Today we continue with our Cold War II thesis. If you want to know why a sequel to the Cuban Missile Crisis is coming and you didn’t read yesterday’s letter, click here to read it.

The final part of this trilogy is coming tomorrow. Today’s story begins in the Oval Office…

Part II: Executive Order 13806

In July 2017, President Donald Trump issued Executive Order 13806. This order, straight from the president, directed the Department of Defense (DoD) to examine the state of US manufacturing and industries that supports their military.

The report the DoD came back with, titled “Assessing and Strengthening the Manufacturing and Defense Industrial Base and Supply Chain Resiliency of the United States”, is more than 140 pages long, and although it’s jargon heavy, I’m afraid I cannot recommend it for bedtime reading, as to my eyes it’s the blueprint for the Cold War that’s coming.

Although the US military machine may appear to be firing on all cylinders in its escapades throughout the Middle East in recent years, the report reveals that it would face massive issues in the event of a conventional war with a more developed country. It has been weakened hugely by globalisation, and is very clear in identifying China as the beneficiary of this strength transfusion.

The report is reads almost like a post mortem. A few of its observations and findings below, emphasis mine. What’s important to note is that although reports of Chinese bad practice have persisted for years, there is no doubt that the current administration is aware and now focused on them.

First off, it recognises that the US industrial base is required for the US to be a superpower:

“A healthy defense industrial base is a critical element of U.S. power and the National Security Innovation Base. The ability of the military to surge in response to an emergency depends on our Nation’s ability to produce needed parts and systems, healthy and secure supply chains, and a skilled U.S. workforce.”

But that industrial base has gone abroad, while the US’s competitors grow stronger:

“The erosion of American manufacturing over the last two decades, however, has had a negative impact on these capabilities and threatens to undermine the ability of U.S. manufacturers to meet national security requirements. Today, we rely on single domestic sources for some products and foreign supply chains for others, and we face the possibility of not being able to produce specialized components for the military at home.”

… All facets of the manufacturing and defense industrial base are currently under threat, at a time when strategic competitors and revisionist powers appear to be growing in strength and capability. As stated in the National Defense Strategy:

“…The central challenge to U.S. prosperity and security is the reemergence of long-term, strategic competition by what the National Security Strategy classifies as revisionist powers. It is increasingly clear that China and Russia want to shape a world consistent with their authoritarian model – gaining veto authority over other nations’ economic, diplomatic, and security decisions.”

… Due to erosion that has already occurred, some manufacturing capabilities can only be procured from foreign suppliers, many of which are not domiciled in allied and partner nations… Ultimately, these negative impacts have the potential to result in limited capabilities, insecurity of supply, lack of R&D, program delays, and an inability to surge in times of crisis.

The US military, the backbone of US power, needs its own manufacturing base to fight any threat. But this has been annihilated, as the report goes on to illustrate…

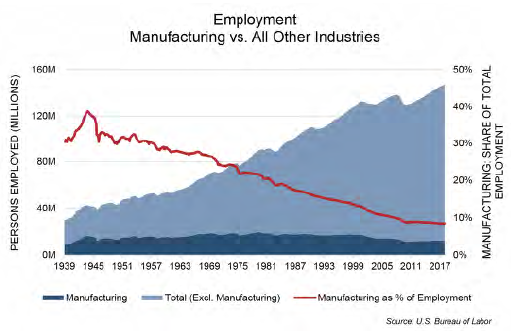

Between 2000 and 2010 alone, the U.S. lost over 66,000 manufacturing facilities. While the U.S. has seen an uptick in manufacturing, adding around 380,000 jobs since January 2017, much work remains to be done to remedy years of decline in the sector.

… From 1979 to 2017, the U.S. lost 7.1 million manufacturing jobs, 36% of the industry’s workforce, with more than 5 million manufacturing jobs lost since 2000 alone. Job losses have been most pronounced in vital sectors subject to import competition, including primary metals, electronics, chemicals, and machinery. Manufacturing and defense industrial base companies’ inability to hire or retain U.S. workers with the necessary skill sets has led to significant gaps in skilled labor.

… In multiple cases, the sole remaining domestic producer of materials critical to DoD are on the verge of shutting down their U.S. factory and importing lower cost materials from the same foreign producer country who is forcing them out of domestic production. Without relief from unlawful and otherwise unfair trade practices, the U.S. will face a growing risk of increasing DoD reliance on foreign sources of vital materials.

