Here’s an idea of how politics, oil, the pound, and the dollar may converge. Not “how” so much as “when”. Try 1 February, or 9 February. More or less. Why?

I’ll get to it in a moment. But let’s take oil first. It keeps falling, both Brent and West Texas Intermediate crude. Iran enters the race to the bottom for control of market share in Opec this week. Most sanctions freezing the country out of global capital and energy markets were officially lifted over the weekend. The Iranians are free to pump as much oil as they’d like. Because that’s what the world needs more of!

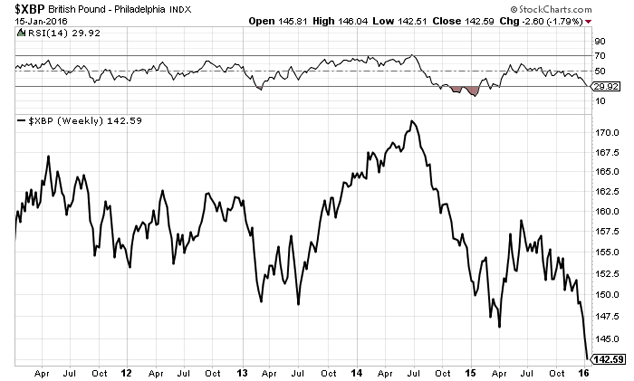

Last week I asked how much of oil weakness was really dollar strength? The reason I asked is that, all things being equal, you’d expect a bottom in the oil price to coincide with a top in the dollar. The price action in the pound also tells you a bit about dollar strength. Namely, you’ve seen global capital reallocated away from “risk” and emerging markets and into the dollar. Dollar strong. Greenback smash!

But keep your eye on the first ten days of February. That’s when you’ll know how seriously to take Donald Trump and Bernie Sanders. The Iowa caucuses take place on the first. New Hampshire has its primary eight days later. What will you learn?

Iowa and New Hampshire are small states. They don’t represent much of America. And most of the campaigning there is pure theatre, mean to winnow out the field of candidates for “Super Tuesday” in March.

But, Iowa and New Hampshire will be the first time anybody actually casts a vote for Trump or Sanders. Up until now, it’s all been polling. Trump’s enjoyed support from between 30%-40% of Republican voters in the polls. Will that carry over to actual votes? And can Sanders narrow his double-digit gap on the presumptive Democratic nominee, Hillary Clinton?

I’d suggest that a poor performance by Trump and a strong performance by Clinton would actually be dollar bearish. Why? It would mean America is not a car being driven by Thelma (Trump) and Louise (Clinton) headed over the proverbial cliff. The prospect of a radical result from the US election having been diminished means it will be safe to put some more “risk on” bets in markets.

Oil would rally. The dollar would fall. And emerging markets might catch a bid. Gold?

That’s the wild card. Charlie Morris reckons gold has about a 30% premium to “fair value”, based on his calculations. Gold has retained that “premium” despite dollar strength. And in a generally “fearful” world, you haven’t seen a correspondingly bullish move in gold.

That’s the risk. Yes, it would be weird to see both gold and the dollar fall together. But you’re seeing all sorts of weird things these days. And if you’re a gold investor or a bullion owner it’s a risk you should be well aware of as political season hits high gear.

There’s more than a political aspect to it, too. Everything falls in a deflationary depression. That includes gold. It’s just such a fall that has me worried right now. But I’ll see if I can get Charlie’s views on it later this week. He’s putting the finishing touches on his asset allocation strategy for the new version of The Fleet Street Letter.

Category: Economics