or the approximately $500m bitcoin hack that led to the 2014 collapse of cryptocurrency exchange Mt Gox.

Yes, the crypto world is just as bad as the real world. The question is whether it will ever do any better.

Cryptocurrencies will reach you

The crypto-craze continues to spread. And it’s getting closer and closer to home.

On Australia Day I discovered a bitcoin ATM in Mooloolaba, down the road from where I live. The mid-size town on the Sunshine Coast is not exactly a hotbed of tech entrepreneurs. And yet, there was the sign advertising the ATM.

Newly introduced draft legislation in the Russian parliament details the creation of a CryptoRuble. It’d be legal tender, taxed at 13% of the increased value since the spender bought it, or 13% of the total value if you don’t want to tell where the cryptocurrency came from…

In Dallas, Texas, the first pure cryptocurrency purchase of a house went off without a hitch. The price of bitcoin doubled since the transaction went through.

Real estate agents in Miami and New York City confirmed they’ve convinced their clients to accept bitcoin too.

In Japan, where cryptocurrencies are explicitly legal tender, a Tokyo firm is selling a commercial building for 547 bitcoin.

In Britain, two developers are offering their apartments for around 30 bitcoin.

But why?

Why use cryptocurrencies?

The popularity of property transactions using bitcoin is based on security, speculation and the high transaction costs you incur in selling property regardless of how you do it.

But there are plenty of other ways to spend your bitcoin. The question is whether doing so makes sense. Whether it’s economically efficient.

In Australia, for example, your cryptocurrency gains are tax free if you spend your bitcoin, as opposed to selling them. That means cryptocurrencies make a lot of sense in everyday spending given their price performance.

But the real use case of cryptocurrencies lies in something more intriguing.

Keep in mind that these currencies can be designed to do things. For example, they can be used to transact securely without an intermediary or title registry.

When people buy a house, their conveyancing lawyers race to the titles office to confirm the transaction. If the seller were to sell their house to two people at the same time, they could theoretically take off with the money. For the buyers, whoever’s lawyer gets to the Land Registry first owns the house. The other is left to the mercy of the legal system.

A cryptocurrency could rejig all this to complete a transaction only when both parties have given up ownership of what they’re exchanging. That gets rid of all sorts of risks. You can only sell what you own, and you both only receive once you’ve given up whatever you’re exchanging in return. It acts like an automated middleman, with a fraction of the cost. It’s a form of the “smart contract” you’ve probably heard about.

If you’re with me that the success of cryptocurrencies depends on their usefulness, then you’ll agree that investing in the most promising cryptocurrencies makes sense.

My friend Sam Volkering has been on to this for many years. He sifts through the many cryptos of the world to find those which will change the world… and their owners’ net worth.

Until next time,

Nick Hubble

Capital & Conflict

Related Articles:

- Is bitcoin a fiat currency

- The return of currency competition

- A beginner’s Guide to Investing in Cryptos

Category: Investing in Bitcoin