It sounds like a spy thriller. You’ve got money to get out of the country, toute suite! But where? How? You’re in a hurry. Quick! To the Spanish property market! Double quick! To the Portuguese property market.

I’m not making this up. “The yuan will keep depreciating as time goes by, so we should swap the money we have in hand into tangible assets.” That was Li Xiaodong, the chairman of Canaan Capital, speaking to investors in Shanghai. Then he mentioned Iberian property. Does it make sense to you?

Think about it. You’re a wealthy Chinese businessman. Or you’re the owner of a business that’s invested in a Chinese factory. Or you moved money into the Chinese financial system because you thought the Chinese yuan was undervalued and you wanted to speculate on its inevitable rise.

But then, the authorities devalue the currency.

Now you want out. A lot of money wants out of China. Nearly $1trn left last year. Another $158 billion left in January. That trails only September of last year, when $194bn headed for the exit after the first yuan devaluation.

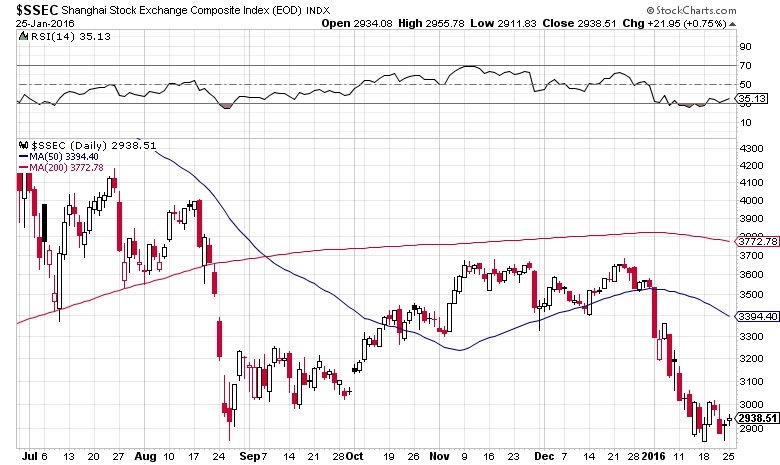

The Shanghai Composite is back to its late August lows. But really, the ups and downs of the Chinese market are neither here nor there for British investors. They simply tell you the pace and intensity of capital flight. It’s picking up. But where’s it going?

One clue came from the latest Demographia study of the world’s most expensive housing. The group tracks a ratio of median house prices to median pre-tax household income. London came in eight at 8.5. One to seven went as follows: Hong Kong (19), Sydney (12.2), Vancouver (10.8), Auckland (9.7), Melbourne (9.7), San Jose (9.7) and San Francisco (9.7).

The last two are mostly Silicon Valley stories. Which reminds me, Apple and Amazon report earnings tomorrow. A good result could revive the momentum behind the FANG and BAGEL trades. A bad result…

But back to the housing boom on the Rim of Fire. It’s no coincidence all the cities on that list have seen booms in high-rise apartments sold, off-the-plan (with few questions asked) to investors from China. The Chinese have the money. A Sydney apartment is a lot more tangible than a bank deposit. And Bondi Beach is closer to Beijing than Barcelona.

How long will the Chinese capital exodus last? Where is “fair value” for the yuan? And what should British investors do? Charlie Morris and I had this discussion yesterday. He’s agreed to an entire monthly edition of the Fleet Street Letter about it in the coming months. To sign up, go here.

Category: Economics