The UK ran a trade deficit of £34.7bn in 2015, according to data released this week from the Office for National Statistics (ONS). The ONS data showed a trade deficit in goods of £125bn. That was offset, partially, by a trade surplus in services of £90bn. The current account deficit, of which the trade deficit is a component, is at 3.7% of GDP.

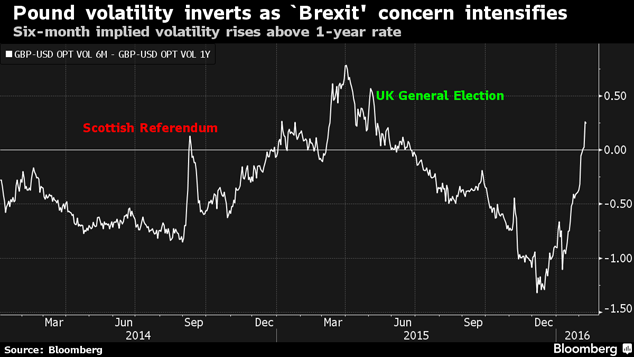

The currency strategists (the ones surveyed by Bloomberg) reckon the pound could fall by anywhere from 8% to 17% against both the euro and the US dollar this year. It’s not so much the outcome of Brexit causing the weaker pound, it’s the volatility associated with the political uncertainty, as you can see from the chart below.

A falling currency is the natural mechanism for correcting a current account deficit. It reduces imports (in theory) and increases exports (in theory). That’s also like a “recession fever”. It looks bad to the politicians. But it’s what the economy needs to return to health. Burn out the disease.

The biggest risk for the UK is that the Fed orders a retreat in its rate hike campaign. The Bank of England is then under no pressure to raise UK rates. Certainly the performance of the economy wouldn’t justify higher rates. And without the prospect of higher rates and higher growth, the pound could fall more quickly and much further than the analysts expect.

Category: Economics