If the European Central Bank (ECB) does anything other than ‘aggressively’ ease interest rates and/or expand its asset purchase programme, it’s going to be a big disappointment. The bank’s honchos meet today in their latest war council. The enemy? Deflation! It must be destroyed.

Never mind that falling prices are good for consumers. Your purchasing power goes up. What’s so evil about that? The 2% inflation target set by the ECB (and the Bank of Japan) is a hard target to hit in a world awash with excess productive capacity (and excess labour).

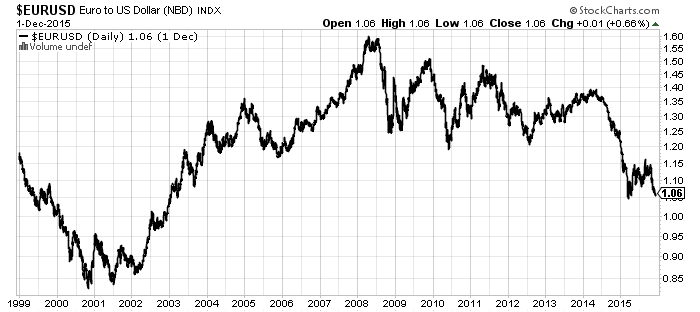

At the currency level, anything other than a big ‘ease’ could see a rally in the euro. Check out the chart below. Interest rates in the eurozone and America appear to be headed in opposite directions. The ECB could go even more ‘negative’ on rates for excess deposits. Meanwhile, the US Federal Reserve is signalling anyone who cares to watch that it’s resolved to ‘normalise’ US interest rates.

Gratuitous prediction? Markets never quite give you what you expect. The fact that everyone seems so confident about the current trends continuing—dollar up, gold and euro and oil down—gets my ‘spidey sense’ tinging. It’s times like this where something comes from out of the blue and changes the trend. Hmm.

How resilient are you?

On the subject of things happening that no one expects, let’s call them ‘black swans’. It’s an event that doesn’t figure in anyone’s model. An ‘unknown unknown’.

It’s a mistake, though, to think that just because you can’t know where ‘the next bad thing’ is coming from that you can’t prepare for it. You can by being, for lack of a better word, resilient. The author of ‘The Black Swan’, Nassim Taleb, made this point even more directly in a recent tweet. He said: “Yes, shit happens. The trick is to put yourself in a position to survive and even thrive when it does.”

How do you do that? A website called ‘The Art of Manliness’ has a suggestion: embrace volatility. Seeking tranquillity and stability—or merely enduring ‘the slings and arrows of outrageous fortune’—is not enough. Volatility is simply change at a rapid pace. If you’re well-informed, have a plan, and content yourself with the whirlwind around you, you’ll be fine.

Japan building stealth fighter

Lest we ignore the ‘conflict’ aspect of this letter, Bloomberg reports that Japan joins Russia, the US, and China in building a ‘fifth-generation’ fighter. These planes are really well-armed bundles of software capable of killing quietly from a great distance. From the story:

“Japan is closing in on becoming the fourth nation to test fly its own stealth jet, a move that could further antagonise neighbouring Asian countries who’ve opposed Prime Minister Shinzo Abe’s bid to strengthen the role of its armed forces.

“The aircraft is scheduled to make its maiden flight in the first quarter of 2016, Hirofumi Doi, a program manager at the Ministry of Defence, said in an interview in Tokyo. The plane, called Advanced Technology Demonstrator X, will then be handed over to the nation’s self-defence forces, which will start conducting their own tests, he said.

“The plane made by Mitsubishi Heavy Industries Ltd. will strengthen Abe’s military ambitions after he succeeded in pushing through U.S.-endorsed legislation to allow Japanese troops to fight in overseas conflicts, despite concerns abroad and at home. Japanese militarism is a particularly sensitive topic for China and South Korea because of the aggression they endured before and during World War II.”

How long will it be before the cultural memory of World War II is gone? When it is, expect to see Japan and Germany become a lot more militarily active. It’s inevitable. If the European Union is serious about securing its borders, German troops will play a role. Similarly, if the US is unable or unwilling to check Chinese expansion in the South China Sea, Japan looks game for the fight.

Category: Geopolitics