A return to the dark days of the first Cold War, constant threat of nuclear annihilation included, is not exactly a pleasant prospect.

So before I conclude this three-part series on why I think that’s coming (and how to profit from it), some light comedy relief.

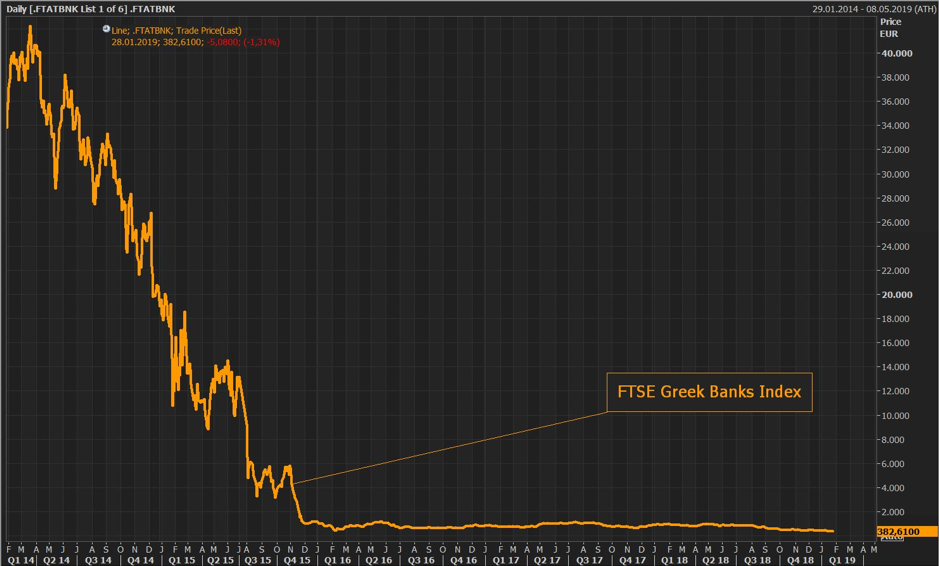

Ladies and gentlemen, I present to you the Greek banking sector, which according to Mario Draghi in Brussels this week is “well capitalised”:

Source: Holger Zschaepitz

As Jean-Claude Juncker said of the Greek crisis, “When it becomes serious, you have to lie.”

Draghi may want us to believe that the Greek banks are well capitalised, but investors certainly aren’t buying it. With 43% of loans on the books of Greek banks are classed as “non-performing” (no payment of principal or interest for 90 days+), I don’t blame them.My colleague Nick Hubble thinks it’s “becoming serious” in a big way for Europe’s banks. Find out why, and how to profit here.

Now, back to the subject at hand. Great power competition, potential nuclear annihilation… and how to profit from it.

If you missed them, you can read part I of this series here, and part II here.

Part III: The key to the conflict

Here’s what’s crucial to understand. For the US to remain a superpower, it must be capable of fighting a conventional war against its competitors. But to fight such a war, it must be in control of its own industrial and manufacturing base.

Globalisation allowed China to take this base away, much to China’s financial and geopolitical gain. The US must take this base back to remain in control as the global hegemon.

But to take its manufacturing/industrial base back, means to damage China, which is now massively more powerful and influential than when the US let it into the World Trade Organisation in 2001.

The scope of China’s ambitions were made clear in remarks by Graham Allison, Harvard professor and political insider in a recent interview with Real Vision, emphasis mine:

… China’s grand strategy, as Xi Jinping said explicitly when he became president, is to make China great again. This means restoring China to its natural place at the top of every pecking order where it was until the century of humiliation when the Westerners showed up with their technology…”

… in China, as you know, the Mandarin word for China means center of the universe. In their story, they are the sun, every other country is a tributary that circulates around them.

China, now with military technology stolen from the US, will not give up its influence without a fight. And the friction between the two countries will turn into Cold War II.

What to expect from the sequel

A new weapon has been created that will define this second Cold War the same way the AK47 defined the first. Believe it or not, there are hundreds of thousands of them in this country right now, with more being manufactured by the second. Similar to the last Cold War, you can’t invest directly in the company that makes them – but that doesn’t mean you can’t harness the investment trend they represent…

Just how bad this Cold War will get is up to debate. To my eyes, it’ll be just as bad as the first one, with overt and covert military operations, proxy wars, and a repeat of the Cuban Missile Crisis (you won’t guess where).

