What if you’d treated your children exactly the same?

No matter what crisis of confidence or overconfidence they faced, you encouraged them. No matter their academic abilities, you sent them all off to by nuclear physicists or sculptors. No matter their behaviour, you bought them a new iPhone.

I think all parents, and innocent bystanders of other people’s families, would agree it’s a recipe for disaster.

People perceive things differently, are differently inclined, require supervision of a very different nature and much more. Fail to recognise this and you sow discord and disaster.

The research institute Bruegel recently examined how Europe’s economic crisis was perceived differently between several different nations in Europe since 2007. Spain blames itself, the Germans blame spendthrift southern nations, the French blame vague concepts I don’t understand, and the Italians claim they’re always victimised.

But the consequences are more interesting. Having vastly different perceptions of what caused and happened during the crisis, Europe now has to come up with a single uniform policy response.

Do you see the problem? The EU has to treat its children the same, even though they couldn’t be more different. They can’t even agree on what happened.

The result is the discord and disaster of the EU. Treating nations that are fundamentally different with the same set of reforms, institutional rules and policies is just a bad idea in the same sense that it’s bad parenting. The same policy does not deliver the same outcome between the various nations of Europe.

It’s much the same in the monetary policy world. Would you lend all your children the same amount of money in the same way? Or would you think twice about how much and on what terms depending on the kid? Perhaps some children need the precaution of legal formalities, while others do not.

Well, the European Central Bank (ECB) is supposed to treat all eurozone members the same. The result is a complete lack of feedback mechanisms. Each country can get away with fiscal murder or doesn’t receive the support it needs. One country might use the ECBs support to worsen its deficit without fear of bond markets holding it accountable, while the other uses the emergency liquidity to improve an already decent fiscal position that doesn’t need support. And then everyone cries foul at the others’ abuses.

The reaction from euro nations is the same as in families. They rebel and their behaviour gets worse. Eurosceptics get into the European Parliament, Brits vote for Brexit, everyone violates fiscal pacts and treaties, and so on.

Apportioning the blame

The good news is, children grow up. Actually, perhaps that’s the bad news.

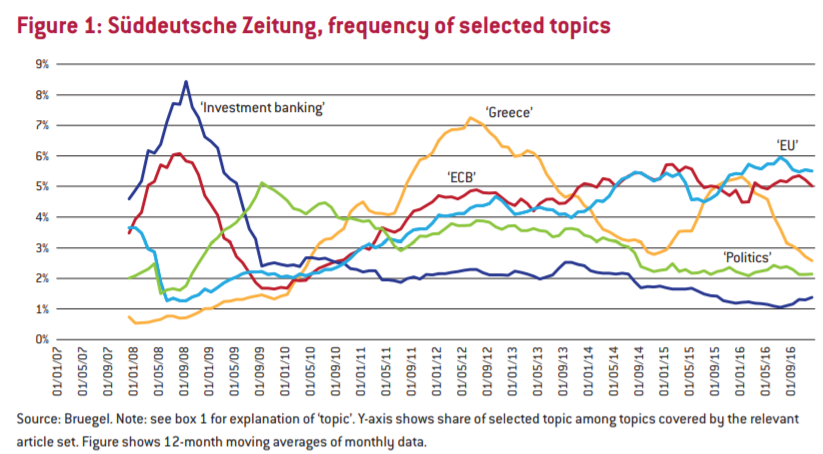

According to the Bruegel research, the southern German newspaper SDZ saw its mentions of various topics steadily change over time when it discussed the crisis. At first it blamed the private sector – investment banking. By 2016 it focused on the EU and ECB.

A realisation is growing across Europe. People are figuring out that their subscriptions to the ECB and the EU are what’s causing their economic trouble.

Getting yourself into an economic mess is very different to being stuck in one thanks to your overlords in Brussels. Avoiding a fiscal mess with proper budgeting doesn’t sound so good if other nations are getting away with trashing their own budgets and then you have to support them.

In two weeks, the Italians go to the polls to decide if they’ve had enough of the status quo. Their economy will take another decade to recover from the 2008 crisis according to the International Monetary Fund. It’s barely grown at all since Italy joined the euro. Even while the rest of the eurozone is doing well, Italy is struggling.

And now the ECB is pulling back its quantitative easing and talking about raising interest rates. Ironically, those interest rate increases will be felt most of all in Italy, where debts and bad debts are the highest, even though Italy needs the interest rate increase least of all.

Who can the Italians vote for? Well, nobody has a mildly credible fiscal plan. Some are anti-euro. Most want to breach the EU’s rules on deficits.

Italy’s economic situation is a bit like Britain in the early 1970s. But Italy is stuck in the euro. It can’t devalue. And leaving the euro means all that euro-denominated debt will become even more unaffordable. Unless they default…

Your new friend at the ECB

Simply quoting large blocks of text from the mainstream media doesn’t provide much value to you. And the following quote from the Financial Times won’t either. But it’s just too comical not to mention, with emphasis added:

Luis de Guindos will become vice-president of the European Central Bank, handing Madrid one of the eurozone’s most senior policymaking jobs and kicking off a shake-up of senior personnel in Frankfurt over the next 18 months.

Mr de Guindos, Spain’s economy minister and a former Lehman Brothers banker, was the only candidate in the race after Ireland said on Monday it would withdraw Philip Lane, its central bank governor, from the contest.

The decision, taken during a meeting of finance ministers in Brussels, means the Spanish minister, who has no previous monetary policy experience, will replace Vitor Constâncio when the Portuguese’s eight-year term ends in May.

A Lehman Brothers banker with no monetary policy experience was chosen as the ECB’s new vice-president because nobody else wanted the job.

At the helm we still have Mario Draghi, who worked for the Goldman Sachs division which helped Greece get into the eurozone by fudging its accounts.

What could possibly go wrong? You’ll find the simple answer here.

Until next time,

Nick Hubble

Capital & Conflict

Related Articles:

Category: The End of Europe