Is it ‘peak globalisation’ or is it another of those dips you should ride out/buy?

That is still the question facing investors, even after a relaxing and rainy bank holiday in London. When China’s Purchasing Manager’s Index—a gauge of manufacturing activity—hit its lowest level since March 2009 (and contracted) it was a green light. If you forgot to panic last week, you’ll have another chance this week.

I’ll come back to ‘peak globalisation’ in a moment. But one immediate side effect from China’s currency-induced crisis is a stronger pound.

Weird isn’t it? Britain has a lot of debt, both public and private. Interest rates are at ‘crisis’ lows (a trap that could spring shut viciously on debtors). But the currency could strengthen.

Relatively speaking, the British economy would appear to have a lot going for it. Second quarter GDP grew by 0.7%, according to figures released last week by the Office for National Statistics. Britain has the second-fastest growing economy in the G7, behind the US. And everyone knows the US GDP figures are bogus.

Are British GDP figures bogus? Well, it’s hard to say.

For example, business investment drove the second-quarter GDP number, up 2.9%. Business investment creates capital, stock, jobs, and incomes. If you were building an economy from scratch, you’d want a healthy balance between consumption (preferably out of available savings and not financed with credit) and business investment.

For its part, GDP doesn’t distinguish between the quality of growth. It only measures quantity. In this case, 3.9% growth in exports over the quarter was also a good sign. The 0.3% decline in the manufacturing sector, though, and the strength of the pound raise an interesting question: how can you expect exports to grow when manufacturing is in decline and a strong pound makes British products more expensive overseas?

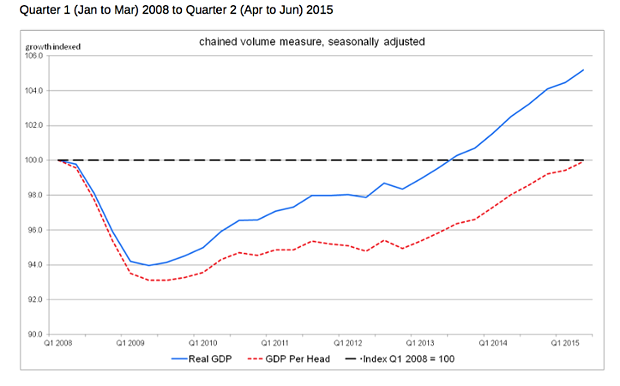

You can’t. But don’t tell anyone that. Take the GDP figures at face value and quit asking questions. Questions like: what does it mean if GDP has grown 5.2% since the peak of the downturn in 2008, but per capita GDP is still 0.1% below the downturn peak? See the chart below.

Is it an export led recovery or not? What are the exports? High-end cars? Car parts? How is it that, seven years into a recovery, the recovery has yet to begin for most Britons?

Is it an export led recovery or not? What are the exports? High-end cars? Car parts? How is it that, seven years into a recovery, the recovery has yet to begin for most Britons?

Questions. Questions. Questions. It’s almost as if the data says one thing but really means another. Hmmn.

Back to China and the signal-jamming efforts of the authorities in the stockmarket. Chinese authorities have spent—or caused to be spent—nearly $200bn in support of the stockmarket since July. Yes, that’s the same stockmarket that’s fallen nearly 40% from its peak.

You can’t keep a good crash down. Or more seriously, no matter how determined you are to conceal reality from people, there is an underlying set of economic laws that can’t be violated forever. Yes, markets are driven by liquidity. And the liquidity leaving China may push up assets somewhere else.

But the Chinese are in a real bind now. They can use their forex hoard to buy gold and oil at low prices. But in selling out their stockmarket, they risk alienating the public. If the Communist Party can’t make the stockmarket rise on command, how can it continue to improve the quality of life for hundreds of millions of Chinese people?

Party officials must have realised late last week it was a losing cause to fight the market. Better to save the economy—or fail trying—than to concentrate on the value of equities. This a minor victory for price signals. But as a signal, does it signal a major disaster for the rest of the world?

Everyone’s hitched their wagon to the China growth story for the last six years. If the arc of that story line has peaked, markets need a new narrative. Investors need some plausible reason to keep over-paying for earnings that may not materialise in a shrinking world.

Where will the growth come from? From currency devaluations? As Jim Rickards has pointed out so often, currency wars are ‘beggar-thy-neighbour’ strategies for growth. They don’t ‘make the pie higher’ as George W Bush once said. They ensure everyone fights for a bigger piece of a shrinking pie.

In a consumption driven world, you need credit growth to grow GDP. But a balance sheet—whether it’s household, public, or corporate—can only carry so much debt before that weight slows it down. The back breaks. The debt is unproductive. The interest cost is prohibitive.

That’s exactly the problem we had in 2008. And it’s exactly the problem we have today. The world didn’t de-leverage. It releveraged. And now we’re on the brink again.

Of course, one thing we’ve learned since 2008 is that there are two ways to blow up: quickly, like Lehman, or slowly, like Japan. Which will be Britain’s fate?

More on this tomorrow.

Category: Economics