But in our view, massive military spending by the US is on the cards, and so US defence contractors are poised to benefit. Like many things these days, there are several exchange-traded funds (ETFs) for this, such as the iShares Aerospace and Defence ETF ($ITA) below:

A risk with this investment is that US defence contractors have absorbed much of the liquidity injected into markets since 2008 (quantitative easing, low interest rates, etc) and so are richly priced already. If we find any niche opportunities from smaller companies, Zero Hour Alert subscribers will be the first to know.

But it’s worth bearing in mind that investing abroad may become fraught with a risk we’re not used to in recent days: capital controls.

One of China’s “asymmetric warfare” strategies is to counter the US Navy’s huge force with “carrier killer missiles”. The US is currently forbidden from developing missiles of a similar variety due to a treaty Ronald Reagan signed with Mikhail Gorbachev during the first Cold War (China was never a signatory). But in order to counter China, it is proposing pulling out of the treaty. From Foreign Policy magazine, emphasis mine:

“The military balance in the Pacific is going in the wrong direction,” said Elbridge Colby, the director of the defense program at the Center for New American Security, who served in the U.S. Defense Department as the deputy assistant secretary of defense for strategy and force development until earlier this year. “The scale of the Chinese military buildup is so significant and so advanced that we need to use every potential arrow in our quiver.”

If the US pulls out of the treaty, and begins deploying such missiles on the coasts of its allies in Asia, will the Chinese government still allow those countries to trade with China, or allow capital to flow at all between them?

The question should be looked at from the other direction as well. If an Asian country refuses to base such missiles on their coasts, will the American government still allow trade and capital to flow between them and the US? Considering the economic sanctions that are being thrown around with increasing frequency, I am inclined to say no.

We have taken for granted our access to global markets, the ability to invest all around the world from the comfort of our own countries. But should Cold War II come to pass, and countries are forced to pick sides between the US and China, “investing in Asia”, especially China, may become as laughable as “investing in the USSR” was 60 years ago. In the event of capital controls and sanctions being placed on countries that side with China, or economies being locked out of Chinese trade, Asian markets may become collateral damage in Cold War II.

The first shot

On 4 October 2018, the US vice president gave a speech as important as it was under reported. While the media were obsessing over the nomination of Brett Kavanaugh to Supreme Court justice, Mike Pence showed up at the Hudson Institute and threw down the gauntlet on China.

If you have 40 minutes spare this weekend, I recommend you watch it – if we’re right about Cold War II, this speech will be one for the history books.

You can find it here. I’ll leave you with a few of his statements that were particularly telling.

I come before you today because the American people deserve to know. As we speak, Beijing is employing a whole-of-government approach, using political, economic, and military tools, as well as propaganda, to advance its influence and benefit its interests in the United States.

… previous administrations all but ignored China’s actions – and in many cases, they abetted them. But those days are over.

… America had hoped that economic liberalization would bring China into greater partnership with us and with the world. Instead, China has chosen economic aggression, which has in turn emboldened its growing military.

… the Chinese Communist Party has… used an arsenal of policies inconsistent with free and fair trade, including tariffs, quotas, currency manipulation, forced technology transfer, intellectual property theft, and industrial subsidies doled out like candy, to name a few. These policies have built Beijing’s manufacturing base, at the expense of its competitors – especially America.

… Beijing now requires many American businesses to hand over their trade secrets as the cost of doing business in China. It also coordinates and sponsors the acquisition of American firms to gain ownership of their creations. Worst of all, Chinese security agencies have masterminded the wholesale theft of American technology – including cutting-edge military blueprints. And using that stolen technology, the Chinese Communist Party is turning plowshares into swords on a massive scale.

… We will not be intimidated; we will not stand down.

The Aerospace and Defence ETF is a start. But if you want to discover a niche, investable asset class set to rocket from Cold War II, you may want to consider a subscription to Zero Hour Alert – our issue on the subject reveals all. Find out more here.

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Geopolitics