Yesterday was Brexit day. Today is Asian domination day.

You can either feel threatened and try to ignore the Asian century, or you can see the opportunity to make money from it. There’s nothing like a bit of greed to promote harmony.

Three remarkable facts popped up on Bloomberg Radio this morning. They’re all major waypoints on the way to Asian domination.

The first was wealth. Asia’s private wealth outstripped Europe for the first time. The first time in a long time anyway. The Boston Consulting Group report released last Tuesday paints an ugly picture for Western Europe’s wealthy households. Bloomberg summarised the key finding:

Western Europe’s private-household wealth grew by 3.2 percent to $40.5 trillion last year, the smallest increase of any region, while Asia-Pacific had a surge of 9.5 percent to $38.4 trillion, the consulting firm said in a report Tuesday. Those totals are expected to climb to $41.9 trillion and $42.3 trillion respectively by the end of 2017, BCG said in an email.

To be clear, wealth in Western Europe is growing slower than in Latin America, which features the likes of Venezuela.

You only need to think about Brexit for a moment to consider why this is important. Who should London and its famous financial firms be aligning themselves with? The fastest growing region or the slowest?

Of course Asia is just getting started

But its stockmarkets still seem out of reach for British investors. We’re lucky enough to have many international firms at our investing doorstop thanks to the London Stock Exchange. But you’re missing out on many of Asia’s best companies. A particularly good opportunity to invest is expected to pop up today for an odd reason…

My second waypoint on the path to Asian domination comes from the world of stockmarket indices. With index investing all the rage these days, deciding what’s in an index becomes incredibly important. And it’s not as settled, scientific or sensible as you might expect.

Every stockmarket index has a different methodology for how it picks which stocks to include. Therefore, they all measure something different. It’s what confounds much of the academic research on investing and makes it dodgy at best.

Anyway, the MSCI indexing company is going through its regular rebalancing of indices and will announce the results today. The big question in the air is whether MSCI will include mainland Chinese stocks in its indices for the first time.

Thanks to the existing heavy presence of Hong Kong stocks and Chinese stocks listed in overseas exchanges like the London Stock Exchange, adding Chinese mainland stocks to the MSCI’s indices could put the Chinese weighting to 40% of MSCI’s Emerging Markets Index, for example.

Why does this matter? A huge portion of the world’s investment funds are invested based on MSCI indices – around US$10 trillion. Exchange-traded funds (ETFs) are the obvious example of this. If MSCI includes Chinese stocks, a huge portion of funds will pile into the Shanghai stockmarket. Many funds are pretty much obliged to make the move as they have to copy the index.

And that’s where the opportunity lies

If you get there first, you’ll benefit from this huge flow of funds. Of course the same funds will have to be selling wherever MSCI decides to decrease its weighting. Can you think of any contenders there? Perhaps the slowest wealth-growing region of the world?

The last three years, MSCI decided to keep China off its list because the Shanghai Stock Exchange isn’t terribly reliable in several ways. But this may be the year things change. The same phenomenon will follow in other Asian stock exchanges eventually too.

Last but not least on the list of Asian waypoints is a symbolic one. You may have the chance to invest in those iconic British brands Land Rover and Jaguar soon. But it’s an Indian firm that’s considering listing the brands it bought back in 2008.

Who would’ve thought just a few decades ago that Tata motors could be the company bringing iconic British brands to the London Stock Exchange? How times have changed in this Asian century.

It’s not just financial markets that the Asians are dominating. They’re leading the world of bitcoin too. China, Japan and Korea account for the overwhelming amount of bitcoin trading. And the countries are increasingly integrating bitcoin into their economies. They have their very own versions of cryptocurrencies too. Some are in their infancy and as cheap as bitcoin was once.

It’s not all good news for Asia, of course. Ironically enough, it’s China that’s leading investors’ worries as well as optimism for the future…

To understand China, ask an Australian about Japan

The risks to China’s economy are something an Australian will intuitively understand. Aussies lived through the Japan craze of the 80s and 90s more than anyone else in the Western world. And then it disappeared just as they were ready to embrace it. A bit like me and Pokémon cards at the time. The same is at risk of happening with the China craze.

Australians still learn Japanese in primary school as their first foreign language. This totally mystified me when I showed up to finish high school in the north-eastern state of Queensland. Why on earth did everyone have to learn Japanese of all things?

Because the education system is always behind the times.

In the late 80s and early 90s, Japan was taking over the world. Especially real estate in Queensland. Japanese cars destroyed the Aussie car industry. And my high school science teacher regularly picked lifeless Japanese tourists off the sand a few kilometres up the beach from where they’d been swept out.

Then, suddenly, it was all over. The Japanese industrial machine, its wealthy tourists and its debt-financed acquisition spree seemed to disappear. They left behind them a few real estate crises on the Gold Coast and children in Queensland learning to count in Japanese for another three decades and counting.

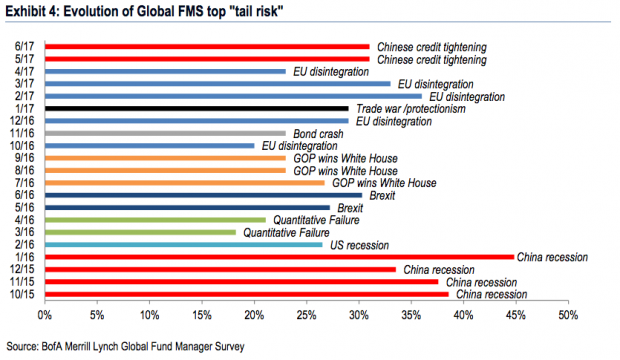

Today the hottest thing in Queensland education is of course a school that hired a Mandarin Chinese speaking teacher. Already problems in the Chinese economy are the number one risk identified by fund managers:

But what happened to Japan, and what’s happening to China?

I think the key to the rise and fall of Japan and China lies in demographics and debt.

Japan’s prowess peaked with its demographics before two and a half decades worth of a so-called lost decade. Japan’s conglomerates were famous for creating banks to finance the rest of the conglomerates’ ventures rather than serving banking customers and lending prudently. That’s why Japanese banks carry big industrial names like Mitsubishi. They called it the keiretsu banking system. It’s a bit like the state-owned banks in China today.

The Chinese workforce is shrinking too now. Yes, there may be many isolated workers yet to be mobilised, but the total number of working-age Chinese is falling. GDP per capita can still rise in such an environment, but debt doesn’t care about the size of your population. It’s a fixed number. And it’s too high.

The Chinese are well aware of the problem of too much debt. But their solution is so stupid it’s mind-boggling:

In 2010, as China’s overall indebtedness was approaching 200 per cent of gross domestic product, Mr Xi, then the country’s vice-president, asked scholars at the Central Party School to research the subject, according to two Chinese academics familiar with his request. A subsequent paper outlined some of the lessons of the Japanese bubble, including the need for Beijing to raise awareness of financial risks, safeguard “economic sovereignty” and not give in to pressure to change its currency policy.

If you have a growing problem then sticking to your guns is the worst thing you can do. The Financial Times continues:

Seven years on, China’s total debt is 250 per cent of GDP and climbing, officials are trying to rein in sky-high real estate prices and the government is still grappling with the aftermath of a stock market bubble that burst in 2015.

What a surprise…

In other words, China continues to follow in the footsteps of Japan. Its policies, its demographics and the predictable results of the two.

And yet, China may have much further to run. Calling something a bubble is different to saying it will burst imminently.

Until next time,

Nick Hubble

Capital & Conflict

Category: Geopolitics