Let’s talk about deficits. The UK recorded a £4.13bn trade deficit in October, according to figures released this morning by the Office of National Statistics (ONS). That number is worse than it looks. Why?

The trade deficit in goods was £8.8bn in September. It grew to £11.8bn in October. It was a combination of higher imports and lower exports. The only thing preventing a bigger blowout in the total deficit was £7.7bn surplus the trade in services.

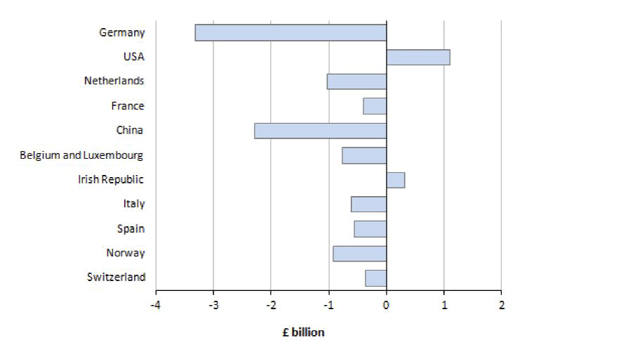

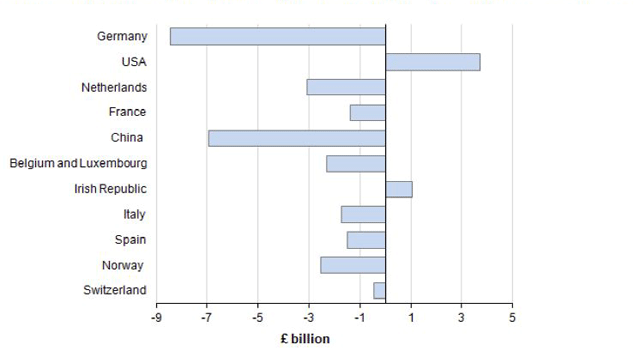

The charts below from the ONS report show one-month and three-month trade balances with “significant partner countries”. Check out the surplus with the US. Check out the deficit with Germany. The eurozone clearly favours German and French manufacturing. It does not favour UK service exports.

Significant UK partner countries, one-month balance, October 2015

Significant UK partner countries, three-monthly balance, August-October 2015

The economic argument for boosting UK GDP growth by leaving Europe is becoming a lot clearer. In the meantime, one big issue for 2016 is the strength of the pound and the direction of UK interest rates. It’s possible that for the first time in a long time, you’ll see diverging interest rate policies in the US and the UK.

If UK economic growth is weak (not helped by the deficit), then it will be harder for the Bank of England to ‘normalise’ interest rates. Janet Yellen’s Fed may begin ‘normalising’ US rates next week. The normal reaction of a currency to a widening interest rate differential and a large (and chronic) trade deficit is… to fall.

All other things being equal, a weaker pound would boost exports (and export earnings) of some UK companies. But until that happens, British investors have to take stock of what appears to be a big trend for next year: a stronger dollar.

I say ‘appears’ because not everyone at the roundtable agreed that US rates were, in fact, headed up next year. There was a view put forward that after a cursory and (non-heartfelt) rate rise next week, the Fed’s next move may actually be down. That’s based on an assessment of the US economy that’s a lot more negative than what you’d read in the papers.

But I’ll let you listen to that yourself on the podcast. It was a good discussion with direct consequences for what you should do with your money in 2016. The podcast is here.

Category: Economics