And there can be no doubt who the Pentagon holds responsible:

While multiple countries pursue policies to bolster their economies at the expense of America’s manufacturing sector, none has targeted our industrial base as successfully as China. China is engaged in economic competition with the U.S. and our alliesover key sectors of the global economy,and China’s strategies of economic aggression and its complementary military modernization efforts are codified in its doctrine of civil-military fusion.

… A key finding of this report is that China represents a significant and growing risk to the supply of materials and technologies deemed strategic and critical to U.S. national security… Areas of concern to America’s manufacturing and defense industrial base include a growing number of widely used and specialized metals, alloys and other materials, including rare earths and permanent magnets.

China is also the sole source or a primary supplier for a number of critical energetic materials used in munitions and missiles. In many cases, there is no other source or drop-in replacement material and even in cases where that option exists, the time and cost to test and qualify the new material can be prohibitive – especially for larger systems (hundreds of millions of dollars each).

From commodity materials to rare earths, Chinese investment in developing countries in exchange for an encumbrance on their natural resources and access to their markets, particularly in Africa and Latin America, adds an additional level of consideration for the scope of this threat to American economic and national security.

We’ll come back to Chinese expansion into Africa in a moment. First let’s see how the US military views China’s strategy and aggressive behaviour, which mainstream commentators and Western politicos have often failed to mention:

China uses legal, extra-legal, and illicitindustrial policy tools and tactics to force or facilitate the transfer of technologies and intellectual property from U.S. and foreign companies to Chinese counterparts and competitors.State-backed actors are buying and stealing differentiating intellectual property on an unprecedented scale, targeting key U.S. technology, infrastructure, and materials and exploiting the free-market system to access and acquire key components of the U.S. industrial base, leaving defense capabilities vulnerable.

… China’s capture of foreign technologies and intellectual property, particularly the systematic theft of U.S. weapons systems and the illicit and forced transfer of dual-use technology, has eroded the military balance between the U.S. and China. Such transfers aid China’s efforts to gain a qualitative technological advantage over the U.S. across key domains, including naval, air, space, and cyber.

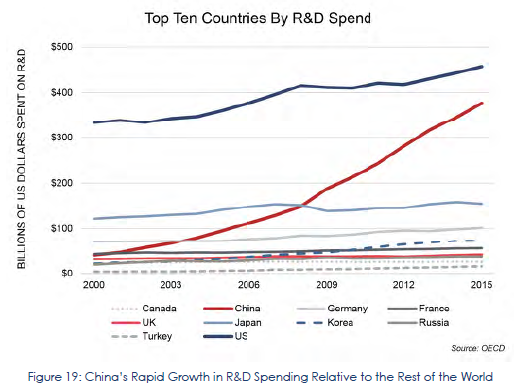

… Although the bulk of China’s early exports were dependent on low value-added manufacturing, Beijing has recognized that it must innovate to obtain long term dominance, as documented in the 2006 Medium to Long Range Plan for Science and Technology. This and other state-authored policies explicitly recognize the need to capture advanced commercial technologies with military applications, and China has directed both state-owned enterprises and private sector investors to advance the military’s access to cutting edge civilian research…As Figure 19 illustrates, Chinese R&D spending is rapidly converging to that of the U.S. and will likely achieve parity sometime in the near future.

That chart alone is an echo of the first Cold War, and a foreshadowing of the second, as the US and China compete for the best technology.

But if you still have any doubt that the US and China are heading for Cold War II, just look at these two statements from the report. They are nails in the coffin for peace between the US and China. I cannot emphasise them enough:

China’s economic strategies, combined with the adverse impacts of other nations’ industrial policies, pose significant threats to the U.S. industrial base and thereby pose a growing risk to U.S. national security.

… China’s non-market distortions to the economic playing field must end or the U.S. will risk losing the technology overmatch and industrial capabilities that have enabled and empowered our military dominance – even as China seeks to raise its military capabilities to U.S. levels.

What to avoid, and how to profit, as China/US relations go nuclear? Find out tomorrow.

Until then,

Boaz Shoshan

Editor, Capital & Conflict

Category: Geopolitics