The global trend of preferring “safety” over “income” continues – this time in Germany. The Germans auctioned €5 billion worth of 10-year bonds with a zero coupon. That means you get no income while you own the bond. You just get… the bond. Which is safety, apparently.

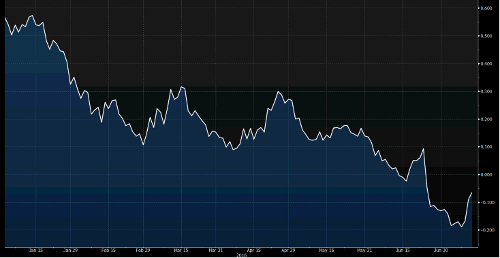

You know that yields in the secondary market, where mostly institutional investors buy and sell bonds, are already negative. For example, 10-year bund yields have gone as low as negative 0.205%. The next frontier is ludicrous: buying a negative-yielding bond at auction. That’s a guarantee of losing money if the bond is held to maturity.

German 10-year bond yields go negative

Source: Bloomberg

The only rational argument for buying a negative-yielding bond is that you’re front running Mario Draghi, Janet Yellen, Mark Carney, and Haruhiko Kuroda. All those central banks have, to various degrees, intervened in financial markets to try and push interest rates down, mostly by buying bonds (government and corporate).

Rates down. Investors and savers forced to make an awful choice: buy bonds with low or negative yields and hope to sell to a greater fool (Tim’s point). Or, take more risk and buy higher-yielding securities elsewhere.

You couldn’t be blamed for wanting to flee into cash. But how safe is that? For now, it’s liquid. And with little inflation (except in the bond market), cash feels relatively safe. But only until the helicopters fire up.

Fortunately, at least for now, the Japanese helicopter fleet is grounded. The Bank of Japan made no big announcement about its next weapon in the war on deflation. Instead, chief cabinet secretary Yoshihide Suga said the government is planning a “bold economic stimulus.”

Hmm. What could that possibly mean? Depreciating currency? Money that expires? Stamp money? Or all of the above?

Category: Economics